COVID Money Tracker: Paycheck Protection Program

Note: See here for an update on the Paycheck Protection Program as of May 23, 2020.

The Paycheck Projection Program (PPP) was established under the Coronavirus Aid, Relief, and Economic Security (CARES) Act to help small businesses maintain their operations and continue to pay their workers during the COVID-19 pandemic through forgivable loans. The CARES Act initially authorized $349 billion for the program, and an additional $321 billion was authorized in the Paycheck Protection Program and Health Care Enhancement Act. This analysis traces the first $349 billion of PPP funds.

This blog post is a product of the COVID Money Tracker, a new initiative of the Committee for a Responsible Federal Budget focused on identifying and tracking the disbursement of the trillions being poured into the economy to combat the crisis through legislative, administrative, and Federal Reserve actions.

The Paycheck Protection Program (PPP) allows businesses and non-profits with fewer than 500 employees (or certain businesses with no more than 500 employees in any one location) to apply for a forgivable bank loan to cover payroll and certain operating costs during the current pandemic. Businesses in need can apply for SBA-backed loans of up to 2.5 times average monthly payroll or $10 million at a local bank and are eligible for loan forgiveness if they maintain their payroll. Specifically, firms that keep (or rehire) all their employees and maintain more than 75 percent of their pay can deduct from their loan repayment any funds spent on payroll, rent, mortgage interest, or utilities over an eight-week period. Firms who reduce their workforce can receive partial forgiveness; and any part of the loan not forgiven can be paid back over 2 years at a 1 percent interest rate.

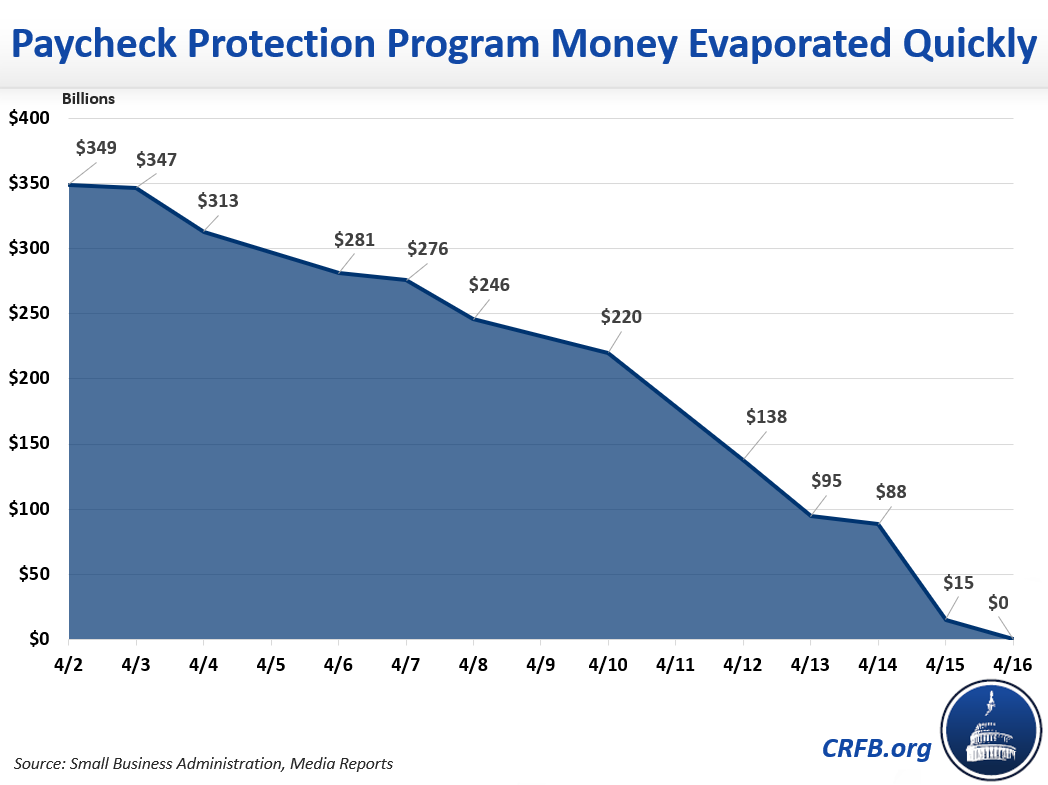

Applications for PPP loans opened on April 3rd, backed by the initial $349 billion in funding under the CARES Act. The funding quickly depleted as the SBA became inundated with millions of applications from eligible entities. The program exhausted its funds on April 16th and was temporarily suspended for 11 days before it resumed on April 27th after an additional $321 billion in funding was authorized in the Paycheck Protection Program and Health Care Enhancement Act.

The initial $349 billion of funding allowed banks to issue $341.4 billion of loans (the rest went toward administrative costs and bank fees). These loans went to more than 1.6 million eligible businesses across all 50 states, five U.S. territories, and the District of Columbia. Among the states, California businesses received the most loans, totaling $33.4 billion, while firms in Alaska and Wyoming each got less than $1 billion. Texas had the highest number of successful loan applications with 134,737 approved loans, while Alaska had the smallest, with 4,842 approved loans. Adjusted for population, North Dakota received the most loan dollars per capita and had the highest number of successful applications per capita.

