The Cost of the Trump and Biden COVID Response Plans

The COVID pandemic has caused considerable economic damage and human suffering. Policymakers responded aggressively this spring to address the economic fallout, as detailed at COVIDMoneyTracker.org, but have not agreed on further steps. Both President Donald Trump and former Vice President Joe Biden have proposed additional actions.

Our recent paper The Cost of the Trump and Biden Campaign Plans analyzed the budgetary effects of the policies proposed by both presidential candidates excluding their COVID response plans. Under our central estimate, we found the Trump plan would cost nearly $5 trillion and increase the national debt to 125 percent of Gross Domestic Product (GDP) by 2030, while the Biden plan would cost $5.6 trillion and increase debt to 127 percent of GDP by 2030.

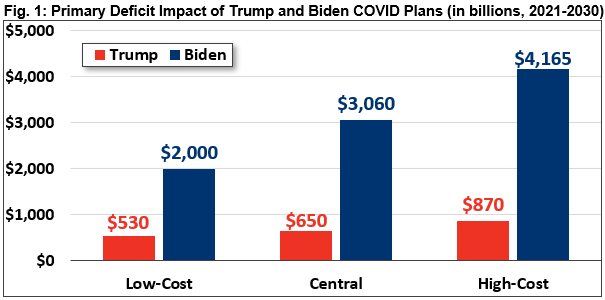

In this paper, we find President Trump has proposed between $530 billion and $870 billion of additional spending and tax relief to address the current public health and economic crisis, with a central estimate of $650 billion. We find Vice President Biden has proposed between $2.0 trillion and $4.2 trillion of additional measures to address the crisis, with a central estimate of $3.1 trillion.

This analysis focuses on proposals specifically put forward by the candidates. It does not include the $1.8 to $1.9 trillion stimulus offer made by Treasury Secretary Steven Mnuchin to House Speaker Nancy Pelosi (D-CA), which was supported by President Trump, nor does it include the original $3.4 trillion Heroes Act introduced and passed by House Democrats and supported by Vice President Biden.

Donald Trump's COVID Response Plan

To address the current pandemic and economic crisis, President Trump has signed several major pieces of legislation and executive orders into law, tracked at www.COVIDMoneyTracker.org.

Trump also recently signed off on a $1.8 to $1.9 trillion stimulus offer made by Treasury Secretary Mnuchin to House Speaker Pelosi. Based on press reports, this offer includes rebate checks up to $1,200 per eligible adult and $1,000 per dependent child, a weekly unemployment insurance bonus of $400 through January 21, 2021, $300 billion of state and local aid, $45 billion for testing, contact tracing, and treatment of COVID, an expansion of Affordable Care Act (ACA) subsidies for certain unemployed workers, a second draw Paycheck Protection Program to support small businesses, and many other provisions.

Our analysis focuses only on the proposals made on Trump’s campaign website or by Trump himself. We exclude elements of the recent offer designed to bridge differences between proposals from Trump and congressional Democrats, except to the degree those proposals have been independently supported by Trump or his campaign.

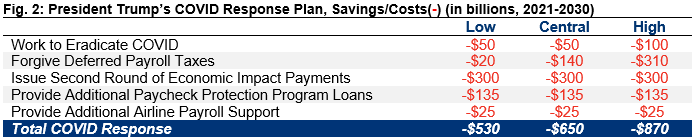

Based on Trump’s campaign website, as well as his social media posts and public remarks, we identified five specific policy proposals to address the current crisis that Trump supports. Altogether, we estimate Trump’s COVID response plan could range from $530 billion to $870 billion, with a central estimate of $650 billion. Including interest costs but excluding economic feedback, the plan would add nearly $700 billion to the debt by 2030 under our central estimate.

This plan would be enacted on top of Trump’s second-term agenda, which we describe and estimate in our recent paper, The Cost of the Trump and Biden Campaign Plans. In that analysis, we found Trump’s non-COVID proposals would cost $4.95 trillion through 2030 and increase debt to 125 percent of GDP under our central estimate. Adding in Trump’s COVID response plan would further increase debt to roughly 127 percent of GDP by 2030. More details on Trump’s agenda are described later in the paper.

Joe Biden's COVID Response Plan

While former Vice President Joe Biden’s proposed plan for addressing the COVID pandemic and subsequent economic crisis has shifted and evolved as the pandemic has stretched on, his overall position has generally mirrored that of House Democrats in their negotiations with the Trump Administration over additional rounds of economic support.

