Clinton & Trump: Where Will Our Debt Be in 10 Years?

Our recent report Promises and Price Tags: A Preliminary Update estimated that both major party presidential candidates' proposals would add to the debt, although Donald Trump's would add significantly more. This update lowered the cost of both of their sets of proposals compared to what we had estimated in June. We now estimate Hillary Clinton's proposals would add $200 billion to the debt over a decade (down from $250 billion), and Trump's proposals would add $5.3 trillion (about half of the previous $11.5 trillion).

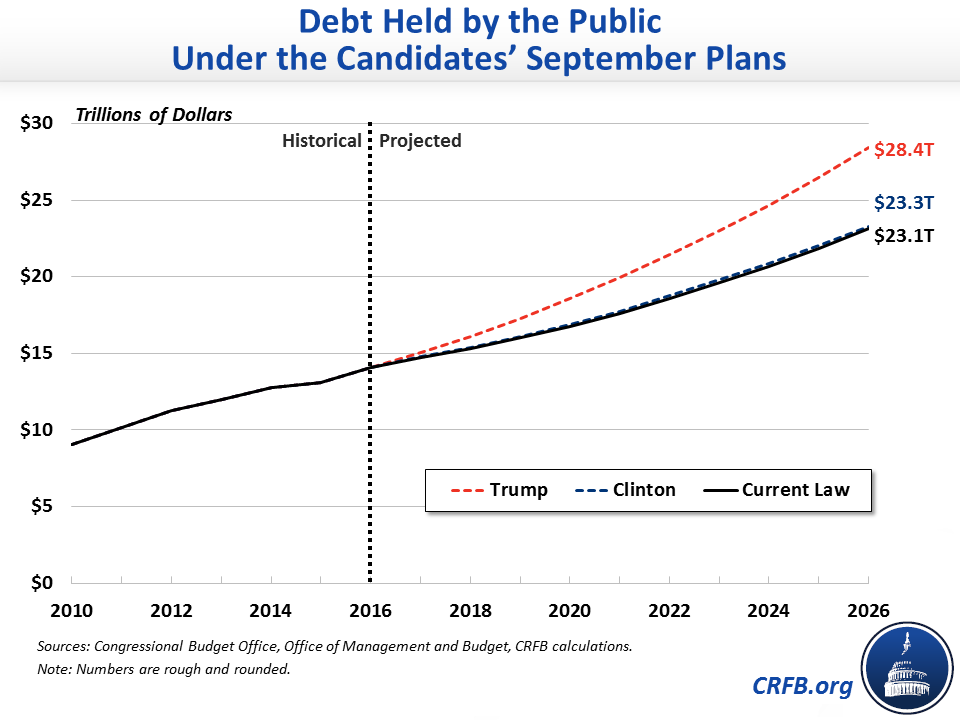

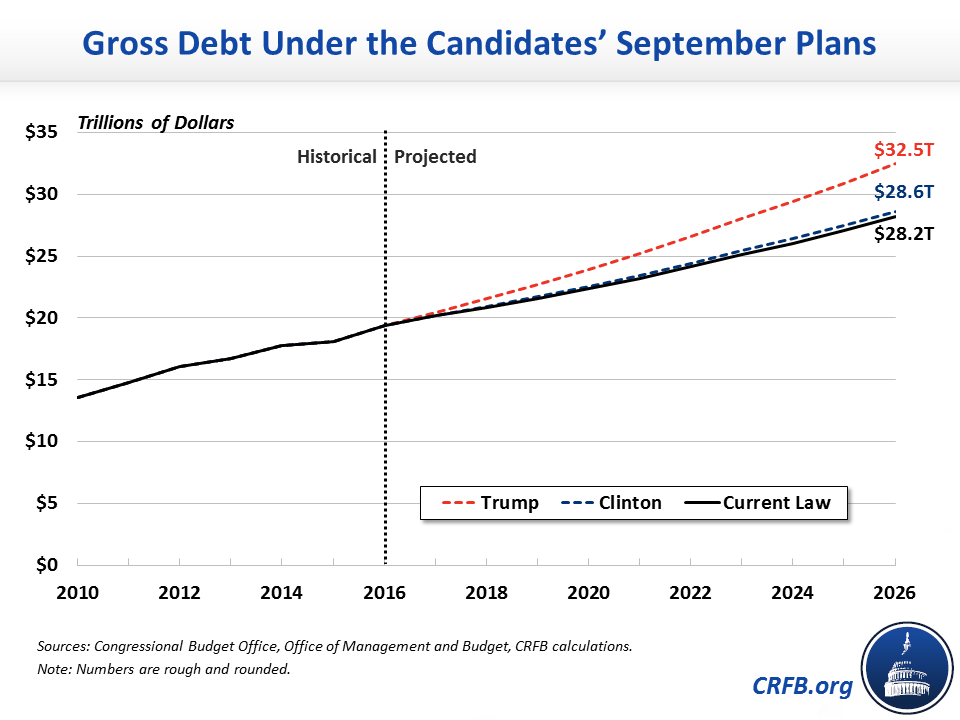

Our report focused on what happens to debt as a share of the economy, but here we show the dollar values of debt held by the public and gross debt ten years from now. Gross debt measures the debt that the government owes itself in addition to debt owned by businesses, central banks, individuals, and foreign countries, so it captures more than just debt obligations to third parties.

Under current law, debt held by the public is already projected to grow by $9 trillion over the next decade, from $14.1 trillion at the end of Fiscal Year (FY) 2016 to $23.1 trillion at the end of FY 2026.

We estimate that both Clinton's and Trump's proposals would worsen this trajectory, though Trump's would worsen it much more. Under Clinton's proposals, debt held by the public would reach $23.3 trillion (86 percent of Gross Domestic Product). Under Trump's proposals, debt held by the public would reach $28.4 trillion (105 percent of GDP).

Both candidates would also worsen gross debt. According to the Congressional Budget Office's current law baseline, gross debt is projected to grow by about $8.8 trillion over the next decade, from $19.4 trillion at the end of FY 2016 to $28.2 trillion at the end of FY 2026.