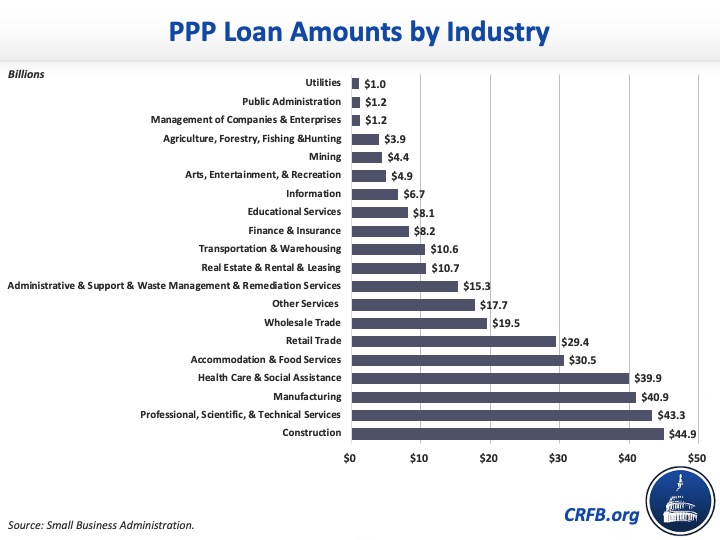

On a sectoral basis, the construction industry received the largest amount of loans ($44.9 billion), followed by professional, scientific, and technical services ($43.3 billion) and manufacturing industries ($40.9 billion). The health care and social assistance industry received $39.9 billion in loans, the accommodation and food service industry received $30.5 billion, and retailers were granted $29.4 billion in PPP loans. The utility, public administration, and management of companies and enterprises sectors each received less than $2 billion in loans.

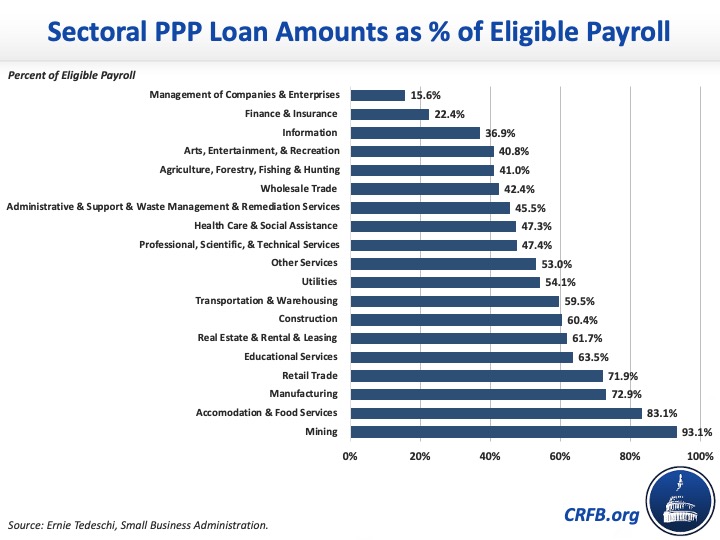

The industrial breakdown differs somewhat when viewed as a percentage of eligible small business payroll, calculated using an SBA formula. Evercore ISI Managing Director and Policy Economist Ernie Tedeschi recently estimated that as a percentage of eligible small business payroll, the mining industry received the most, with 93 percent ($4.4 billion) of its eligible payroll ($4.7 billion) covered in PPP loans, while the management of companies and enterprises sector only received 15.6 percent ($1.2 billion) of its payroll ($7.7 billion) in loans. Other hard-hit industries - including the retail, construction, manufacturing, accommodation and food service industries - received between 60 and 83 percent (between $29.4 billion and $44.6 billion) of their eligible payroll (between $36.7 billion and $74.4 billion) in PPP loans.

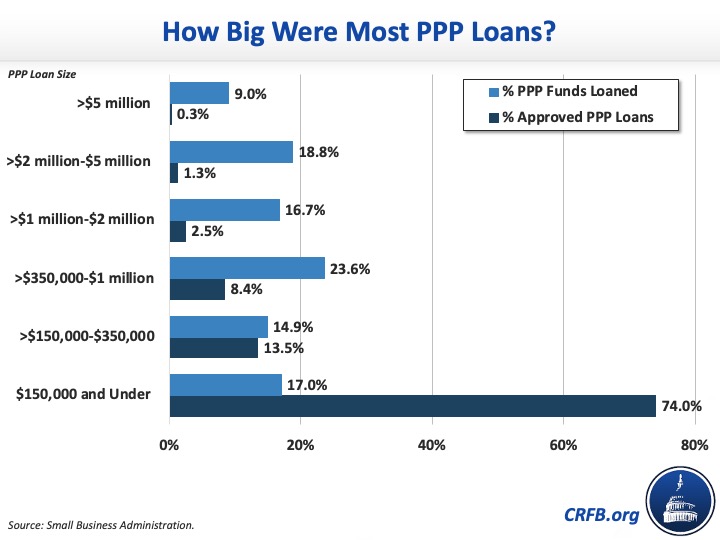

As of April 16, the average loan totaled just $206,022, and nearly three-quarters of the approved loans are under $150,000. Another 22 percent of loans were between $150,000 and $1 million, and only 0.3 percent -- or 4,412 loans -- were over $5 million. As a share of dollars loaned, 17 percent were for loans under $150,000, slightly above 38 percent were for loans between $150,000 and $1 million, and only 9 percent of funds were for loans above $5 million.

The figures above are based only on the first $349 billion tranche of PPP loans, and do not include any loans from the second $321 billion tranche. They also do not account for any of the firms which have declined PPP funds or given the money back.

Since the program resumed on April 27, another 475,000 loans valued at $52 billion have been approved. We estimate the average loan is about $109,500, though we do not yet have the breakdown by state or industry. As more loans are made and additional data become available, we will track additional disbursements under the Paycheck Protection Program in our COVID Money Tracker.