In April, Biden called for passage of a plan “a hell of a lot bigger” than the $2 trillion CARES Act passed in March. Then, in June, Biden declared that “the Republican Senate needs to do its job and pass the Heroes Act,” referring to a $3.4 trillion bill that would extend expanded unemployment insurance benefits, issue further rebate checks, provide significant aid to states and localities, support small businesses and promote employee retention, enact targeted tax breaks, and boost spending for health care, housing, and agriculture.

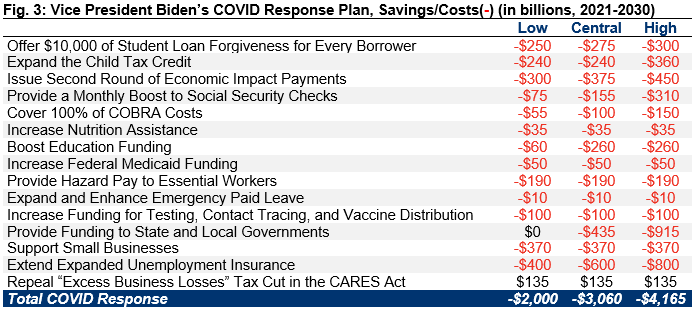

Biden has also put forward several of his own plans to address the COVID crisis, some of which are similar to policies in the Heroes Act. This analysis focuses only on policies Biden has specifically proposed. We also do not include his initial COVID plan, which was released before this spring’s legislative response and contains several elements that were later enacted. Altogether, we estimate Biden’s COVID agenda could cost anywhere from $2.0 trillion to almost $4.2 trillion, with a central estimate of nearly $3.1 trillion. Including interest but excluding economic feedback, the plan would add nearly $3.3 trillion to the debt by 2030.

Though there is a small amount of overlap and interaction, this plan would generally be enacted on top of Biden’s campaign agenda, which we outline and estimate in our recent paper, The Cost of the Trump and Biden Campaign Plans. In that analysis, we found Biden’s non-COVID proposals would cost $5.6 trillion through 2030 and increase debt to 127 percent of GDP, under our central estimate. Adding in Biden’s COVID response would further increase debt to 137 percent of GDP in 2030.1 More details on Biden’s agenda are described later in the paper.

Details of Donald Trump's COVID Response Plan

| Work to Eradicate COVID | -$50 billion | -$50 billion | -$100 billion |

In August, President Trump’s campaign issued a set of bullet point principles and goals as part of a release entitled Trump Campaign Announces President Trump’s 2nd Term Agenda: Fighting For You!. Among the 54 bullet points in the core agenda, four are dedicated to an overall goal to “Eradicate COVID-19.” These include individual goals to “Develop a Vaccine by the End of 2020,” “Return to Normal in 2021,” “Make All Critical Medicines and Supplies for Healthcare Workers in The United States,” and “Refill Stockpiles and Prepare for Future Pandemics.” Based on COVID vaccine, treatment, equipment, and testing-related funding in the Senate-proposed Health, Economic Assistance, Liability Protection, and Schools (HEALS) Act and the reported offer from Secretary Mnuchin, we assume these four goals would cost about $50 billion under our low-cost and central estimates. In our high-cost estimate, we assume a cost of $100 billion based on funding in the House-passed Heroes Act.

| Forgive Deferred Payroll Taxes | -$20 billion | -$140 billion | -$310 billion |

Through much of the COVID crisis, Trump has advocated for a payroll tax holiday to boost worker income. In August, he took executive action to support this goal by issuing a memorandum entitled Deferring Payroll Tax Obligations in Light of the Ongoing COVID-19 Disaster, allowing employers to defer the withholding of most workers’ 6.2 percent Social Security tax for September through December. While current IRS guidance calls for this withholding to be paid back in the first four months of next year, the executive memo instructs the Treasury Secretary to explore avenues, including legislation, to forgive any deferred taxes. Because few employers have taken advantage of this deferral, we estimate a forgiveness of just the deferred taxes would cost $20 billion, as reflected in our low-cost estimate. We believe a proposal more consistent with Trump’s goal would be House Ways & Means Committee Ranking Member Kevin Brady’s (R-TX) Support for Workers, Families, and Social Security Act, which would effectively forgive any payroll tax payments that were eligible for deferral (and expand that eligibility modestly). Based on Joint Committee on Taxation (JCT) estimates, this policy would cost about $140 billion, as reflected in our central estimate. In a number of statements, Trump has also indicated support for a payroll tax holiday that extends into 2021. We rely on a Moody’s Analytics assumption that the holiday would take place over the first four months of 2021 at a cost of over $170 billion. Our high-cost estimate assumes this holiday, plus the full forgiveness, at a cost of $310 billion.

