COVID Response: How Much Money Has Been Made Available So Far?

The fiscal and monetary policy response to the COVID-19 pandemic and subsequent economic crisis has been both swift and substantial. We have been tracking these support measures — in the form of spending, tax breaks, loans, and other actions — as part of our COVID Money Tracker initiative.

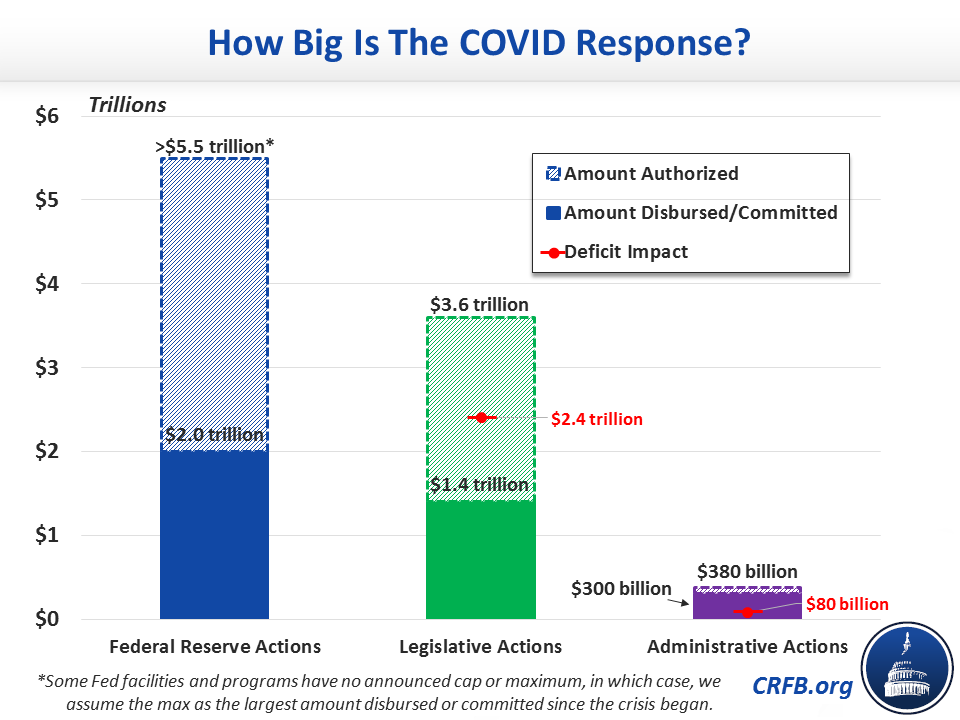

The Federal Reserve has authorized more than $5.5 trillion in economic support and disbursed roughly $2 trillion. Another $3.6 trillion of support has been authorized through legislation, of which at least $1.4 trillion has been either disbursed or committed (net deficit impact will be roughly $2.4 trillion). Finally, the Administration has authorized nearly $400 billion of support through executive action and disbursed roughly $300 billion (net deficit impact will be less than $100 billion).

This blog post is a product of the COVID Money Tracker, a new initiative of the Committee for a Responsible Federal Budget focused on identifying and tracking the disbursement of the trillions being poured into the economy to combat the crisis through legislative, administrative, and Federal Reserve actions.

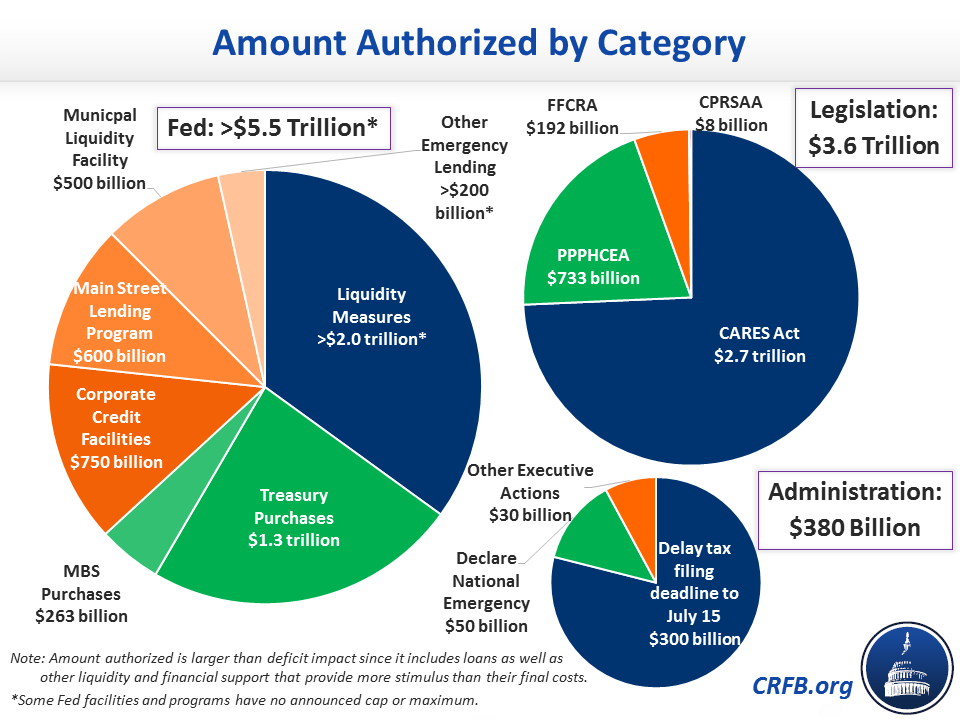

The Federal Reserve has committed to support the economy in a number of ways, including regular purchases of Treasuries and Mortgage-Backed Securities, establishing new lending facilities (or reviving old ones from the Great Recession), and buying and supporting debt from businesses, states, and municipalities. In total, we estimate the Fed has announced it could provide at least $5.5 trillion of support to the economy — and possibly much more. So far, it has disbursed roughly $2 trillion — mainly through loans and asset purchases.

Meanwhile, Congress has passed and the President signed into law four pieces of legislation — including the Coronavirus Preparedness & Response Supplemental Appropriations Act (CPRSAA), the Families First Coronavirus Response Act (FFCRA), the Coronavirus Aid, Relief, and Economic Security (CARES) Act, and the Paycheck Protection Program and Health Care Enhancement Act (PPPHCEA). Over ten years, CBO estimates these bills will cost a combined $2.4 trillion. However, when taking into account loans that will be repaid and other temporary relief measures, we estimate they will ultimately provide up to $3.6 trillion of support to the economy. So far, at least $1.4 trillion has been disbursed.

Finally, the White House has taken several administrative actions to support the economy, including declaring a national emergency, delaying the tax filing deadline, instituting a moratorium on federal student loan interest, and establishing a system to support food producers and distributors. We estimate these actions will provide up to $380 billion in short-term economic support, mainly by delaying the tax filing deadline from April 15 to July 15. Of that total, approximately $300 billion has already been disbursed.

In the weeks and months ahead, we will continue to track the government's fiscal and monetary policy response to the ongoing economic crisis in greater detail through our COVID Money Tracker project. See our latest update here.