Build Your Own Child Tax Credit – A Web-Based Version

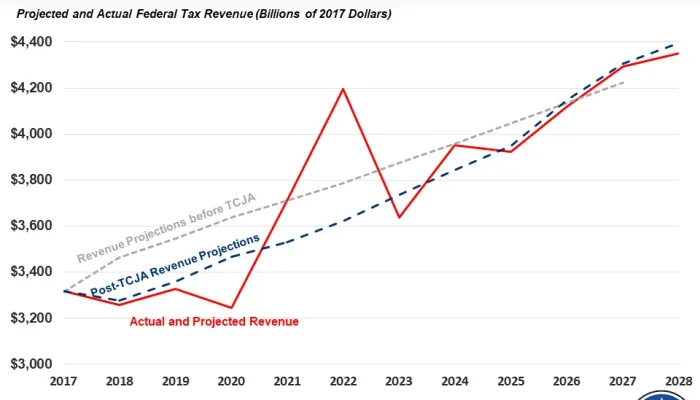

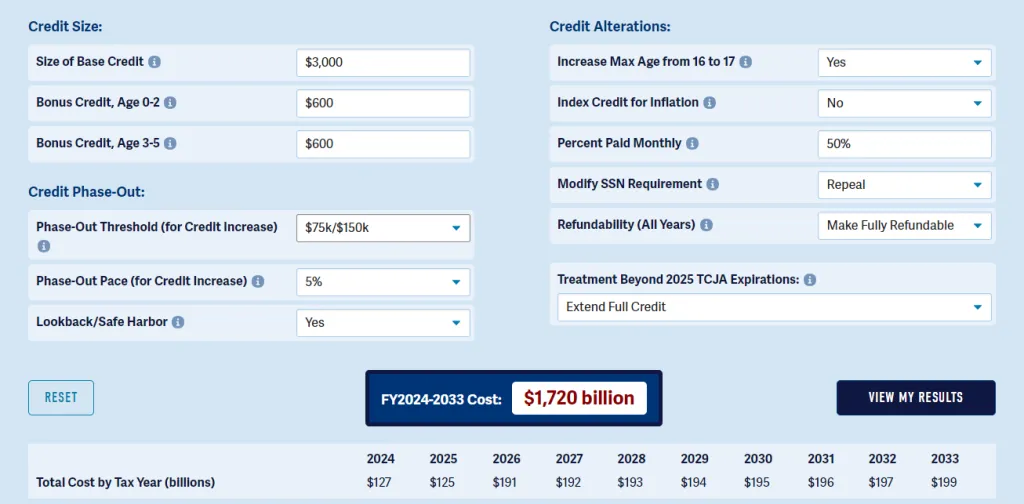

The Child Tax Credit (CTC) has become a topic of significant debate among policymakers as they wrestle with determining its appropriate size, particularly in light of the approaching 2025 expiration of the Tax Cuts and Jobs Act’s (TCJA) expansion of the credit. Our updated Build Your Own Child Tax Credit model allows you to design your own CTC policy and estimates the ten-year cost of your customized parameters.

The model is now featured as an iterative tool on our website, allowing users to share their results and help inform the ongoing discussion. Our newly released version offers enhanced user-friendliness and incorporates a wide array of updates, including expanded refundability options, a new budget window, and up-to-date inflation metrics. The online version also allows users to submit their results, which can be shared anonymously with policymakers here in Washington.

Build Your Own Child Tax Credit

Using the model, we estimate reviving the expanded, fully refundable $3,000/$3,600 child tax credit from the American Rescue Plan would cost over $1.7 trillion through 2033 relative to current law; the cost would total $1.2 trillion if users also extend the TCJA’s repeal of the dependent exemption (which the larger CTC was designed to replace).

Build Your Own Child Tax Credit

A more modest expansion that lifted the credit to $2,500/$3,500 for households making less than $60,000, tightened eligibility, and partially expanded refundability would cost about $900 billion over a decade. The cost would be about $380 billion if the new credit was extended as a supplement to current law – meaning the credit was increased by $500 for most children and $1,500 for children under the age of six on top of the $2,000 credit in effect today and the $1,000 credit scheduled to return starting in 2026.

In either case, lawmakers would need to identify revenue or spending offsets – which could come in part from reforms to the base child tax credit and other family-related benefits within the tax code and budget – to ensure new proposals do not add to the debt.

Importantly, the Build Your Own Child Tax Credit model is not a micro-simulation model and is meant only to provide rough estimates of various choices. It is also still in beta-testing mode, so please contact us if you identify any errors or believe we should add additional features.

Build Your Own Child Tax Credit

To design your own CTC proposal, click here. Tweet your results with the hashtag #BuildYourOwnCTC, and make your choices count by sharing your ideal CTC policy design with us!