Build Back Better for Less: Two Illustrative Packages

Note: We have published a chartbook to accompany this paper.

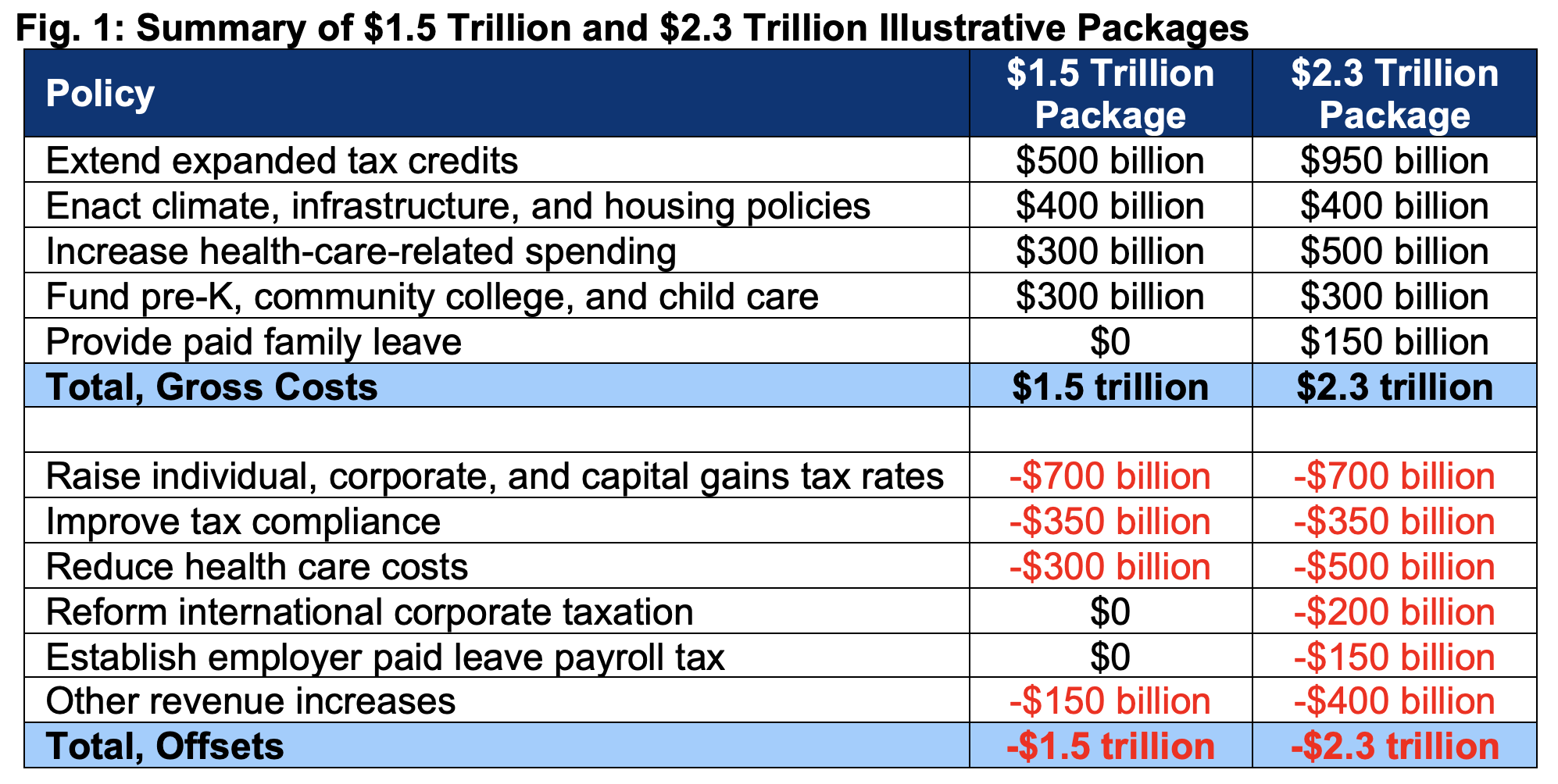

Policymakers are apparently now targeting $1.5 trillion to $2.3 trillion of gross spending increases and tax cuts for their Build Back Better reconciliation plan. This is much less than their prior $3.5 trillion target or $5 to $6 trillion of proposed policies. Rather than enact too many policies temporarily with arbitrary expirations, policymakers should aim to do a few things well – and at a lower cost when possible.

