It's Time for A Bipartisan Fiscal Commission

The national debt is on an unsustainable path, interest costs are exploding, and the Social Security and Medicare trust funds are approaching insolvency. A new fiscal commission can help policymakers work on a bipartisan basis to identify the necessary tax and spending changes to help improve the nation’s fiscal outlook.

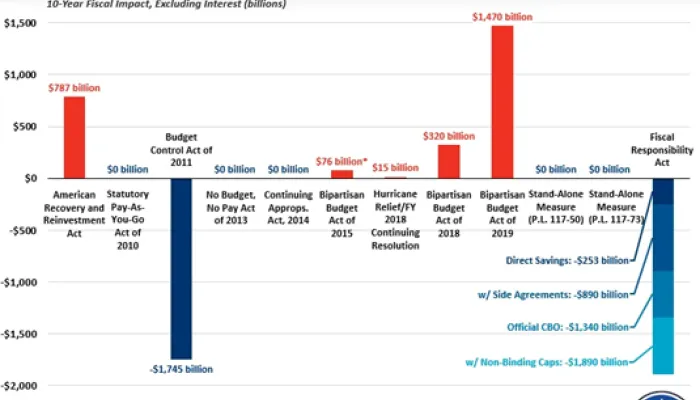

The recent enactment of the Fiscal Responsibility Act (FRA) – which capped defense and nondefense discretionary spending – was an important first step toward improving budget discipline. However, the FRA’s caps only apply to about one-quarter of the budget and last only two years. Congress and the President have been largely unable to address revenue or mandatory spending through the normal legislative process.

To tackle our nation’s fiscal, economic, and budgetary challenges, policymakers should establish a bipartisan, bicameral fiscal commission. The commission should put all parts of the budget and tax code on the table to facilitate earnest negotiations. And political leaders should commit to consider its recommendations.

In this paper, we show that:

- Commissions have often helped to effectuate policy change not only by having their recommendations enacted, but also by facilitating bipartisan negotiations, developing and socializing policy solutions, and elevating public discourse on important policy issues.

- Successful commissions create safe space for negotiations, offer opportunities for bipartisan cooperation, solicit input from Congress and stakeholders, rely on Presidential and Congressional leadership, and often include some type of fast-track process and/or enforcement mechanism.

- The current fiscal and economic situation makes a fiscal commission particularly timely.

Historically, commissions have helped policymakers to extend the life of Social Security, consolidate military bases, identify government waste, develop frameworks for tax reform, improve homeland security after 9/11, and draw attention to our unsustainable fiscal outlook.

Ultimately, Democrats and Republicans will need to come together to consider revenue and spending changes to address our nation’s most serious fiscal challenges. A bipartisan commission can help facilitate these discussions and support efforts to usher in a new era of responsibility and prosperity.

Past Commissions Have Succeeded in Many Different Ways

Throughout history, policymakers have turned to commissions when confronted with difficult decisions related to the economy, oversight, government waste, military base consolidation, budget deficits and debt, national security, energy and federal lands policy, homeland security, health care, great power competition, trust fund solvency, and the structure of the tax code.

There have been hundreds of commissions, task forces, and similar committees established over the years – some through executive action, some through legislation, and some through other processes. Some of these commissions have failed to reach agreement or effectuate change, but many commissions have succeeded. That success has taken many forms. Past commissions have:

- Recommended policy changes implemented in full. Some commissions have developed recommendations that were enacted as written. For instance, the Base Realignment and Closure (BRAC) commissions were successfully used to consolidate military bases. And the 1974/75 Quadrennial Social Security Advisory Council recommended technical changes to Social Security’s indexation formula that were enacted in 1977.

- Facilitated bipartisan negotiations. In many cases, commissions have served to allow high-level bipartisan negotiations. For example, the 1983 Greenspan Commission helped President Reagan, Speaker O’Neill, and others negotiate a package that rescued Social Security from insolvency and extended its life for 50 years. In the aftermath of the deadliest terrorist attack in U.S. history, the 9/11 Commission served as an effective vehicle for the deliberation and implementation of numerous bipartisan recommendations aimed at bolstering national security, decreasing the likelihood of a subsequent attack.