Under Clinton, gross debt would increase by more than the costs of her proposals because the increased revenue from immigration reform partially helps the Social Security and Medicare Hospital Insurance (HI) trust funds, which affect public debt but not gross debt. This means that Clinton's plans would raise gross debt by about $450 billion more than current law, resulting in debt of $28.6 trillion at the end of FY 2026.

On the other hand, Trump's proposals would add less than the cost of his plans to gross debt due to higher spending and lower revenue from the HI trust fund as a result of repealing the Affordable Care Act as well as lower revenue for Social Security. This equates to Trump adding $4.3 trillion more than current law to gross debt over the next decade, reaching about $32.5 trillion at the end of FY 2026.

It is important to note (as we did before) that most economists believe the key measure of fiscal health is debt held by the public as a percentage of GDP, but the media and many politicians prefer to use the gross debt figures.

| Debt Held by the Public | Gross Debt | |

|---|---|---|

| Current Law, 2016 | $14.1 trillion | $19.4 trillion |

| Current Law, 2026 | $23.1 trillion | $28.2 trillion |

| With Clinton's Proposals | $23.3 trillion | $28.6 trillion |

| Change from Current Law with Clinton's Proposals | +$0.2 trillion | +$0.4 trillion |

| With Trump's Proposals | $28.4 trillion | $32.5 trillion |

| Change from Current Law with Trump's Proposals | +$5.3 trillion | +$4.3 trillion |

Sources: Congressional Budget Office, CRFB calculations.

These large debt increases highlight the importance of candidates taking our current debt problem very seriously rather than just present ways to cover the costs of their new initiatives. It will take a combination of revenue increases, spending cuts, and entitlement reforms in order to return to a fiscally sustainable debt trajectory.