With the national debt already headed to record levels, policymakers should focus first on addressing our unsustainable fiscal trajectory. At minimum, reconciliation should be fully paid for to avoid worsening the debt.

In this paper, we present two illustrative reconciliation frameworks – one with $1.5 trillion of policies and one with $2.3 trillion, both fully paid for. These packages are based on current political dynamics and do not represent our recommendations.

The $1.5 trillion package reforms and extends expansions of the child, child care, and earned income tax credits, enacts free community college and preschool for middle-class families, strengthens the Affordable Care Act (ACA), funds climate change and infrastructure efforts, and supports state child care programs. It is offset mainly with higher tax rates, improved tax compliance, and lower prescription drug costs.

The $2.3 trillion goes further by making the changes to the child tax credit permanent, increasing health care spending for the elderly and disabled, and establishing a paid family leave program. For offsets, it enacts an employer payroll tax, increases health care savings, reforms international taxation, and closes tax loopholes. We present more options and analyses on our Reconciliation Resources page.

A $1.5 Trillion Illustrative Package

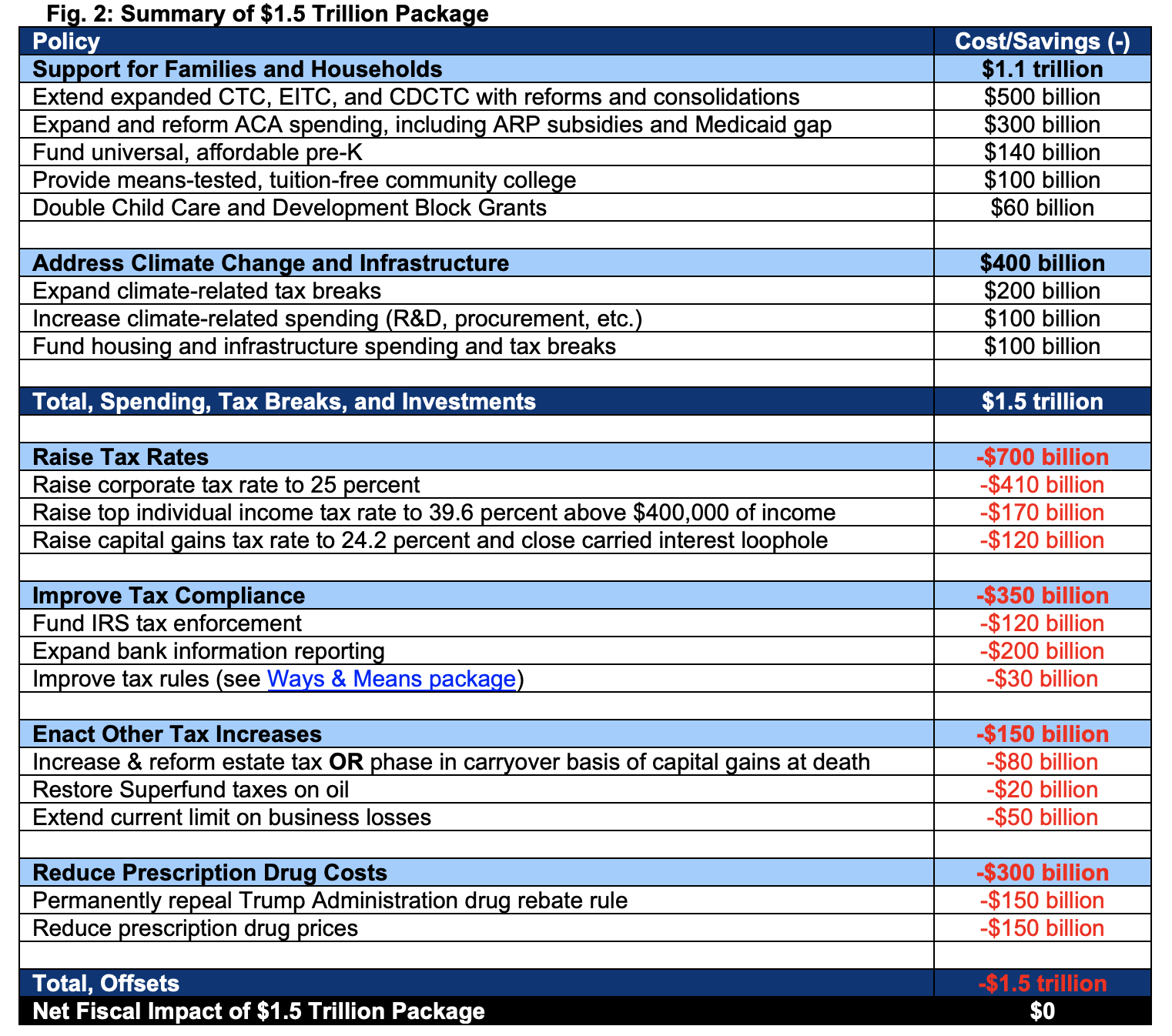

The $1.5 trillion illustrative package outlined below includes $1.1 trillion of targeted spending and tax breaks on families and households while budgeting $400 billion for climate and infrastructure. It would be offset with $700 billion from higher tax rates, $350 billion from improved tax compliance, $150 billion of other revenue, and $300 billion of drug savings.

Extend and Reform the Expanded CTC, EITC, and CDCTC ($500 billion)