| Issue Second Round of Economic Impact Payments | -$300 billion | -$300 billion | -$300 billion |

The CARES Act provided most households with rebates of $1,200 per taxpaying adult and $500 per dependent child. Trump has called for a second round of stimulus checks. Assuming this mirrors the CARES Act policy, it would cost about $300 billion, based on the Congressional Budget Office’s (CBO) score of that policy.

| Provide Additional Paycheck Protection Program Forgivable Loans to Small Businesses | -$135 billion | -$135 billion | -$135 billion |

The Paycheck Protection Project (PPP), which authorized up to $670 billion of forgivable loans to small businesses, expired in August with approximately $135 billion of leftover funds. Trump recently called on Congress to spend the leftover PPP funds, presumably on a new – and perhaps more targeted – tranche of forgivable loans. For example, a recently-passed Senate bill would allow smaller businesses with substantial revenue losses to take a “second draw” PPP loan of up to $2 million (the first round of PPP loans was capped at $10 million). We assume a cost of $135 billion in all three scenarios.

| Provide Additional Airline Payroll Support | -$25 billion | -$25 billion | -$25 billion |

The CARES Act authorized $32 billion of loans and grants to airlines through a program to support airline employees. This program required airlines to retain their workers through October 1, but many have since been furloughed. Trump recently called on Congress to immediately provide an additional $25 billion of payroll support to airlines. A similar proposal was included in the House-passed Heroes Act. We estimate this policy would cost $25 billion under all three of our scenarios.

| Total COVID Response | -$530 billion | -$650 billion | -$870 billion |

Details of Joe Biden's COVID Response Plan

| Offer $10,000 of Student Loan Forgiveness | -$250 billion | -$275 billion | -$300 billion |

As part of his Emergency Action Plan to Save the Economy, Vice President Biden has suggested the federal government forgive up to $10,000 in student debt for all Americans. This proposal was included in an early version of the House-passed Heroes Act. CBO reportedly estimated that the proposal would cost between $250 billion and $300 billion; however, it was significantly pared down before House passage to apply only to borrowers who were in economic distress prior to the onset of the pandemic.2 We therefore estimate that this proposal could cost as little as $250 billion or as much as $300 billion, with a central estimate of $275 billion.

| Expand the Child Tax Credit | -$240 billion | -$240 billion | -$360 billion |

In a section of his website contrasting his tax plan with Trump’s, Biden proposes a significant expansion of the Child Tax Credit (CTC) for 2020 and 2021, and potentially beyond if economic conditions require. As proposed in the House-passed Heroes Act, Biden would increase the current CTC from $2,000 to $3,000 per child for children aged 6 to 16, expand the credit to children that are 17, and increase it to $3,600 for children under the age of 6. He would also make the CTC fully refundable, whereas only $1,400 of the $2,000 is refundable under current law.3 Finally, Biden would allow families to receive their CTC in the form of monthly payments, as opposed to one lump sum received after filing annual tax returns. Based on CBO’s score of the version of this proposal included in the Heroes Act, which would have applied for just 2020, we estimate this proposal would cost roughly $120 billion per year. Biden’s proposal would apply for 2020 and 2021, and potentially longer if conditions require. Therefore, we estimate this proposal would cost $240 billion under our low-cost and central scenarios, and $360 billion under our high-cost scenario.

| Issue Second Round of Economic Impact Payments | -$300 billion | -$375 billion | -$450 billion |

Biden proposes additional rounds of checks to families “should conditions require.” We assume this refers to the one-time Economic Impact Payments included in the CARES Act, which provided $1,200 per adult and $500 per child, phased out above $75,000 in income, at a cost of roughly $300 billion. However, he could be referring to the more generous provision included in the Heroes Act, which would have provided $1,200 for each dependent (capped at three dependents) instead of $500. Enacting that provision, along with another provision from the Heroes Act that loosens restrictions on both the previous and current rounds of payments, would cost roughly $450 billion. Our central estimate of $375 billion assumes a middle-ground between these two versions of the proposal.

