CBO Projects Debt Will Reach New Record

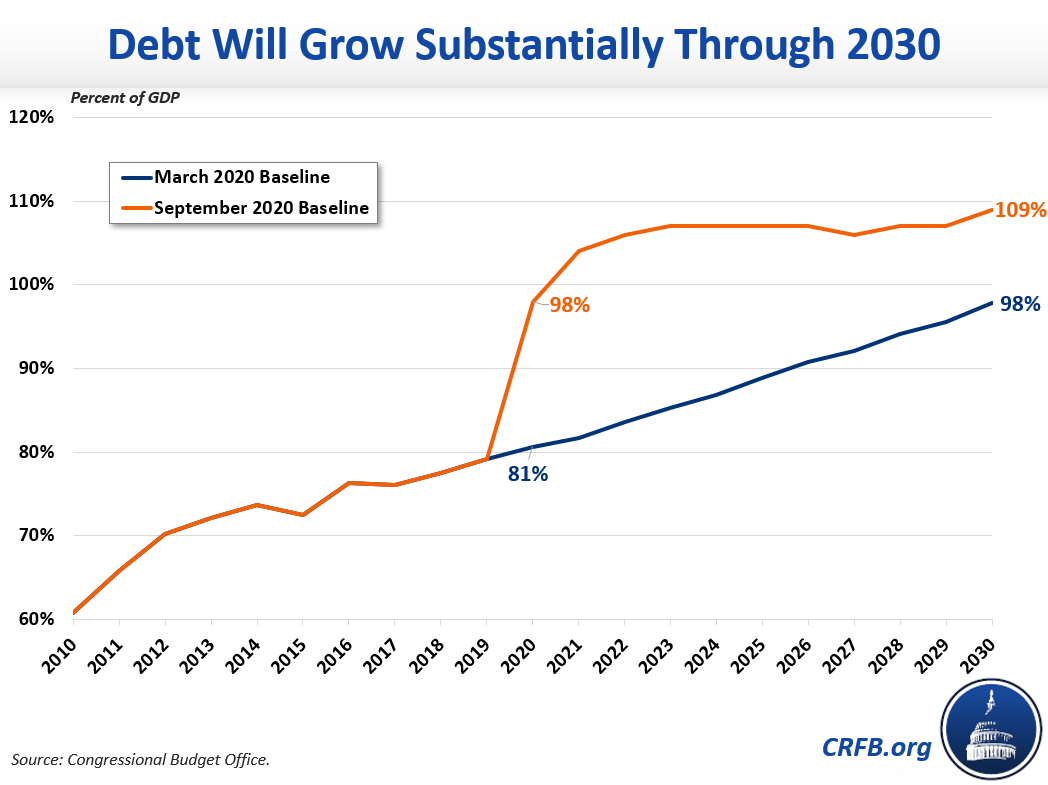

The Congressional Budget Office (CBO) just released its updated Budget Outlook, showing that the COVID-19 public health and economic crisis has substantially worsened an already unsustainable budget outlook. According to CBO, deficits will total $3.3 trillion in Fiscal Year (FY) 2020, and $1.8 trillion in FY 2021. Debt will eclipse the size of the economy next year – at 104 percent of GDP – and surpass the all-time record in 2023 when it reaches 107 percent of GDP. From 2021 through the end of the decade, CBO estimates the deficit will total $13.0 trillion and debt will reach 109 percent of GDP by 2030.

CBO’s September 2020 baseline is based on its July economic forecast and marks the agency’s first set of ten-year budget projections that incorporates the fiscal effects of the current crisis. These projections have deteriorated significantly since the agency last published a ten-year baseline in March.

CBO's 2020 to 2030 deficit projections are $2.1 trillion higher than its previous estimate of $14.2 trillion. At 109 percent of GDP, debt will be 11 percentage points higher in 2030 than the 98 percent projected in CBO's March estimate. By 2030, CBO does expect annual deficits to be similar to previous projections – $1.6 trillion as opposed to $1.8 trillion – with lower interest rates and price levels leading to lower spending than previously estimated.

The worsened fiscal outlook is driven by increased spending and tax relief to fight the pandemic and economic crisis. You can track these measures at COVIDMoneyTracker.org.

Of the $2.1 trillion deficit increase, more than all of it – $2.8 trillion – comes from legislative changes. Technical changes contribute another $420 billion in deficit increases. Economic changes actually reduce projected deficits by $1.1 trillion – with lower inflation and interest rates reducing spending far more than lower GDP reduces revenue.

Changes in CBO's Baseline Budget Projections

| Source of Change | 2020 | 2020-2030 |

|---|---|---|

| Deficits Projected in March 2020 Baseline | $1,073 billion | $14,164 billion |

| Economic Changes | $316 billion | -$1,089 billion |

| Legislative Changes | $2,317 billion | $2,802 billion |

| Technical Changes | -$396 billion | $420 billion |

| Deficits Projected in September 2020 Baseline | $3,311 billion | $16,298 billion |

| Change in Baseline Deficits | $2,237 billion | $2,133 billion |

Source: Congressional Budget Office.

Note: All numbers include debt service. Numbers may not sum due to rounding.

CBO also released new trust fund projections, showing all major trust funds will become insolvent within the next 11 years. CBO estimates the Highway Trust Fund (HTF) will deplete its reserves in FY 2021, the Medicare Hospital Insurance (HI) trust fund in FY 2024, and the Social Security Disability Insurance (DI) trust fund in FY 2026, and the Social Security Old-Age and Survivors Insurance (OASI) trust fund in calendar year 2031.

As CBO shows, our fiscal situation will continue to deteriorate as a result of irresponsible tax and spending policies, rising health and retirement costs, and increased fiscal support to address the COVID-19 crisis. While policymakers rightly enacted deficit-increasing fiscal support to bolster the economy, they must turn their attention to long-term debt and deficit reduction to get the country on solid fiscal ground once the crisis ends.

The Committee for a Responsible Federal Budget will release our full analysis of CBO's projections later today.