Chairman Price Rolls out the FY 2017 House Budget

House Budget Committee Chairman Tom Price (R-GA) today released the FY 2017 House budget resolution to formally kick off the Congressional budget process. The budget proposes about $6.5 trillion of spending reductions, which along with a war draw down, economic effects, and interest would lead to $7.9 trillion of total savings -- enough to balance the budget by 2026. The budget also instructs five committees to generate $30 billion of savings over the next two years (two have already submitted packages), and includes reconciliation nominal instructions to all 12 committees for further savings.

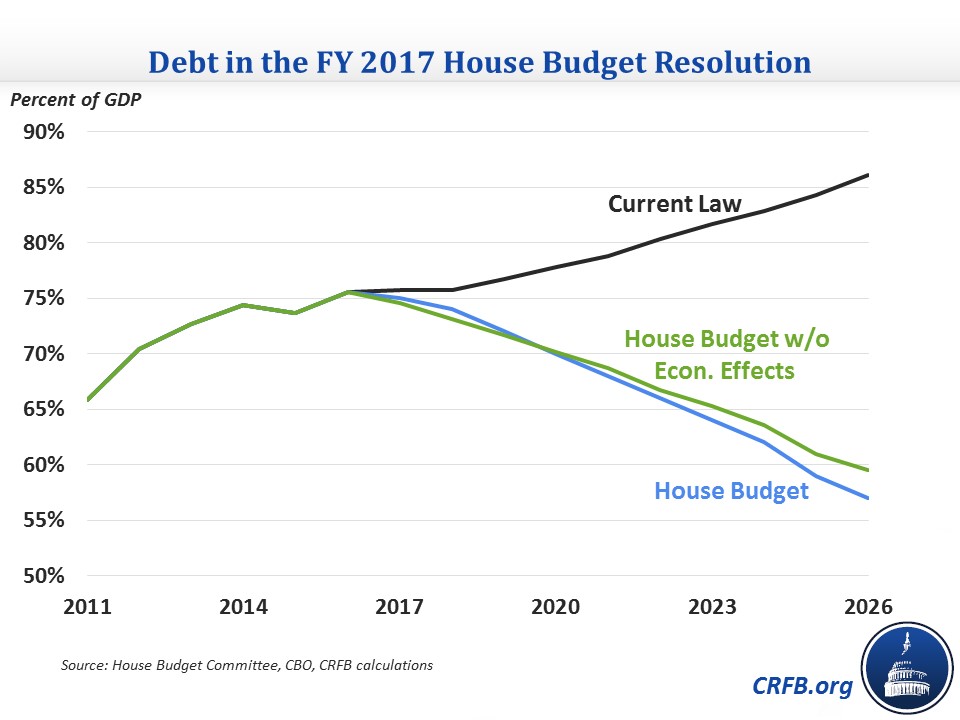

Overall, the budget -- based on the numbers provided by the budget committee -- would put debt on a clear downward path, falling from 76 percent of GDP in 2016 to 57 percent by 2026. Even excluding the economic effects of Affordable Care Act (ACA) repeal and the budget's deficit reduction ("dynamic scoring"), debt would still decline to 59 percent. Both of these numbers are much better than current law, under which debt will reach 86 percent of GDP by 2026.