| Provide a Monthly Boost to Social Security Checks | -$75 billion | -$155 billion | -$310 billion |

Borrowing from a proposal put forward by Senators Ron Wyden (D-OR), Elizabeth Warren (D-MA), and Chuck Schumer (D-NY), Biden would provide a temporary $200 increase to the monthly benefit for all Social Security beneficiaries during the crisis. Based on the total number of eligible beneficiaries, we estimate this would cost approximately $13 billion per month.4 On his website, Biden does not specify how long this increase would last. Therefore, we assume six months of increased benefits in our low-cost scenario, 12 months in our central scenario, and 24 months in our high-cost scenario, at a cost of $75 billion, $155 billion, and $310 billion, respectively.

| Cover 100% of COBRA Costs | -$55 billion | -$100 billion | -$150 billion |

For individuals who have lost their jobs as a result of the COVID pandemic, Biden proposes to subsidize 100 percent of the cost to maintain health insurance coverage under their former employers, known as COBRA insurance. Since Biden has not specified how long these subsidies would last, we assume 6 months in our low-cost scenario, 12 months in our central scenario, and 24 months in our high-cost scenario, at costs of $55 billion, $100 billion, and $150 billion, respectively.5

| Increase Nutrition Assistance | -$35 billion | -$35 billion | -$35 billion |

Biden has proposed an increase in Supplemental Nutrition Assistance Program (SNAP) benefits, also known as food stamps, by 15 percent “during the deepening recession.” He also proposes to provide low-income families with “about $100 per-month in extra nutritional support.” We believe this is roughly the same as the proposal included in the House-passed Heroes Act, which CBO estimated would cost $35 billion.

| Boost Education Funding | -$60 billion | -$260 billion | -$260 billion |

In his Roadmap to Reopening Schools Safely, Biden calls on President Trump and Senate Republicans to pass the education funding included in the House-passed Heroes Act, specifically highlighting the $58 billion included in that bill for “local school districts to stabilize public education and save jobs.” We estimated the Heroes Act had roughly $259 billion in total education-related funding. Therefore, for our central and high-cost scenarios, we assume Biden is referring to all education-related funding in the Heroes Act, and therefore assume a cost of $260 billion. For our low-cost scenario, we assume Biden is only referring to the $60 billion of funding for local school districts he specifically points out.

| Increase Federal Medicaid Funding | -$50 billion | -$50 billion | -$50 billion |

Under the Families First Coronavirus Response Act (FFCRA) – which Congress passed in March – policymakers increased the federal share of base Medicaid costs by 6.2 percentage points, up from 50 to 78 percent depending on the state, through the end of the public health emergency. In his plan for Supporting People With Disabilities During the Coronavirus (COVID-19) Pandemic, Biden calls for a 12-percentage-point enhancement, almost doubling the boost currently in effect. We estimate this would cost about $50 billion.6

| Provide Hazard Pay to Essential Workers | -$190 billion | -$190 billion | -$190 billion |

Biden proposes providing premium “hazard pay” to front-line workers and other essential employees who have been obligated to continue working in-person throughout the pandemic. While Biden does not provide specifics as to how this premium pay would be structured, he says it would be very similar to the “Heroes Fund” provision included in the Heroes Act, which would provide a boost of roughly $13 per hour for essential workers, capped at $10,000 for those earning less than $200,000 per year and $5,000 for those earning more than $200,000 per year. CBO estimated this provision would cost $190 billion.

| Expand and Enhance Emergency Paid Leave | -$10 billion | -$10 billion | -$10 billion |

Biden has stressed the need to fully compensate all American workers who must take time off work due to falling ill themselves or needing to care for a family member who has fallen ill. The FFCRA included a provision to reimburse businesses with fewer than 500 employees for the full cost of up to two weeks of paid sick leave (capped at $511 per day), as well as two-thirds of the cost of up to ten weeks of paid family and medical leave (capped at $200 per day) for every employee. The Heroes Act would have expanded the emergency paid sick leave and family and medical leave programs by applying the requirement (but not the reimbursement) to businesses with more than 500 employees and providing the reimbursements to state and local governments, among other expansions. Based on CBO’s score of the Heroes Act, we estimate this proposal would cost $10 billion.

