CBO's Social Security Projections

In CBO's 2014 Budget and Economic Outlook released this week, they addressed the future of the federal government's largest program, Social Security. Social Security has two separate trust funds: one for Old Age and Survivors Insurance and one for Disability Insurance. It is clear from CBO's analysis that both face mounting fiscal challenges in the coming years.

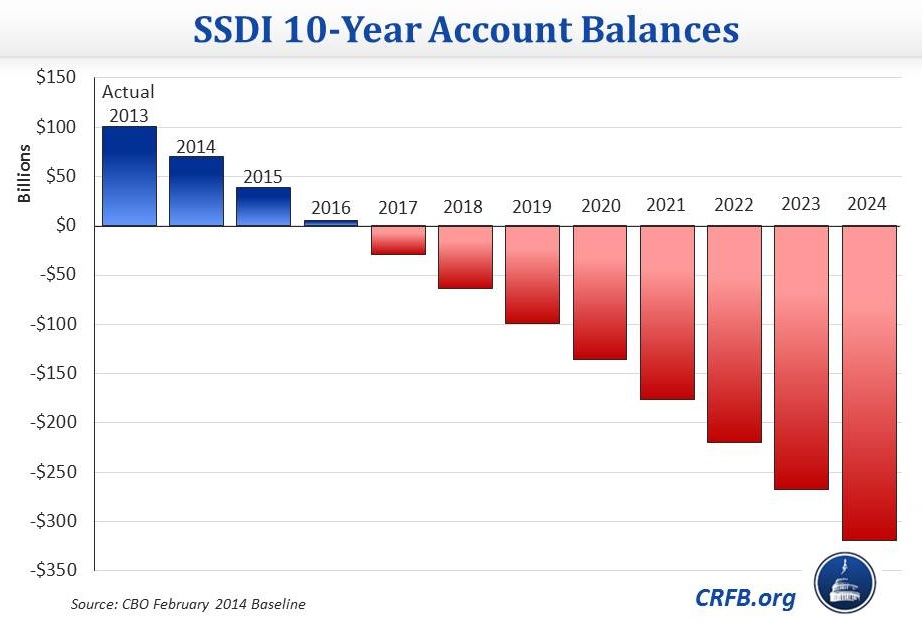

Disability Insurance (DI)

The Social Security DI program pays benefits to some workers who suffer debilitating health conditions before they reach Social Security's full retirement age. Payments are also made to their eligible spouses and children. As CBO explains, the trust fund is paying out more than it is taking in, so its annual cash flows of the DI program, excluding interest, will add to federal deficits every year for the next ten years, by amounts ranging from $35 billion to $52 billion. Even with interest receipts included, the DI trust fund is expected to run a yearly deficit throughout that period. CBO estimates that, in the absence of legislative action, the balance of the DI fund will be exhausted in Fiscal Year 2017, though it appears that the trust fund would run out near the end of calendar year 2016. The chart below shows the outlook for the DI fund over the next decade (excluding interest payments and expenses):

By law, CBO is required to assume the Social Security Administration (SSA) will pay DI benefits in full after the trust fund is exhausted even though SSA is not allowed to pay benefits in excess of the available balances, borrow money from a trust fund, or transfer money from one trust fund to another. In Congressional testimony yesterday, CBO Director Doulas Elmendorf addressed this issue stating that in 2017 the DI program “would require then a substantial reduction in benefits to fall down to the level of the ongoing incoming receipts” unless Congress acted to shift money to the DI fund. If Congress wants to avoid a sizeable reduction in disability benefits, they will need to take action to shore up the program's finances.

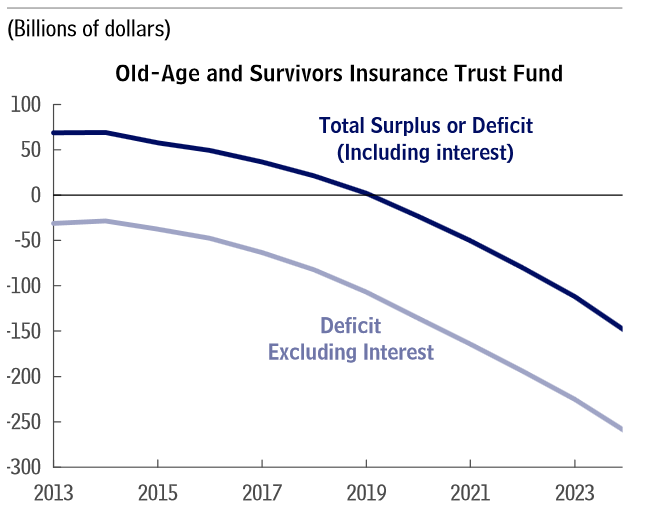

Old Age and Survivors Insurance (OASI)

Unlike the DI program, OASI is currently running surpluses and will continue to do so through 2019, however, these amounts will decline over that period. By 2020, even with interest income, CBO projects the trust fund will start recording annual deficits. While about 46 million people received OASI benefits in 2013, more baby boomers are becoming eligible for the program and the number of people collecting those benefits will increase by an average of 3 percent per year. By 2024, CBO estimates 63 million people will receive benefits, 38 percent more than the number of recipients in 2013. Additionally, CBO estimates that the average benefit will increase by 3 percent each over the next decade. CBO shows the projection of decreasing surpluses and eventually deficits in their graph:

Annual Surpluses or Deficits Projected in CBO's Baseline for the OASI Trust Fund

Source: CBO cbo.gov/sites/default/files/cbofiles/attachments/45010-Outlook2014.pdf

Over the coming decade, Social Security spending will climb steadily (6 percent on average per year) due to the nation’s growing elderly population and rising benefits. Under current law assumptions, Social Security outlays will encompass 5.6 percent of GDP by 2024. CBO's analysis shows that in the near future, both Disability Insurance and Old Age and Survivors Insurance will face major funding challenges and will need to be addressed.

The Disability Insurance Fund will run out in 2016 or 2017, and Social Security as a whole will become insolvent by the early 2030s. As we discuss in our paper Social Security Reform and the Cost of Delay, acting sooner will mean that the necessary changes can be smaller and gradually phased in. If policymakers wait until Social Security is on the brink of insolvency, the problem becomes much more difficult to fix.