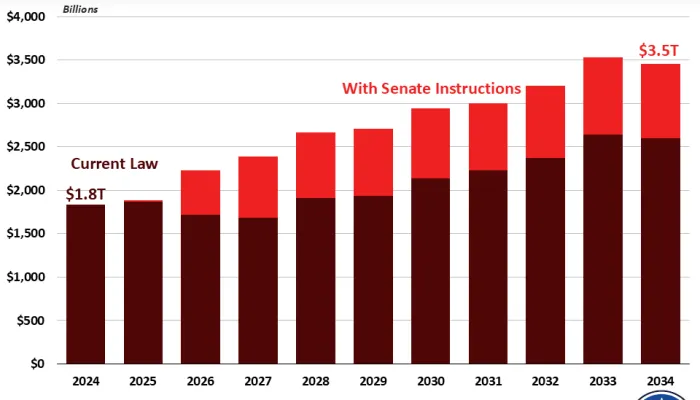

Budget Deal Could Ultimately Add $2 Trillion in Debt

The budget deal lawmakers have agreed to would increase discretionary spending above and beyond repeal of the sequester and the caps set in law under the Budget Control Act, in addition to a Christmas list of other items they desire. This deal comes with a hefty price tag of $320 billion over ten years according to the Congressional Budget Office, despite the fact that most of the deal is only temporary. It would push the deficit in 2019 clearly above $1 trillion to $1.2 trillion.

That $320 billion mostly reflects near-term costs, however. If temporary provisions in the bill were made permanent, the ultimate cost could increase to $1.7 trillion, or $2.1 trillion including interest, and increase debt to 105 percent of Gross Domestic Product (GDP) by 2027. Coming on the heels of the $1.5 trillion tax cut in December, this deal would be another huge blow to fiscal responsibility.

The largest expense in the budget deal is a plan to increase defense caps by $165 billion over two years and non-defense discretionary caps by $131 billion. But the legislation also allocates $89 billion of new budget authority on disaster relief and includes additional spending and tax cuts by repealing the Independent Payment Advisory Board (IPAB), extending tax measures that expired at the end of 2016, and funding community health centers.

These $419 billion of increases are offset by just $100 billion of spending cuts, with a third coming from extending the sequester on mandatory spending for an extra two years beyond 2025; another third from various changes and reforms to Medicare, Medicaid and other health programs; and the rest from selling oil from the Strategic Petroleum Reserve, extending various customs and visa fees, and further limiting Federal Reserve remittances.

| Policy | Ten-Year Cost / Savings (-) |

|---|---|

| Increase discretionary caps in 2018 and 2019 | $290 billion |

| Enact disaster relief (discretionary and mandatory) | $72 billion |

| Repeal IPAB | $17 billion |

| Extend tax extenders and other revenue measures | $17 billion |

| Enact health extenders and family policies | $13 billion |

| Extend community health center and other public health funding | $9 billion |

| Make various agriculture program changes | $1 billion |

| Subtotal, Costs | $419 billion |

| Extend mandatory sequester through 2027 | -$35 billion |

| Make various changes to Medicare, including further means testing premiums and updating payment schedules | -$16 billion |

| Extend certain customs, visa, and immigration fees | -$13 billion |

| Make changes to Medicaid, including limit lottery winners from receiving Medicaid | -$11 billion |

| Accelerate Medicare Part D manufacturer discounts in donut hole | -$10 billion |

| Drawdown from the Strategic Petroleum Reserve | -$6 billion |

| Extend CHIP authorization for four more years, through 2027 | -$5 billion |

| Limit Federal Reserve remittances | -$2 billion |

| Other health offsets | -$1 billion |

| Subtotal, Offsets | -$100 billion |

| Total | $320 billion |

| Total with interest | $418 billion |

| Potential Cost with Permanent Extensions | $1.7 trillion |

| Potential Cost with Permanent Extensions and Interest | $2.1 trillion |

Sources: Congressional Budget Office, Joint Committee on Taxation, and CRFB calculations. Note: all spending shown in outlays. Numbers may not add due to rounding.

This amount of deficit increase is unacceptable and the result of a budget process that has recently disregarded all constraints in making deals. Lawmakers should follow the precedent of the previous two budget deals and offset the full cost of the deal rather than adding hundreds of billions or even multiple trillions to the debt.