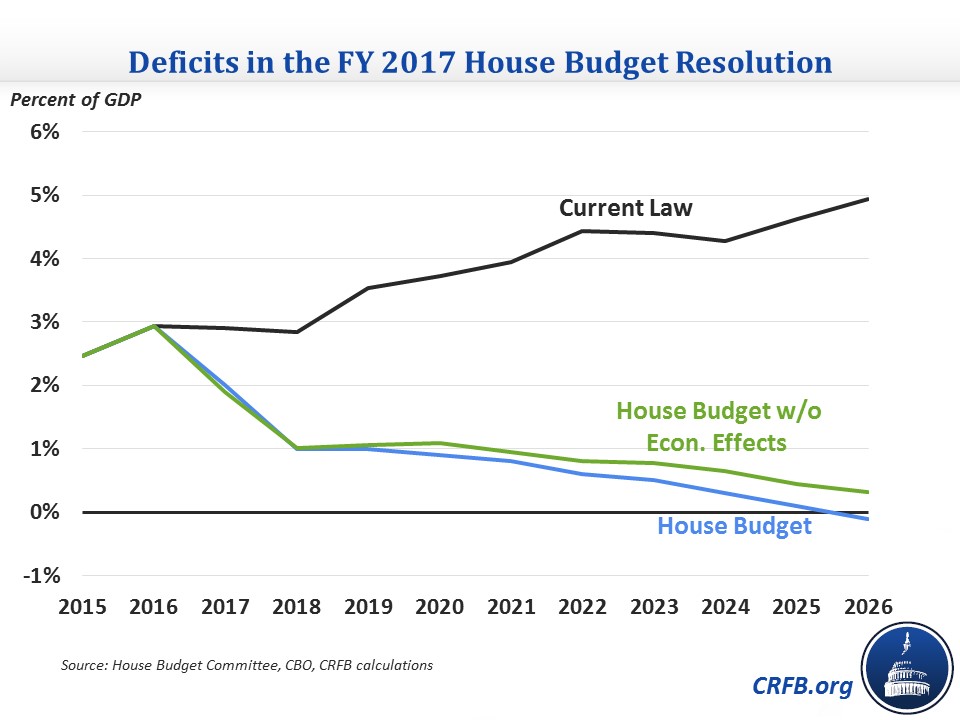

The budget would also gradually reduce and then eliminate annual deficits. Deficits would fall from 2.9 percent of GDP in 2016 to a 0.1 percent deficit by 2025, and there would be a small 0.1 percent of GDP surplus in 2026. Even excluding economic effects, deficits in 2026 would be quite small -- about 0.3 percent of GDP. This represents a significant improvement over the 4.9 percent deficit currently projected for 2026 under current law.

The budget generates the bulk of its savings from health care and other mandatory spending programs. This includes $2 trillion of savings from repealing the coverage expansions in the Affordable Care Act (while leaving the spending cuts and essentially the tax increases in place), $1 trillion from block granting Medicaid and capping its growth, and $449 billion from Medicare savings policies, including reforming cost-sharing rules and switching to a premium support system in 2024.

The budget also calls for $1.5 trillion of savings from other mandatory programs, citing policies such as block granting food stamps and reforming housing, education, and job training programs as ways to get there. On discretionary (appropriated) spending, the budget would stick with the current FY 2017 spending cap but in future years, it would increase defense budget authority by $267 billion above sequester levels while decreasing non-defense budget authority by $887 billion below sequester levels. In addition, the budget claims $225 billion of revenue (and $216 billion of net deficit reduction) from the macroeconomic effects of repealing the Affordable Care Act.

Note that almost all these numbers are more aggressive than last year's House budget, which is for the most part unsurprising given that the worse budget outlook makes it more difficult for lawmakers to get to balance.

| Policy Changes in the House FY 2017 Budget | |

| Budget Category | 2017-2026 Savings |

| Affordable Care Act | $2,013 billion |

| Medicaid and Other Health | $1,028 billion |

| Medicare (net) | $449 billion |

| Social Security | $14 billion |

| Other Mandatory | $1,471 billion |

| Discretionary and Highway | $690 billion |

| Revenue | $0 billion |

| Interest | $818 billion |

| Subtotal, Policy Savings | $6,482 billion |

| Economic Effect of Deficit Reduction | $241 billion |

| Economic Effect of ACA Repeal | $254 billion |

| Subtotal, Claimed Savings with Economic Effects | $6,977 billion |

| Baseline Adjustments* | $900 billion |

| Total, Claimed Savings Compared to CBO January Baseline | $7,877 billion |

Source: House Budget Committee

*Includes war spending draw down and added revenue from economic effects of last year's tax deal that were not included in CBO's January baseline.

As with past budgets, some of these savings may be unspecified, and much of it may be unrealistic. We will analyze these aspects of the budget as more information becomes available.

Encouragingly, the budget does call for some specific savings to be enacted in the near term and facilitates the enactment of more savings over the next few months. Specifically, the budget calls for $30 billion of two-year savings and $140 billion of ten-year savings outside the reconciliation process from the Agriculture, Energy and Commerce, Financial Services, Judiciary, and Ways and Means Committees. Judging by the committees named and the committees that have reported legislation so far, the policies involved in the final package could be similar to ones used in a 2012 House package that would have delayed the sequester for one year.

The budget also includes reconciliation instructions to 12 committees to save at least $1 billion over ten years -- a nominal target designed to give the committees maximum flexibility. Hopefully, the reconciliation instructions will be used to getting substantial deficit reduction beyond that required of the five committees.

Enacting $140 billion of deficit reduction into law would be a good start -- and certainly better than adding to the debt as we did last year. But lawmakers will need to enact $3.5 trillion simply to stabilize the debt, and $8 trillion ($7.9 trillion based on this budget resolution) to balance the budget.

We will follow up with further analysis of the budget resolution, which can be read here.