Democrats, Republicans, Economists All Want to Replace the Sequester

With the March 1 deadline of sequestration only nine days away, lawmakers should work toward developing a plan that would replace the across-the-board spending cuts with smarter and more gradual policies that would put the debt on a downward path as a share of the economy. The worst possible outcome would be to punt on our debt problem and waive the sequester without offsets, as the country can no longer continue down this unsustainable fiscal path. In addition to not allowing lawmakers to direct cuts to areas where they would do the least harm (at least until they enact another continuing resolution), the sequester fails to address the drivers of our long term debt problem, population aging and growing health care costs. As a result, many are calling for the sequester to replaced with an alternative deficit reduction plan.

The Pentagon today issued a furlough notice to its 800,000 employees, as it attempts to deal with the across-the-board cuts in sequestration. According to the Washington Post, "the Pentagon's tentative plan is to put civilian employees on leave one day per week for 22 weeks." This would clearly restrict the Defense Department's ability to operate, but it is not alone in being hurt by the blunt cuts, as many economists have said that the sequester would have negative effects on the economy as a whole as well.

Just yesterday in a blog post, Macroeconomic Advisers further quantified how a failure to avoid the sequester could impact economic growth. After running a simulation of the sequestration scenario, it can be clearly seen how much the sequester would affect economic performance in the next few years:

Source: Macroeconomic Advisers, LLC

Macroeconomic Advisors concludes by saying that while sequestration would not be a huge disaster, it is a damaging way to implement deficit reduction, especially compared to the alternative of a phased-in comprehensive plan.

The impact of the sequestration would not be a macroeconomic catastrophe. Nevertheless, the indiscriminate fiscal restraint would occur on the heels of tax increases that total nearly $200 billion in the first quarter, with the economy still struggling to overcome the legacy of the Great Recession, and when the FOMC is constrained in its ability to offset the additional fiscal restraint. Furthermore, spending cuts that are so arbitrary in their allocation and timing can’t possibly be optimal from a public policy perspective. The preferable policy is a credible long-term plan to shrink the deficit more slowly through some combination of tax increases within broad tax reform, more carefully considered cuts in discretionary spending, and fundamental reform of entitlement programs.

Economists are not the only ones to speak out against sequestration, as political leaders on both sides of the aisle have warned of the damage that sequestration could do. In remarks yesterday, President Obama reiterated that the sequester was not good policy:

So these cuts are not smart. They are not fair. They will hurt our economy. They will add hundreds of thousands of Americans to the unemployment rolls. This is not an abstraction -- people will lose their jobs. The unemployment rate might tick up again.

Earlier that day, the Wall Street Journal ran a piece from Speaker Boehner (R-OH), in which he argued that sequestration would create many problems and that there we better ways to reduce the deficit.

The sequester is a wave of deep spending cuts scheduled to hit on March 1. Unless Congress acts, $85 billion in across-the-board cuts will occur this year, with another $1.1 trillion coming over the next decade. There is nothing wrong with cutting spending that much—we should be cutting even more—but the sequester is an ugly and dangerous way to do it.

But it is important to note that just as they signed the sequester into law, Congress and the President obviously can get rid of it. Rather than play the blame game, we need to replace and thoroughly address our debt problem. We cannot continue to kick the can down the road, and repealing the sequester without replacing the savings would be a large step back.

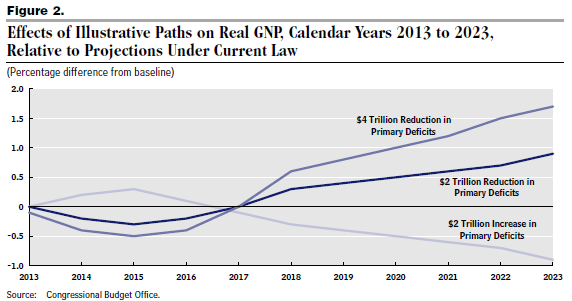

But a well-designed deficit reduction plan could even boost the economy and lead to greater economic growth. A CBO report earlier this month showed that a $2 trillion deficit reduction plan would lead to nearly 1 percent greater output (GNP) by 2023. Deficit reduction that is targeted and phased-in can protect the fragile economy in the short term while leaving the economy and federal finances in a better position in the long term. Deficit reduction in the longer-term will increase growth by lessening the "crowding out" effect of debt on private investment, and the benefits will only increase as time goes on.

The new framework put forward by former Fiscal Commission co-chairs Erskine Bowles and Alan Simpson, among other proposals, shows that replacing the sequester with a comprehensive plan is doable. Everyone agrees we need a solution, so lawmakers need to work toward a compromise that meets our short-term and long-term economic challenges.