Concord Coalition Calls for Social Security Reform

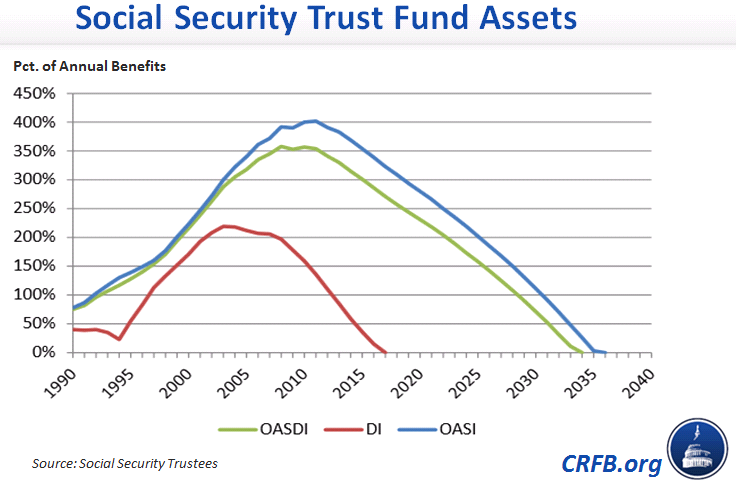

As we have discussed numerous times, the Social Security program is on an unsustainable path, and its combined trust fund will be depleted within the next 20 years. If Congress does not act to reform the system, all beneficiaries will see a 23 percent benefit cut upon the exhaustion of the funds. The Disability Insurance portion of the fund is in more immediate danger: it is expected to be insolvent by 2016, triggering an immediate 19 percent cut in disability benefits.

On Tuesday, Ben Ritz of the Concord Coalition published an article entitled "Impending Crisis Should Force Action on Social Security in the Next Congress." He warns of the looming insolvency and details a commonly offered but insufficient solution to the issue:

The last time the DI fund faced exhaustion was in 1994. At that time, Congress adopted a recommendation from the trustees to reallocate a portion of the OASI payroll tax to the DI program (increasing DI’s share to 1.8 percent, up from 1.2 percent).

Those who want to avoid the realities of Social Security’s challenges are suggesting that Congress could fall back on this supposedly simple solution again. Unfortunately, circumstances are very different now than they were in 1994.

Back then, OASI had an annual cash-flow surplus of $23 billion (and thus more money available) compared to its $34 billion deficit last year.

Ritz emphasizes that reallocation of the trust fund assets would be insufficient to fix the program, while making future changes more costly and creating political issues:

The public trustees agree that reallocating money from OASI may seem like the “easy” solution, but without other reforms this would simply be robbing Peter to pay Paul. It would do nothing to ensure the long-term sustainability of either program and would make addressing the overall shortfall in Social Security that much more difficult in the future.

At a time when there are already insufficient revenues to pay for promised old age benefits, elected officials should be concerned of the possible political consequences a reallocation could invite. It would not be surprising for some people to allege that this cop-out is “taking money from seniors’ benefits to pay for congressional can-kicking.”

In addition, policymakers in both parties who have been reluctant to provide specific plans to reform and strengthen Social Security should consider the growing economic ramifications of inaction. Allowing Social Security’s deficits to grow unchecked would put a greater burden on general revenues, raising concerns that many other important government programs will be increasingly squeezed out. Responsible reform should protect Social Security programs as well as other national priorities.

To make the trust fund sustainable, Congress will have to enact policies that increase revenue, decrease benefits, or some combination of the two. However, the longer we wait before these changes are made, the larger and more costly they will be. Waiting to act until the insolvency dates could incur sudden tax hikes and/or benefit reductions, giving taxpayers and beneficiaries little time to adjust. Refusing to take action at all, however, will result in substantial loss of benefits for all beneficiaries regardless of income level. According to Ritz, "such a steep cut would impose unconscionable on people who depend on the program." He concludes by stressing the need for a bipartisan reform effort:

No one supports 19 percent or 25 percent benefit cuts for those who depend on these crucial safety-net programs, so the path forward is clear. The next Congress must be when all Americans -- Democrats, Republicans, seniors, workers, and policymakers, both inside and outside the beltway -- come together and compromise on a plan to sustainably strengthen these critical programs for future generations.

You can design your own plan to reform Social Security and restore its solvency with our interactive tool The Reformer. You can also find additional information on the topic in our publications listed below.

Related Posts: