CRFB Dives Deeper Into the Fiscal Cliff

After the report we released in March, the topic of the fiscal cliff has risen in prominence as CBO and others have attempted to estimate the size of the cliff. In addition, uncertainty over how it will be handled has started to make many different sectors of the economy anxious. In light of all this, CRFB re-released its original analysis today with new appendices that go deeper into various effects associated with the year-end cliff.

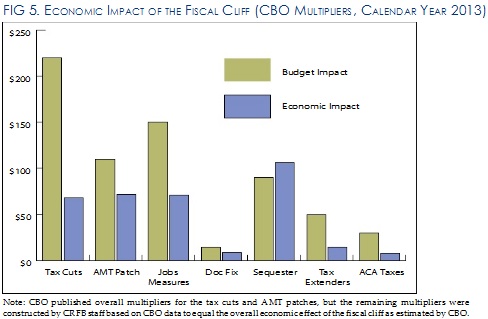

The first appendix summarizes many different estimates of the economic impact of the cliff, including ours and CBO's. We used CBO's multipliers to roughly break down the overall economic impact of each group of policies involved in the fiscal cliff. Other estimates, of course, vary based on which policies are included, but the general consensus is that the economy would take a significant hit if we were to take the plunge. CBO has said that the cliff scenario could result in a mild recession in the first half of next year. Of course, putting the cliff off permanently would also do significant damage to the economy over the longer term. This option should be a non-starter.

Additional appendices show how the cliff will affect each area of the budget. A variety of tax increases will hit the vast majority of taxpayers, albeit in a progressive manner. In addition, the sequester will make across-the-board cuts to a number of areas of the budget--specifically, defense, non-defense discretionary spending, and Medicare. We detail how each area of the budget will be impacted.

While the the fiscal cliff would affect many sectors of the economy, an even greater threat is the one posed by the country's ever-increasing debt levels. The fiscal cliff must be addressed as soon as possible to minimize damage to the economy while also ensuring that debt does not rise to an unsustainable level over the longer term. Failure to resolve this issue may already be harming the economy, so lawmakers must act quickly to enact a smart and gradual deficit reduction plan.