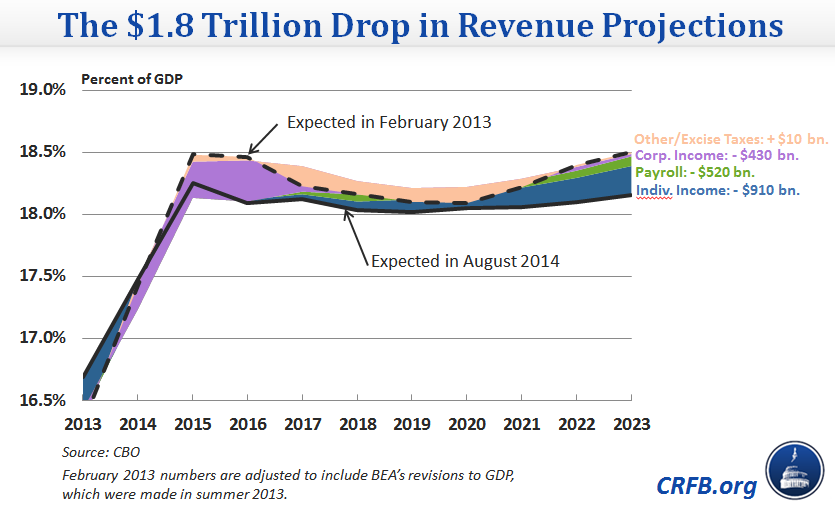

The $1.8 Trillion Drop in Revenue Projections

With the economy recovering slower than originally anticipated, the government now expects to collect significantly less revenue this decade than it did just two years ago. The most recent budget projections from the Congressional Budget Office (CBO) show the government taking in $1.8 trillion less over a ten-year period than was projected in February 2013.

Growing entitlement spending is the primary source of growth in the federal budget, but this growth would not lead to higher debt if revenues kept pace. Despite the savings from the widely noted $900 billion slowdown in health care spending since March 2011, federal revenues are set even faster, widening the deficit. Over the same 2013-2021 time period, revenue projections have fallen $1.2 trillion since February 2013 and net health care spending has fallen $780 billion since March 2011.

February 2013 was the first budget baseline after the fiscal cliff law, which allowed certain tax cuts for high earners to expire while permanently extending most of the 2001/2003 tax cuts. In that baseline, revenues were expected to climb to 18.5 percent of GDP, both in the immediate future and by the end of the decade. Over the last two years, though, CBO has continually revised these revenue projections downward, particularly in their February baseline of this year. The last month's projections showed revenue staying under 18.2 percent of GDP throughout the period.

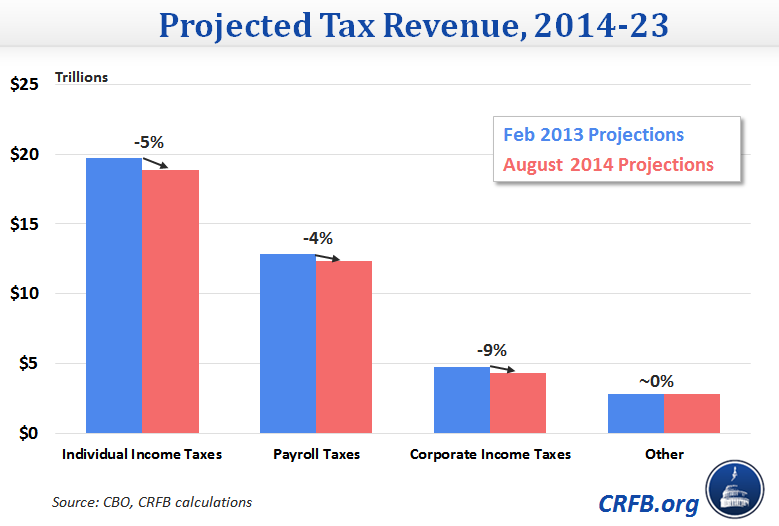

Half of the $1.8 trillion is due to decreases in individual income tax revenue. Payroll taxes experienced a similar but smaller decline. Corporate tax revenue is expected to be much lower than expected in the near term – projections for 2016 dropped over 15 percent – but only slightly lower over the long term. Excise taxes are the only exception to the decline, with projections that have slightly increased over the last two years.

Nearly all of the drop has been due to changes in economic projections – lower GDP and lower expected salaries and wages. Technical changes in CBO's methodology have been responsible for less than $100 billion of the drop, with upward revisions last month and May 2013 partially cancelling out downward technical revisions in February and April. Legislative changes have increased revenue by about $10 billion.

As CRFB President Maya MacGuineas explained, "Declining revenue projections are one reason why our debt problems still look about the same as two years ago, despite the good news on health care savings." While the health care savings will have a greater long-term impact than the revenue dropoff, any declining revenue means it will be that much harder to get deficits under control.

Update: This post was updated to make the apples-to-apples comparison more clear between the revenue and healthcare slowdowns, as well as adjusting the first graph for BEA's revisions to GDP.