Budget Deal Truly Offsets Only Half Its Cost

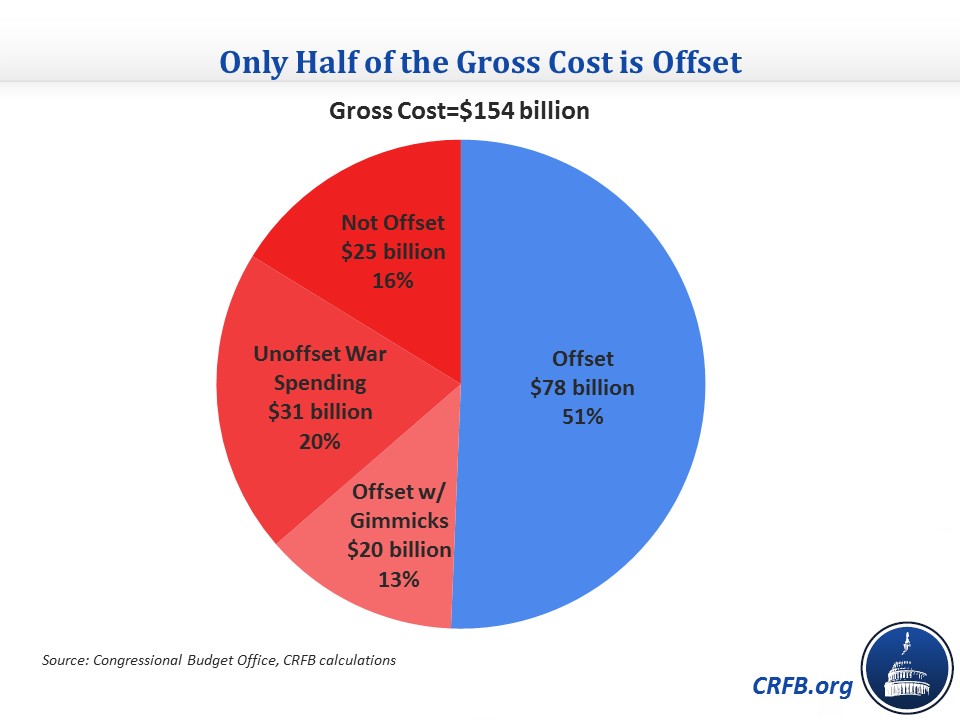

Lawmakers are currently considering a budget deal that would increase appropriated spending, suspend the debt limit until March 2017, reallocate revenue to the Social Security Disability Insurance trust fund, and avoid a spike in some Medicare premiums. Although this bill is being hailed as a fiscally responsible sequester replacement bill, we estimate that when interest is added and gimmicks are removed, only half of the bill's cost is truly paid for.

The legislation includes about $80 billion of direct sequester relief and another $8 billion of Medicare premium relief. But when you include the additional $31 billion increase in war spending (a gimmick that lets policymakers backfill discretionary spending without offsets) and $36 billion of interest costs, the total cost of the bill rises to $154 billion.

Of this $154 billion, about $78 billion is paid for honestly: through a combination of Medicare reforms, reductions in farm subsidies, increases in PBGC premiums, asset sales, tax compliance measures, and other changes (plus the subsequent interest savings). The legislation also includes $20 billion of phony or double-counted savings, mainly from pension smoothing and other timing gimmicks but also from $3 billion of crop insurance savings that lawmakers have promised to repeal later. And the remaining $56 billion of the legislation – mostly the war spending increase and interest costs – is not paid for at all.

| Budgetary Effect of the Budget Deal | |

| Category | Ten-Year Cost/Savings (-) |

| Defense Sequester Relief | $39 billion |

| Non-Defense Sequester Relief | $39 billion |

| War Spending Increase* | $31 billion |

| Medicare Premium Fix | $8 billion |

| Interest Cost | $36 billion |

| Total Gross Cost | $154 billion |

| Extend Mandatory Sequester by One Year | -$14 billion |

| Sell from Strategic Petroleum Reserve | -$5 billion |

| Increase PBGC Premiums | -$5 billion |

| Make Up Medicare Premium Fix | -$8 billion |

| Repeal Health Insurance Auto-Enrollment | -$8 billion |

| Equalize Payments for Similar Services | -$9 billion |

| Extend Medicaid Inflation Rebate to Generic Drugs | -$1 billion |

| Enact Judiciary Savings | -$4 billion |

| Auction Spectrum | -$4 billion |

| Change Partnership Audit Rules | -$11 billion |

| Interest Savings | -$9 billion |

| Total Legitimate Offsets | -$78 billion |

| Shift PBGC Premium Payments | -$3 billion |

| Extend Pension Smoothing | -$8 billion |

| Double-Count Social Security Savings | -$4 billion |

| Change Crop Insurance Agreements (Agreed to Be Repealed) | -$3 billion |

| Interest Savings | -$2 billion |

| Total Gimmicks and Double-Counting | -$20 billion |

| Net Cost of the Bill | $56 billion |

| Net Cost Excluding Gimmicks | $76 billion |

Source: CBO, CRFB calculations

Numbers may not add due to rounding.

*Measured relative to the Pentagon's FY 2016 budget request assumed in both 2016 and 2017

This means only half of the bill is paid for with real honest savings over the next decade. Even excluding interest costs, only 60% of the bill is. That's better than nothing but falls far short of any definition of fiscal responsibility.

Note: This blog has been updated for the latest CBO score of the bill (H.R. 1314) on October 28.