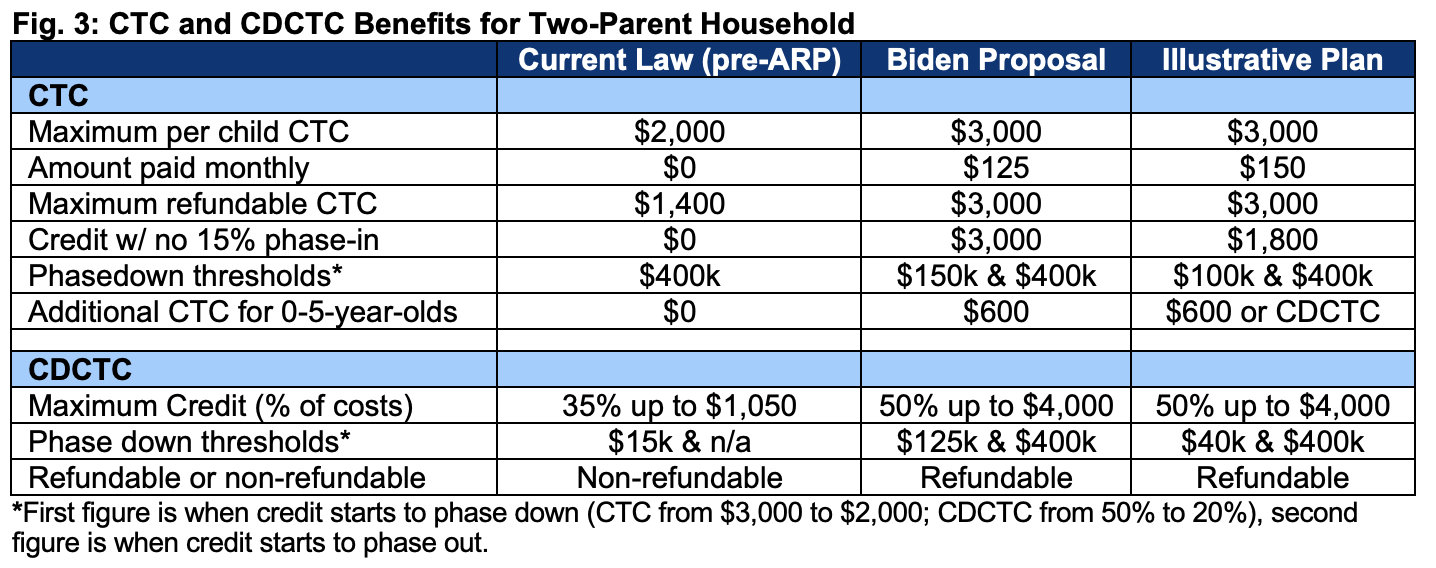

For 2021, the American Rescue Plan (ARP) increased the Child Tax Credit (CTC) to $3,000 ($3,600 for children under age six), made it fully refundable, and issued benefits monthly. The ARP also expanded the Child and Dependent Care Tax Credit (CDCTC), including by boosting the maximum benefit to $8,000 for two children, and it expanded the Earned Income Tax Credit (EITC) for childless workers. The President’s budget would extend the CTC expansion through 2025 and make the other provisions permanent at a cost of roughly $650 billion over a decade.

Our illustrative package would also extend the CTC through 2025 and make the other tax credits permanent. However, we would employ more aggressive means testing for the CTC and CDCTC, eliminate double-dipping between the CDCTC and the CTC supplement for children under six, and retain part of the CTC as a traditional tax credit with an income-based phase in. This would likely cost about $500 billion rather than $650 billion. To avoid further out-year costs, lawmakers should commit upfront to offset any future extensions of the CTC and other parts of the Tax Cuts and Jobs Act (TCJA) of 2017.

While exact parameters could differ, our package would:

- Provide a $150 per child refundable monthly benefit, increased to $200 per month for children under age six (for a total of $1,800/$2,400).

- Provide an additional $1,200 refundable CTC, phased in with earnings as in current law.

- Means test the combined credits during tax filing, with single filers making over $50,000 and married filers making over $100,000 seeing the initial $1,000 (or $1,600 for kids under six) phased out and the rest phased out over $200,000 for single/$400,000 for married filers.

- Provide a fully refundable CDCTC of 50 percent of expenses for those making $40,000 or less, phased down to 20 percent above $100,000 to 0 percent between $400,000 and $440,000. Maximum credit of $4,000 for one dependent and $8,000 for two or more.

- Make a young child eligible for either the CDCTC or the $50 per month CTC supplement.

- Extend EITC expansion similar to the ARP.

- Enact other adjustments as necessary to address interactions, target benefits, and contain costs.

Expand and Reform the Affordable Care Act ($300 billion)