| Increase Funding for Testing, Contract Tracing, and Vaccine Distribution | -$100 billion | -$100 billion | -$100 billion |

Biden has repeatedly called for a dramatic expansion in both COVID testing and contact tracing programs. Again, Biden has not provided many concrete details regarding this proposal, but the Heroes Act contained a $75 billion increase in funding for nationwide testing and contact tracing, so we assume Biden would support a similar funding increase. In addition, as part of his seven-step plan to beat COVID-19, Biden proposes investing $25 billion into developing a robust and secure system for manufacturing and distributing a potential COVID vaccine, designed to “guarantee it gets to every American, cost free.” We estimate these proposals will cost $100 billion.

| Provide Funding to State and Local Governments | $0 | -$435 billion | -$915 billion |

Biden proposes providing fiscal relief to state and local governments to support essential workers and maintain government services. For our high-cost scenario, we assume Biden would provide the same level of funding as the direct state and local support included in the original Heroes Act: $915 billion. For our central scenario, we assume the reduced $435 billion amount of relief in the updated Heroes Act, which the House passed on October 1, 2020. For our low-cost scenario, we assume that the support for state and local governments would be provided through other proposals mentioned in this analysis, mainly the increase in education and Medicaid funding, and therefore not have an additional cost.

| Support Small Businesses | -$370 billion | -$370 billion | -$370 billion |

Biden would provide additional support to struggling small businesses. He specifically proposes a “restart package” that includes funds to help retain and rehire workers and cover fixed costs, as well as grants to help small businesses adapt to the pandemic (for example, by buying personal protective equipment) and additional support for minority-owned businesses. While Biden does not elaborate on the specifics of this small business support package, we assume it would be similar to the small-business related provisions in the Heroes Act. We estimate this proposal would cost $370 billion.

| Extend Expanded Unemployment Benefits | -$400 billion | -$600 billion | -$800 billion |

The CARES Act included several expansions of Unemployment Insurance (UI) programs, including a new, temporary federal program to provide up to 39 weeks of unemployment benefits for those who wouldn’t qualify for regular unemployment compensation – called Pandemic Unemployment Assistance (PUA) – as well as a $600 per week Federal Pandemic Unemployment Compensation (FPUC) bonus to regular unemployment benefits, and Pandemic Extended Unemployment Compensation (PEUC), which allows for an additional 13 weeks of regular unemployment benefits. While PEUC and PUA won’t expire until December under current law, the FPUC bonus expired in July.

Biden has called for extending these UI expansions. He has also proposed to “dramatically scale up” state-level short-time compensation, or “worksharing” programs, in a number of ways, so that workers can receive partial unemployment benefits while still working reduced hours.7 In our low-cost estimate, we assume Biden would implement the unemployment provisions included in the Heroes Act, which would retroactively extend all three programs through January 2021 for new applicants and through March for existing beneficiaries. Along with workshare expansion, we estimate these provisions would cost about $400 billion. In our high-cost scenario, we assume expanded unemployment benefits will continue through the end of 2021, at a cost of roughly $800 billion. Our central scenario assumes funding through the middle of 2021, at a cost of $600 billion.

| Repeal "Excess Business Losses" Tax Cut in the CARES Act | $135 billion | $135 billion | $135 billion |

To offset a portion of the cost of his COVID response agenda, Biden has proposed repealing a provision in the CARES Act that suspended a temporary limit on deductible business losses. The Tax Cuts and Jobs Act included a $250,000 limit on the amount of losses that can be deducted by pass-through entities in any given year. The CARES Act removed this limit for 2018, 2019, and 2020, allowing business owners to deduct an unlimited amount of their business losses against their non-business income. Based on the Joint Committee on Taxation’s score of this suspension in the CARES Act, we estimate that repealing it would raise approximately $135 billion.

| Total COVID Response | -$2,000 billion | -$3,060 billion | -$4,165 billion |

Conclusion

Both President Donald Trump and former Vice President Joe Biden support substantial new spending and tax relief to address the current public health and economic crisis, on top of what has already been enacted and signed by the President. By our estimates, the additional proposals Trump has put forward would cost between $530 billion and $870 billion, with our central estimate at $650 billion. The proposals Biden has put forward would cost $2 trillion to $4.2 trillion, with our central estimate at nearly $3.1 trillion. Plus, both candidates have signaled support for additional measures beyond what they personally proposed.

