Can America Sustain the Recent Economic Boost?

Key Takeaways:

- The good news is that the economy is doing well; however, this is unlikely to turn into sustained growth at the same rate.

- Short-term improvements in economic growth are primarily the result of the completion of the economic recovery and the temporary stimulative or one-time effects of debt-financed tax cuts and spending increases; this is unlikely to translate into a sustained improvement in growth.

- Sustained growth is still projected to average less than 2 percent annually rather than 3 percent, primarily due to the aging of the population.

- The country should adopt pro-growth policies whenever sensible, but be realistic about the structural challenges constraining growth.

Read the full PDF of the paper here.

Can America Sustain the Recent Economic Boost?

The United States is in a period of relatively robust economic growth. The country has enjoyed 16 consecutive quarters of economic growth and is projected to grow by about 3 percent annually in 2018 and 2019. This is welcome news, but unlikely to last.

The Congressional Budget Office (CBO) estimates that after it grows by 3 percent in 2018 and 2.9 percent in 2019, real GDP will grow by 2 percent in 2020 and between 1.5 and 1.8 percent in future years. Other forecasters – from the Federal Reserve to Blue Chip private estimates – share the view that growth will fall below 2 percent.

Strong growth over the last year is largely the result of the completion of the economic recovery, while projections of rapid growth over the next year or so are largely the result of temporary stimulative effects of recent debt-financed tax cuts and spending increases.

However, this short-term “economic sugar high” cannot continue indefinitely. Over the medium and long terms, the aging of the population means the United States is facing historically slow labor force, capital, and productivity growth; meanwhile, ever-rising levels of debt represent a continued burden on long-term growth.

Rather than counting on 3 percent growth to continue indefinitely, policymakers must accept the reality that growth will slow down. They will need to pursue a pro-growth policy agenda to assure the fastest sustained growth possible, which will require policies to increase the size of the labor force, promote work, support investment, encourage innovation, and put the budget on a sustainable path.

Strong Near-Term Growth Is the Result of the Economy Reaching Its Potential

The U.S. economy is currently in the second longest expansion in modern history, following the deepest contraction since the Great Depression. That expansion has led to robust growth over the past year. Between the first quarters of 2017 and 2018, for example, the economy grew by nearly 3 percent in real (inflation-adjusted) terms.

Continued 3 percent growth would be a welcome improvement for families and businesses as well as the country’s poor fiscal situation. Unfortunately, this surge in growth will almost surely be temporary – driven more by the recovery than an improvement in underlying trends. Most forecasters expect 2 percent annual growth or less over the long term.

It is important for policymakers to understand the difference between temporary conditions and sustainable improvements to the economy.

Broadly speaking, there are two ways to grow the economy. One is to increase the size of how large the economy could be in an ideal situation with full employment and stable inflation – also known as its potential GDP.1 The other way to grow the economy is to increase actual production relative to that potential – known as closing the output gap.

Potential GDP grows when more people work more hours, new factories and machines and software are built, and society learns how to more efficiently produce goods and services. The output gap is closed when larger private and government purchases cause an economy to rely more on underutilized machines and workers.

The distinction is important because faster growth as a result of rising potential GDP can generally be sustained while reductions in the output gap generally offer only a temporary boost.

Reductions in the output gap, rather than a significant boost in potential GDP, appear to have played a major role in the recent economic boom. CBO estimates that real GDP grew about a percentage point faster than potential GDP over the past year and that the economy will reach its potential this quarter.

Assuming CBO is correct and the economy has reached its potential, there is little room for further rapid growth.2

The economy can rise above potential for limited periods of time. But if not reigned in through monetary policy, economic booms that lift the economy above its potential generally cause overheating – leading to excessive inflation, asset bubbles, and ultimately tighter monetary policy or market crashes in response. In anticipation of possible overheating, the Federal Reserve has already begun to raise interest rates in order to manage inflation, which will help to slow economic activity back to its structural potential.