- Developed and socialized policy solutions. By bringing together experts and politicians from both political parties to focus on a specific issue, commissions often provide opportunity for the development and dissemination of new policy ideas and designs. The 1982 Grace Commission, the 9/11 Commission, the 2005 Tax Reform Panel, the 2010 Simpson-Bowles Commission, and the 2011 Joint Select Committee on Deficit Reduction all introduced numerous policy ideas that were ultimately enacted into law – often years later.

- Elevated public discourse around important policy issues. Sometimes commissions succeed by changing the conversation in Washington and among the public. The 9/11 Commission, for example, helped raise public awareness on some of our nation’s national security vulnerabilities. The 2010 Simpson-Bowles Commission raised awareness to the nation’s unsustainable long-term fiscal outlook and the need to look at all areas of the budget and tax code to address it, drove much of the conversation around fiscal policy, spurred high-level budget negotiations between President Obama and Speaker Boehner, and helped create the pathway to enactment of the bipartisan, deficit-reducing Budget Control Act.

To be sure, commissions do not always succeed. There have been occasions in which commissions have not been able to build the necessary consensus to offer recommendations and times in which the recommendations offered were not adopted until years later or never at all. However, they often have a better track record than the normal legislative process, and their establishment provides opportunity for policy change.

Case Studies of Commission SuccessesThe Greenspan Commission In 1983, the Social Security trust funds were within months of running out of reserves and being unable to pay benefits. The National Commission on Social Security Reform, often called the Greenspan Commission after commission chair Alan Greenspan, was appointed by President Regan to recommend changes to avoid the near-term insolvency and close the program’s 75-year funding gap. The commission was comprised of a bipartisan group of 15 individuals appointed by the President and Congressional leadership – including Members of Congress, experts, and representatives from labor and business. After a series of fits and starts, the Greenspan commission released recommendations based on proxy negotiations between President Reagan and House Speaker Tip O’Neill. Based on their recommendations, Congress enacted a package of revenue, benefit, and eligibility changes that ultimately extended the life of the trust fund by 50 years. Base Realignment and Closure (BRAC) Commissions In 1988, Congress established the first of five Base Realignment and Closure (BRAC) commissions to help make decisions over military base closures insulated from parochial Congressional interests. The commissions varied in size and were appointed by the President. Once made, BRAC commission recommendations were sent to the President for approval and then to Congress where the recommendations could only be rejected by a joint resolution of disapproval. Over five rounds in 1988, 1991, 1993, 1995, and 2005, BRAC closed or consolidated over 350 installations, enabling efficient defense resource allocation. The Simpson-Bowles Commission The National Commission on Fiscal Responsibility and Reform, often called the Simpson-Bowles Commission after bipartisan co-chairs Alan Simpson and Erskine Bowles, was established by President Obama in 2010 amidst mounting concerns about the long-term fiscal health of the United States. The bipartisan commission included 18 members, divided between senators, representatives, and Presidential appointees. The Simpson-Bowles Commission’s final report, "The Moment of Truth," proposed $4 trillion of ten-year debt reduction from a combination of defense and nondefense discretionary caps, revenue-boosting tax reform, health care savings, spending cuts, user fees, excise taxes, and a balanced Social Security solvency package. The report was supported by 11 of 18 commissioners, including five Democrats, five Republicans, and one Independent. Although the Simpson-Bowles proposal was not enacted in full, the plan helped to shape the national discourse on fiscal policy and was the basis of high-level negotiations between President Obama and Congressional Republicans. Many of its policy recommendations were enacted, including roughly $1 trillion of savings under the Budget Control Act; others periodically resurfaced in subsequent budget discussions and proposals. |

Elements of a Successful Commission

The success of a given commission depends on numerous factors, from design of the commission and public opinion surrounding the commission to the ideology and personalities of those appointed to the commission and luck and random chance. Commissions can succeed or fail for any number of reasons. Commissions must include members working to reach agreement rather than impede it. And they rely on a development of trust amongst the commissioners as well as between the commissioners and their staff.