While these measures would mostly be temporary in nature and are designed to address the current crisis – a moment for which new borrowing is perfectly appropriate – the additional lending needed to finance them would come on top of record-high levels of debt under current law and ambitious proposals to increase debt further.

Over the past year, debt has grown from about 80 percent of economic output to roughly the size of the economy. Under the candidates’ full proposals, debt could rise further, to 127 percent of GDP under Trump or 137 percent under Biden.

Even though COVID relief has helped strengthen the near-term economy, such high levels of debt could slow economic growth over the long-term. Whichever candidate wins the election must carefully consider the economic, distributional, and generational trade-offs associated with any policies they put forward in their budget.

This paper is part of US Budget Watch 2020, a project focused on the fiscal and budgetary impact of proposals put forward in the 2020 presidential election. You can read our other analyses, explainers, and fact checks here. US Budget Watch 2020 is designed to inform the public and is not intended to express a view for or against any candidate or any specific policy proposal. Candidates’ proposals should be evaluated on a broad array of policy perspectives, including, but certainly not limited to, their approaches on deficits and debt.

1 While there would likely be some degree of interaction between Biden’s COVID response plan and his non-COVID proposals, which would result in a slightly lower combined net deficit effect, we are unable to estimate that interaction accurately.

2 Stratford, Michael. “House Democrats Scale Back Student Debt Relief Plan Over Cost Concerns.” Politico Pro, 14 May 2020, https://subscriber.politicopro.com/article/2020/05/house-democrats-scale-back-student-debt-relief-plan-over-cost-concerns-1936835.

3 Under the Tax Cuts and Jobs Act, the refundable portion of the Child Tax Credit (CTC) was initially set at $1,400 (or 15 percent of earned income above $2,500) for tax year 2018, and was indexed to inflation from there. However, the smallest incremental increase in the refundable portion of the CTC is $100 under current law, and inflation since 2018 has not been sufficient to justify an increase of that proportion, which is why the refundable portion remains at $1,400 in tax year 2020. See “What Is the Child Tax Credit?” Tax Policy Center, May 2020, www.taxpolicycenter.org/briefing-book/what-child-tax-credit.

4 According to the Social Security Chief Actuary, as of June 2020 there were approximately 64.7 million Americans receiving some form of Social Security benefit. See https://www.ssa.gov/news/press/factsheets/basicfact-alt.pdf

5 Our estimates are based on CBO’s estimate of a similar provision included in the Heroes Act, which would have applied from March of 2020 through January of 2021, at a cost of approximately $100 billion, or about $9 billion per month. However, as time goes on, this program would gradually become less costly as the economy recovers. Therefore, we assume an average per-month cost of roughly $9 billion in our low-cost scenario, $8 billion in our central scenario, and $6 billion in our high-cost scenario.

6 This estimate is based off of data from our COVID Money Tracker, which indicates the cost of the temporary FMAP increase included in FFCRA will cost approximately $55 billion in 2021. We then adjusted this estimate down to model an additional FMAP increase of 5.8 percentage points in our central and high-cost scenarios and 3.8 percent in our low-cost scenario.

7 Short-time compensation, or “workshare” programs pay partial unemployment benefits to some workers who have experienced reductions in their hours. These programs are currently offered in only 26 states and the District of Columbia, and participation is usually subject to a relatively strict set of criteria, which may explain why fewer than 200,000 workers were collecting these benefits as of the beginning of October. Biden would push for adoption in all 50 states and would have the federal government take up 100 percent of the cost of the programs. Furthermore, he would implement reforms to make it easier for businesses to take part, for instance by reducing caps on work-hour reductions, expanding the program to cover employee benefits and overhead costs, and eliminating future tax penalties for participating businesses. He would also engage in a major awareness campaign and build automatic triggers to extend the program based on economic and public health conditions. Moody’s has estimated these changes would cost almost $10 billion. See Zandi, Mark, and Bernard Yaros. “The Macroeconomic Consequences: Trump vs. Biden.” Moody’s Analytics, 23 Sept. 2020, www.moodysanalytics.com/-/media/article/2020/the-macroeconomic-consequences-trump-vs-biden.pdf.