As the economy does normalize, the temporary surge over the past year will fade and the economy is likely to return to growing at an average rate closer to 2 percent than 3 percent.

|

Box 1: The Next Recession Is Always Just Around the Corner Economies rarely grow at stable rates for long periods of time, and instead often experience booms and busts. The business cycle is marked by periods of expansion and contraction. According to the National Bureau of Economic Research (NBER), the average economic expansion from 1945 to 2009 lasted 58 months – a little under five years – while the average recession lasted just under one year. Since the last recession officially ended in June 2009, the United States has experienced a 107-month period of expansion, which is nearly double the average economic expansion and represents the second longest expansion since World War II. Rapid growth could continue for months or even years, but is unlikely to persist. Based purely on the length of the current expansion, a recession could emerge some time in the next few years. The timing of recessions cannot easily be predicted, and there are no strong signs that the economy will enter recession any time soon. But a downturn at some point is inevitable, and when it occurs growth will slow substantially. |

Recent Debt-Financed Laws Will Provide a Further Temporary Economic Boost

Though the economy is likely operating around its potential, recent debt-financed tax cuts and spending increases may offer additional short-term economic stimulus. These policies will boost short-term growth in part by slowing long-term growth.

The 2017 Tax Cuts and Jobs Act, the 2018 Bipartisan Budget Act , and the 2018 Consolidated Appropriations Act are projected to cut taxes and increase spending by nearly $650 billion over the next two years. The result will be more consumption, investment, and government purchases and thus greater economic output in the near term.

Without these pieces of legislation, we estimate the economy would grow by roughly 2.2 percent per year in 2018 and 2019, rather than nearly 3 percent.3

Unfortunately, the near-term growth effect from these laws is unlikely to continue over the long term. Recent spending increases will likely shrink the economy over the medium and long terms due to higher levels of debt. The tax law will continue to boost potential GDP modestly by improving incentives to work and invest over the medium term; however, CBO projects that effect will decline after 2022.

Once the stimulus fades, CBO projects GDP to grow at an average rate of 1.8 percent annually in the last five years of the decade.

Economic Fundamentals Still Suggest 2 Percent Long-Term Growth

Fundamentally, long-term economic growth is driven by increases in labor supply, capital, and total factor productivity. Last year in How Fast Can America Grow?, we explained that population aging has led to a slowdown of all three factors relative to historic growth rates. Though the recent tax bill will lead to some modest improvements in labor and capital investment, nothing has fundamentally changed to offset the economic effects of aging.

Using CBO’s latest projections, we estimate labor will contribute an average of 0.2 percentage points per year to growth over the next decade, capital will contribute 0.7 points, and productivity will contribute 0.9 points. The result is a projected average growth rate of 1.8 percent over the next decade. This is in line with forecasts from Federal Reserve officials, Blue Chip’s panel of private forecasters, Goldman Sachs, and Moody’s, who estimate long-term growth rates of 1.8, 2, 1.75, and 2 percent, respectively; it is higher than the International Monetary Fund’s 1.4 percent projection.

As we illustrated in our paper, it would take record levels of growth in productivity, capital stock, or age-adjusted labor force participation – or else extremely robust growth of all three – to achieve sustained 3 percent growth. No single policy change could result in this level of growth.

Encouragingly, the tax law is likely to help boost both labor and capital growth, but the effects will be modest. CBO estimates the tax law will improve the average annual growth rate by 0.06 percentage points over a decade – and other outside estimates range from a small negative impact on growth to a 0.29 percentage point increase (this estimate is an outlier; the next highest estimate is 0.11). Improving, offsetting, and making permanent pro-growth features of the tax law could provide an additional boost – but not a dramatic increase in growth.

The Country Needs Pro-Growth Policies and a Dose of Realism

The temporary return to 3 percent growth is a welcome phenomenon, but it will likely be short lived. Economic recoveries end after an economy is recovered, and deficit-financed tax cuts and spending hikes provide only a short-term boost to the economy.

Over the long term, policymakers should prepare for annual growth of 2 percent or less, but they should not accept it as an inevitability. Thoughtful pro-growth policies can improve the potential growth of the economy, lift incomes, and improve the federal government’s fiscal position.

Fig. 5: Potential Pro-Growth Policies

| Policy Change | Boost in Annual Growth Rate |

Estimated By |

|---|---|---|

| Enact immigration reform to increase number of workers | 0.3% | CBO |

| Increase Social Security retirement ages by two years | 0.15% | CBO |

| Reduce deficits by $4 trillion over ten years | 0.1% | CBO |

| Expand energy production at level of shale boom* | 0.09% | CBO |

| Repeal the Affordable Care Act ("Obamacare") | 0.08% | CBO |

| Make the tax law fiscally responsible and permanent | 0.05% | CRFB^ |

| Implement a trade deal similar to the Trans-Pacific Partnership | 0.01% | U.S. ITC |

| Increase public investment in infrastructure, education, and research by $400 billion | 0 - 0.01% | CBO |

Note: most of these estimates were for a given growth over a specified period (e.g., the economy would be 1 percent bigger after ten years). For comparison, we converted all to a compound annual average growth rate, generally using ten-year scores over the period when the policy was implemented. *Shale boom indicates estimates of the effect of the ongoing boom in shale exploration (which are already included in the baseline). ^CRFB rough estimate based on CBO and other analysis of the tax law. CBO = Congressional Budget Office; U.S. ITC = U.S. International Trade Commission.

