Delaney and Cole Propose Social Security Commission

Reps. John Delaney (D-MD) and Tom Cole (R-OK) introduced the Social Security Commission Act of 2014 today, which would establish a statutory commission with a mandate to recommend ways to make Social Security solvent for at least 75 years. The policy prescriptions would then be subject to an up-or-down vote in Congress.

The commission created by the legislation would be composed of 13 commissioners: three commission members appointed by each of the Democratic and Republican leaders in the House and Senate and a Chair appointed by the President. At least one of the congressional appointees from each party must be non-elected experts, but the other ten commissioners appointed by Congress could be either sitting Members of Congress or unelected officials.

The commission would be directed to report to Congress its recommendations for making the Social Security trust fund solvent for at least 75 years no later than one year after its first meeting. The commission must have a minimum of nine votes in favor of its recommendations to send the plan to Congress for consideration. Achieving that level of support for recommendations will be difficult but will ensure that they have bipartisan support. The legislation sets out a process for expedited consideration of the commission recommendations in the House and Senate for an up-or-down vote without amendments.

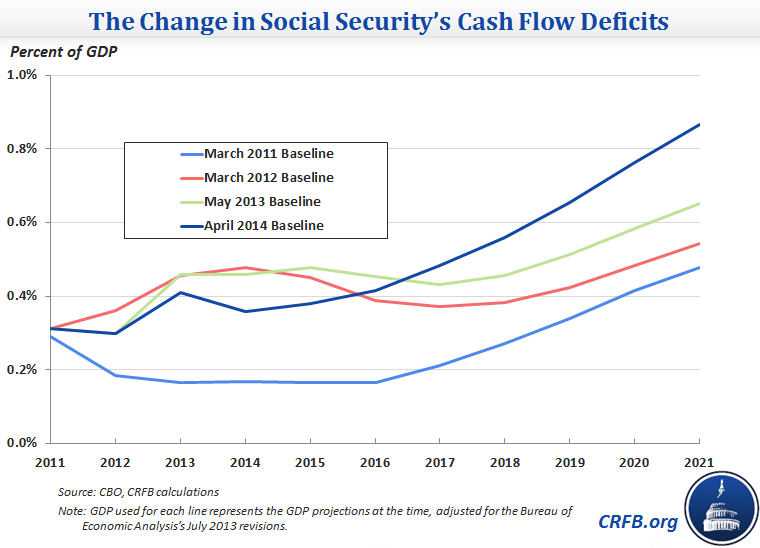

The need for policymakers to begin a serious discussion about Social Security finances is becoming increasingly urgent. Although the program is funded by its own stream of revenues, Social Security's costs are increasing as the population ages, from 4 percent of GDP in 2006 to nearly 5 percent today, and will reach 6 percent of GDP before 2030. The program began running cash-flow deficits with outlays exceeding tax revenues in 2010. The projected shortfall over the next decade has nearly doubled in the last three years. This shortfall between revenues and outlays will continue indefinitely and will require the federal government to borrow more going forward to make up the difference. In less than three years, the Social Security Disability trust fund will become completely exhausted. The most recent report by the Social Security Trustees projected that the entire program will become insolvent by 2033, leading to an across-the-board benefit cut of 23 percent for all beneficiaries regardless of age or income.

The solutions in Social Security may be easier than other parts of the budget because the demographic trends driving the problem are clear, and there are a limited number of reform options. The bipartisan plans suggested by Bowles-Simpson and Dominici-Rivlin have laid out the broad outlines of reform, combining modest tax and benefit changes with protections for low-income beneficiaries. Moreover, if the programs are reformed soon, changes can be much more gradual than if Congress waits 20 years to address the shortfall. We've put together the most common options in the Social Security Reformer, a tool that lets you create your own plan to fix Social Security.

The Fix the Debt Campaign noted how Social Security reform is key to reducing long-term debt, saying:

Social Security is a significant contributor to our long-term fiscal challenges along with growth in spending on health care entitlements and a broken tax code. Fixing Social Security won’t solve all of our country’s fiscal challenges, but it would be a significant step in the right direction that could lead to further actions on tax and entitlement reform and help restore public faith in Washington.

What’s needed now is hard work to build a consensus around a mix of options and the political will to make the tough choices. While a commission is not a substitute for political will, it can provide valuable work in developing a consensus and building support for action among policymakers and the public. The leadership Congressmen Delaney and Cole have demonstrated in putting this bill forward is an encouraging sign that at least some elected officials in Washington are prepared to tackle the fiscal challenges facing our nation.