Those designing a commission cannot, of course, build in trust – trust must grow organically. But certain design choices can improve the likelihood that trust develops, the chances that this trust turns into agreement, and the probability that agreement turns into action.

Historically, some ingredients for success have included:

- Safe space for negotiations. Commissioners need to be able to engage in open and frank discussions without fear of political reprisal or open attack from special interests. Transparency is critical for fostering public trust and supporting democratic outcomes; recommendations should be fully vetted by the public before being voted on by Congress. But negotiators must be able to discuss, deliberate, and opine without fear that ideas will be leaked before policies have been fully considered and pieced together.

- Opportunity for bipartisan cooperation. Commissioners must be able to identify areas of consensus, make compromises, and negotiate trade-offs. In the case of fiscal commissions, this means that both revenue and spending must be considered with no sacred cows.

- Input from Congress and stakeholders. Commissions must be able to incorporate diverse viewpoints from those who understand the issue, are impacted by the issue, and must answer to voters on the issue. Engaging stakeholders, subject matter experts, and elected officials can bring credibility and pragmatism to the process and ensure different views are considered.

- Presidential and Congressional leadership. The President and Congressional leaders must be bought into and supportive of the process. Often this is more effective when from afar, where they express general support for a commission’s work and make their most important priorities known without impeding the ability of commissioners to negotiate details.

- A fast-track process and/or enforcement. Special rules or penalties are often helpful to incentivize commissioners to reach agreement, to ensure their recommendations are acted upon, and to shift blame in the name of avoiding an alternative. This could take the form of simply guaranteeing a vote, of waiving various legislative procedural hurdles, and/or of creating an automatic alternative or penalty in the case of failure.

Ultimately, no single design choice will make or break a commission. But commissions with strong leadership, representation of different viewpoints, Presidential and Congressional support, fast-track consideration or enforcement, and a process to negotiate without political interference probably have the best chance for success. But central to success is trust.

It’s Time for A Bipartisan Fiscal Commission

With interest rates at a 16-year high, the national debt approaching record levels as a share of the economy, and major trust funds within a decade of insolvency, a bipartisan fiscal commission is needed now more than ever. Although its success is far from guaranteed, it represents perhaps the best chance to put the country on a more sustainable fiscal path.

A fiscal commission can bring Democrats and Republicans together to consider all areas of the budget and tax code and make thoughtful recommendations that both sides can agree upon.

This approach already has broad bipartisan support in Congress. Key members of both parties have expressed support for a fiscal commission, including the Problem Solvers Caucus, the Bipartisan Fiscal Forum, and others. Recently, an ideologically diverse group of thought leaders in federal budgeting policy wrote a letter to the leaders of both parties in Congress asking for the establishment of a fiscal commission. Bipartisan solutions and addressing budget deficits have also been shown to garner support from voters in recent polling.

A bipartisan group of House lawmakers – led by Representatives Bill Huizenga (R-MI) and Scott Peters (D-CA) – recently introduced the Fiscal Commission Act of 2023. Their bill would establish a 16-member fiscal commission, including 12 Members of Congress and four outside experts appointed by House and Senate leadership, tasked with proposing improvements to the fiscal outlook. The commission would consider revenue and spending changes, and its recommendations would receive fast-track consideration (but still require 60 votes for passage in the Senate).

At least two other commission bills have also been introduced this Congress. The bipartisan Sustainable Budget Act would establish a single 18-member commission tasked with proposing changes to reduce budget deficits over the next decade and beyond. Alternatively, the bipartisan TRUST Act would establish three rescue committees tasked with proposing revenue and spending changes to restore solvency to the Social Security, Medicare, and Highway Trust Funds.

Commissions cannot replace the need for political will. But history has shown that they can help facilitate the necessary conversations to support meaningful policy improvements.

Given our current fiscal outlook, Democrats and Republicans will need to rise above partisan divisions and collectively confront our pressing fiscal challenges. By leveraging the power of bipartisan commissions and embracing the lessons learned from successful precedent, we can forge a path toward a new era of fiscal responsibility, ensuring long-term economic stability and prosperity for future generations.

What's Next

-

Image

-

-

Image