Returning to the post-WWII historical average of 3.2 percent growth on a sustained basis may be out of reach, given the aging population and the fact that the historical average is built upon events that are impossible to repeat (such as the near-doubling of the female labor force participation rate). But significant improvements to the growth rate are possible.

Much of the expected slowdown is the result of an aging population, and thus policies to increase labor force participation – especially among older workers – should be part of the solution. To boost the country’s economic capacity, policymakers could pursue pro-growth reforms to the Social Security retirement program, immigration law, disability programs, training and rehabilitation policies, the Earned Income Tax Credit, welfare programs, and even the criminal justice system.

Lawmakers can also do more to increase capital stock, including by making responsible public investments, promoting individual savings, and enacting regulatory reform. Policymakers could (and should) also improve and build upon the tax law to make it fiscally responsible, permanent, and better targeted toward promoting work and investment.

Other ideas – from expanding education and lifetime learning opportunities to promoting research and development to improving international trade laws – can also boost growth.

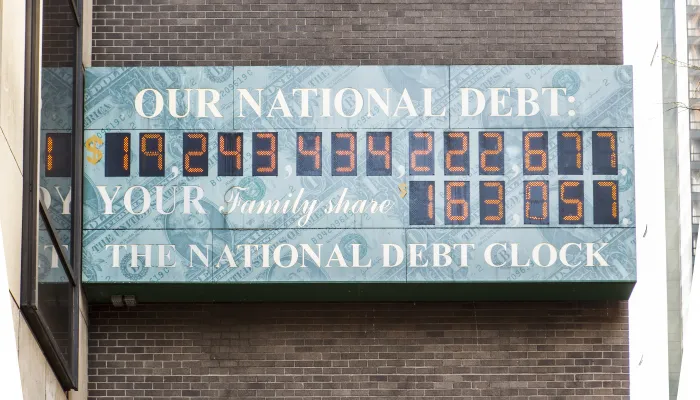

Perhaps most importantly, policymakers must bring the fiscal situation under control. The national debt is projected to exceed the size of the economy in just over a decade and continue to grow unsustainably thereafter. Reversing this trend can increase capital flowing to productive private investments, create more fiscal space for important federal initiatives, and avoid a potential fiscal crisis that could roil the global economy.

No magic bullet will assure rapid economic growth. Even all these policies in combination will not guarantee 3 percent sustained growth. But failure to pursue a pro-growth agenda will all but guarantee falling short of the goal.

Those who claim we’ve already achieved sustained 3 percent growth based on near-term euphoria are committing a disservice to the broader growth agenda.

Conclusion

Don’t be fooled by the current economic sugar high. It does not reflect permanent trends. Recent good news is the result of a recovering economy and a one-time stimulus from deficit-financed tax and spending policies that could ultimately hurt our long-term growth prospects.

Little has changed, demographically or economically, to suggest the country will produce long-term sustained growth well in excess of 2 percent per year. Still, more should be done to boost growth levels as high as possible on a sustained basis. Such an effort must include slowing the unsustainable growth of our federal debt.

1 Potential GDP (or productive capacity) is driven by the size of the labor force, capital stock, and total factor productivity. Actual GDP is unlikely to deviate too dramatically from potential GDP but is driven by consumption, investment, government purchases, and net exports (see How Fast Can America Grow? for more details).

2 Potential GDP is not a hard cap on the size of the economy. The economy is able to operate in excess of potential for periods of time through unusually low levels of unemployment, sale of inventory, use of machinery beyond its expected useful life, and increased demand for U.S. exports. Some analysts also believe economic potential is slightly higher than CBO estimates, suggesting some modest additional growth is possible without exceeding potential GDP.

3 CBO estimates that the tax law and spending bills will each grow the economy by 0.3 percent in 2018 and 0.6 percent in 2019 – suggesting each will contribute 0.3 percentage points to growth per year. We also estimate that other legislation – including disaster relief and various tax extenders – will increase GDP by 0.2 percent in 2018 and 2019, suggesting 0.2 percentage points more growth in 2018 and no effect on growth in 2019.