Changes to Note in the Social Security Trustees Report

The Social Security Trustees Report showed a largely similar outlook compared to the report last year, though it was slightly worse. Trust fund exhaustion dates were similar other than the date for the separate Old-Age and Survivors' Insurance (OASI) fund, which was brought forward one year to 2034. In addition, the 75-year actuarial shortfall increased slightly from 2.72 percent of taxable payroll to 2.88 percent, largely the result of changes in economic assumptions and shifting the 75-year period over one year.

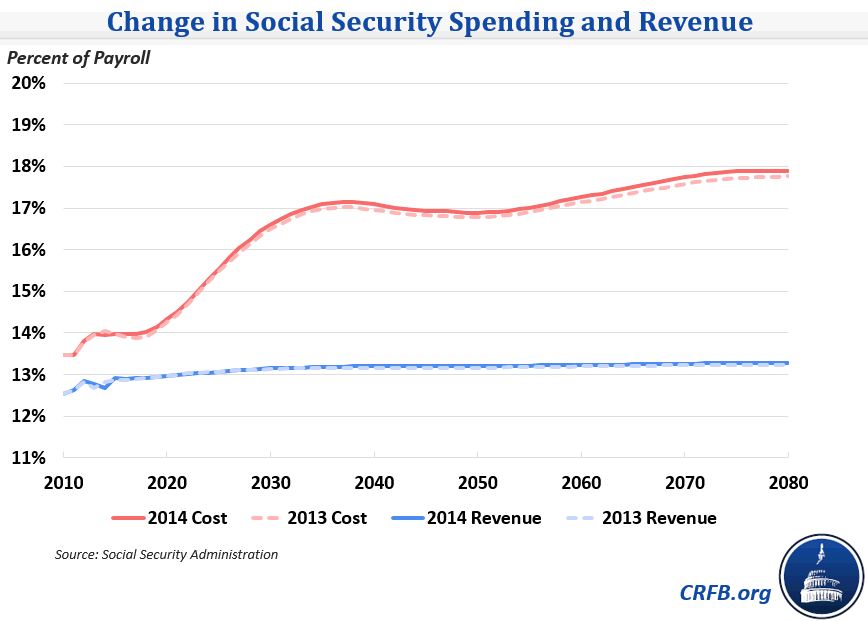

As a percent of payroll, the change is entirely concentrated on the spending side, but this appears to be more a factor of payroll shrinking than nominal dollar spending increasing. Social Security revenue is the same at 13.9 percent of payroll over the 75-year period, while spending is 0.2 percentage points higher than last year at 16.8 percent.

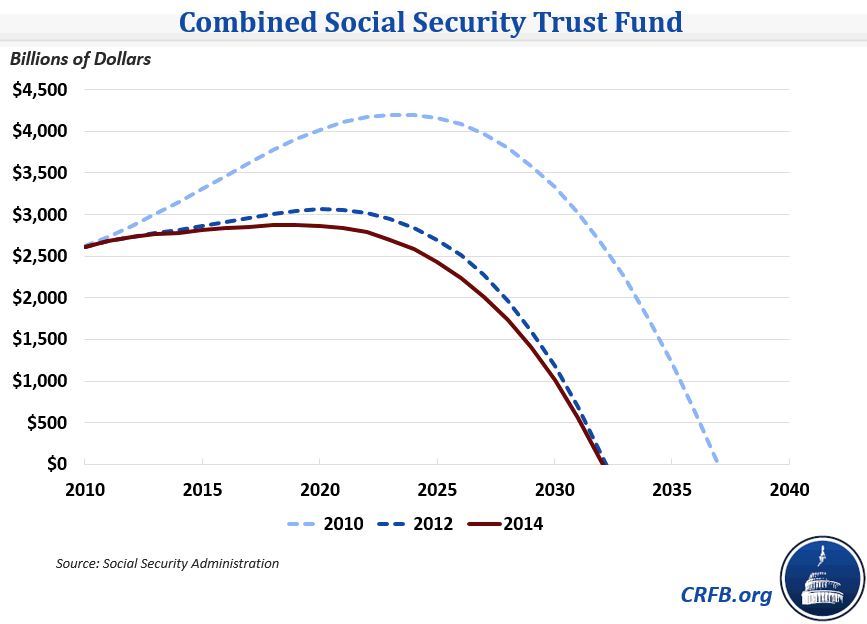

Looking back further, as we noted in our analysis of the report, the outlook for the program has deteriorated in each of the last four reports. Below, we show the assets in the trust fund over time as projected in the 2010, 2012, and 2014 Trustees reports.

While the change in Social Security projections this year is relatively small, there are some interesting sources for those changes, some of which may have implications for future changes in Trustees forecasts.

Same-Sex Marriage

The only major "legislative" change that affected Social Security came from the Supreme Court: the Windsor decision which overturned the part of the Defense of Marriage Act that prohibited federal benefits for same-sex couples even if they reside in a state that recognized their marriage. This decision makes more people eligible for survivors' benefits. The report notes that there is significant uncertainty around the estimate of new benefits because rules have not been finalized about how far back a marriage would count -- whether it would start at the time of the Supreme Court decision or when the state legally recognized the marriage, as the Social Security Administration has proposed -- and because it is uncertain how many states will legalize same-sex marriage. (The Trustees assume all states eventually will.) While the decision increases the 75-year shortfall by only 0.01 percent of payroll, the uncertainty surrounding the change means that this area could be a source of future revisions.

CPI-W

Social Security determines cost-of-living adjustments (COLAs) for benefits using the CPI-W. In this report, the Trustees lowered their long-term CPI-W growth from 2.8 percent to 2.7 percent, apparently placing increased weight on the average over the past 20 years (2.4 percent) rather than the last 30 years (2.8 percent). While this assumption results in lower benefits, it also lowers the interest rate on bonds held by the trust fund and lowers the discount rate used in calculating the shortfall, resulting in more weight being placed on the higher-deficit years in the latter part of the projection window. Thus, the change increases the actuarial shortfall by 0.02 percentage points. (Correction: the increase in the actuarial shortfall is actually because of the timing of the effects on revenue and outlays. The lower inflation lowers payroll tax revenue immediately but generally does not affect benefits until one year later).

Earnings and GDP

A major source of revisions came to the projections of earnings and GDP. On the former point, the Trustees have revised down their estimate of the ratio of average taxable earnings to the average wage index by 1 percent over the long term. This means that payroll tax revenue is expected to be lower relative to benefits, since average taxable earnings determines revenue, and the average wage index (AWI) determines the growth of initial benefits (benefits are based on a person's highest 35 years of earnings, adjusted for the AWI). In addition, the Trustees revised down near-term economic growth rates and lowered their estimate of full-employment GDP by about 1 percent due to slow economic growth in recent years relative to the decline in the unemployment rate. As a result, GDP is expected to be 3 percent lower in 2050 than last year. These changes combined increase the actuarial shortfall by 0.08 percentage points.

Fertility

Overall, demographic assumptions reduce the actuarial shortfall by 0.04 percentage points based on the incorporation of recent data and historical revisions. One of those assumptions to watch for future years is the fertility rate, which has fallen slightly since the onset of the Great Recession from 2.1 percent to 1.9 percent. Birth data in 2012 came in just a bit under the 2013 Trustees' expectation, which they attributed to the ongoing effect of the slow recovery. This change has caused them to reverse down their fertility rate projection -- which is expected to rise to 2 by 2017-- in the near term, increasing the 75-year shortfall by 0.01 percentage points. The change is small, but it is a reminder that if fertility rates remain subdued for longer than the Trustees anticipate, it could have a larger impact on the program's finances.