Can Delaney Provide a Bipartisan Way Forward for Infrastructure and Tax Reform?

As discussions about President-elect Trump's first 100 days agenda continue, Representative John Delaney (D-MD) is suggesting that a bill he proposed last session of Congress, which temporarily boosts infrastructure funding and sets the stage for corporate tax reform, might serve as a bipartisan basis for Congress and the Trump administration to achieve their tax and infrastructure priorities.

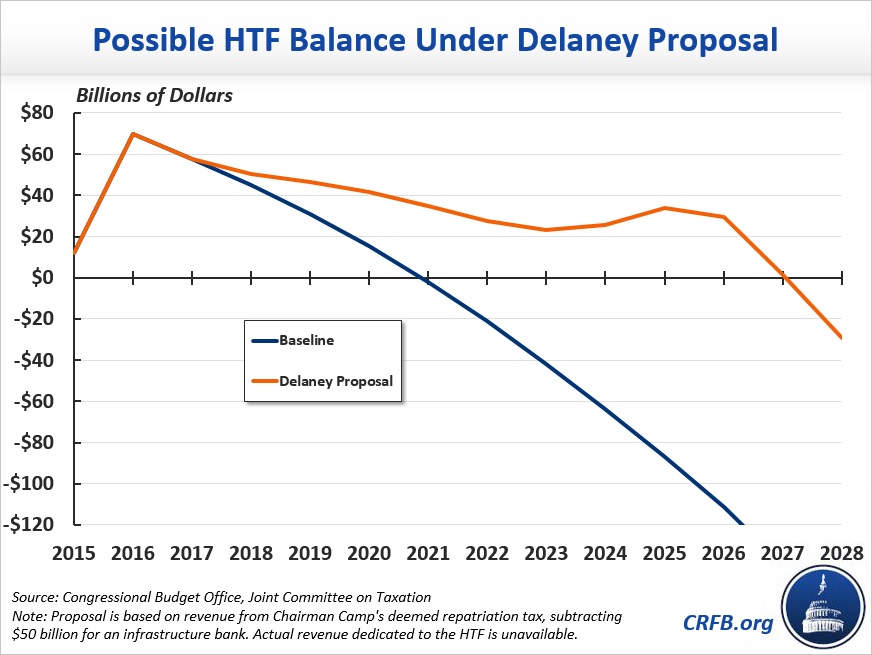

Delaney’s 2015 bill, which is based on a similar piece of legislation he introduced in December 2014, was introduced before the “Fixing America’s Surface Transportation” (FAST) Act, which extended the Highway Trust Fund’s (HTF) solvency for five years, was signed into law. In 2015, it was estimated the HTF faced a shortfall totaling $170 billion over the subsequent ten years as a result of spending exceeding dedicated revenues for most of the previous 15 years. Though it provided a temporary solution to these problems, the FAST Act relied on gimmicks for its offsets without providing a permanent funding stream for the increased spending.

Delaney’s solution could provide an infrastructure spending boost or be used to further extend the solvency of the HTF. His proposal uses “deemed repatriation” at an 8.75 percent tax rate to raise $120 billion for the HTF and $50 billion for an infrastructure bank – building off the approach from former Ways and Means Chairman Dave Camp's (R-MI) Tax Reform Act. This deemed repatriation tax would apply to more than $2 trillion in earnings held by U.S. corporations overseas. The revenue raised toward the HTF would extend its solvency for over 5 years, and the $50 billion infrastructure bank would use public seed funds to leverage private investments in finance transportation, water, energy, communications, and education projects.

Delaney’s bill uses a one-time charge on foreign earnings to levy the funds necessary to seed the infrastructure bank and fund the HTF while allowing for a transition period for larger corporate tax reform. Rather than using temporary funds to permanently lower the corporate tax rate as suggested in some tax reform plans, Delaney would redirect the revenue toward shoring up the HTF while setting the stage for larger tax reform.

Since a deemed repatriation tax is usually done in the context of international tax reform, Delaney’s bill would set an eighteen-month timeline for Congress to enact a plan. If Congress does not come to an agreement, Delaney’s legislation would implement a modified version of "Option Z" from former Senate Finance Chairman Max Baucus's (D-MT) international tax discussion draft, which would end deferral and tax corporate income at a lower rate in the year it is earned.

While deemed repatriation could provide a short-term fix, Delaney's bill would also create a bipartisan, bicameral commission tasked with finding permanent financing mechanisms that can address the structural problems facing the HTF. We recommended a similar approach last year in our paper "The Road to Sustainable Highway Spending."

Delaney's bill could provide fiscally responsible, actionable solutions to address the problems facing our infrastructure and our tax code - two areas where Congress has shown bipartisan interest in reform. Additionally, Delaney's proposal recognizes the importance of using temporary offsets for temporary measures and permanent offsets for permanent measures, thus setting the stage for larger-scale tax reform and long-term, sustainable infrastructure spending. Responsibly-funded tax reform and public infrastructure investment could boost long-term economic growth. For these reasons, we hope that Delaney’s bill serves as a model for the Trump administration and the 115th Congress as they work to enact meaningful, bipartisan reform.