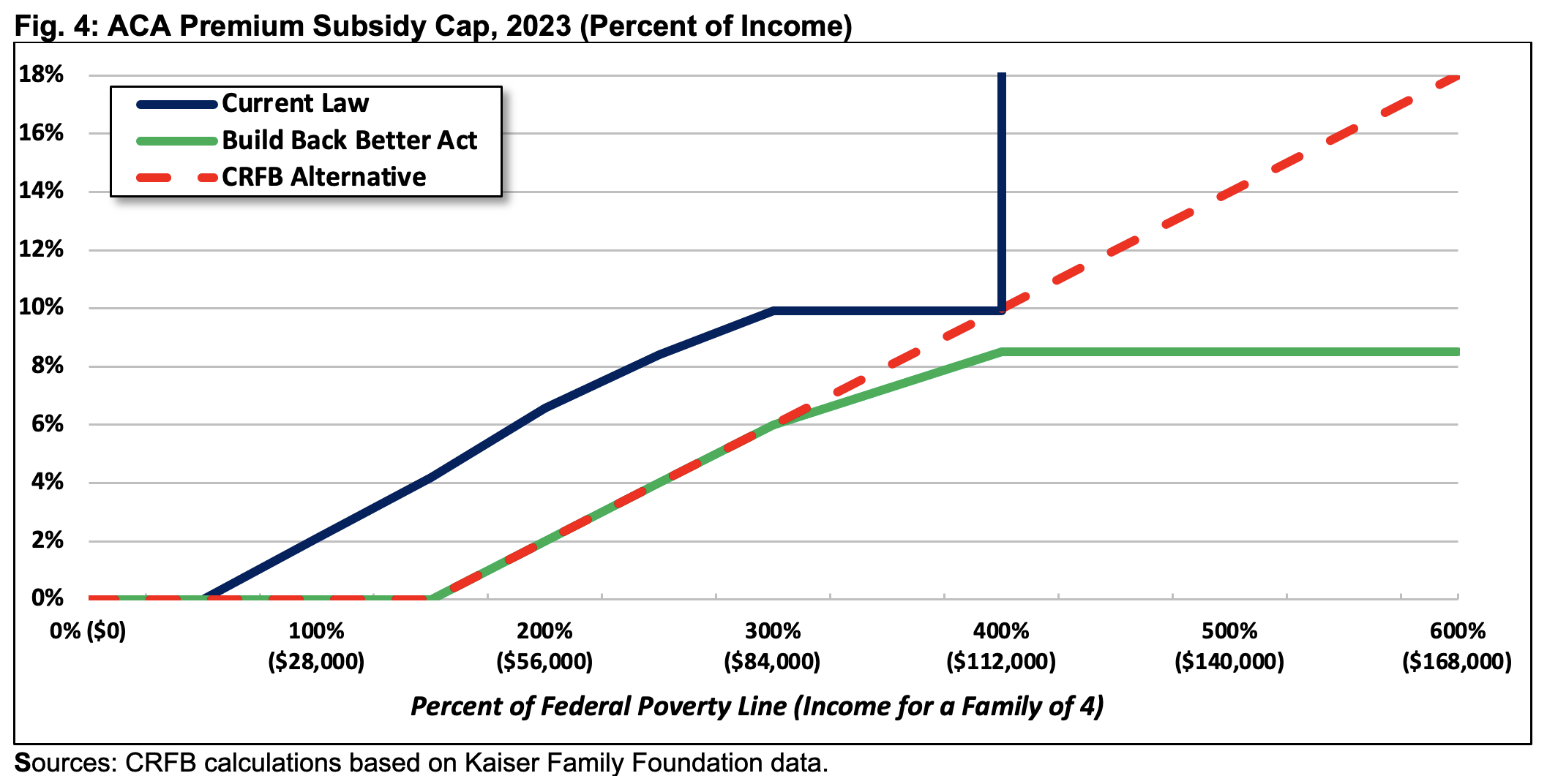

For 2021 and 2022, the American Rescue Plan increased the value of Affordable Care Act (ACA) subsidies across the income spectrum. Policymakers have proposed making this expansion permanent, establishing a new reinsurance program, and using a combination of subsidies and a “federal Medicaid program” to provide coverage to those below the poverty line in states that didn’t expand Medicaid under the ACA. These proposals could cost $400 billion to $500 billion.

Our illustrative alternative would achieve the same goals but cost closer to $300 billion. It would:

- Restore cost-sharing reduction payments discontinued by the Trump Administration.

- Establish a state-based reinsurance and invisible risk pool fund.

- Extend subsidy increases with a more progressive formula above 300 percent of poverty.

- Establish federal Medicaid program for those below 138 percent of poverty in gap states.

- Provide those below poverty exchange subsidies until federal Medicaid is established.

Fund Universal, Affordable Pre-K ($140 billion)

The President’s budget proposes grants to states to support universal pre-K for all three- and four-year-olds. While the White House estimates this would cost $140 billion over a decade, meeting that budget could require means testing or targeting in some states.

Provide Means-Tested, Tuition-Free Community College ($100 billion)

The President’s budget proposes to fund up to two years of universal tuition-free community college at a cost of roughly $110 billion. Our illustrative package includes tuition-free community college for those in households earning less than $100,000 per year, phased out gradually above that. To the extent total costs fall below $100 billion, remaining funds could be used to support college completion grants or to provide other higher education support.

Double Child Care and Development Block Grants ($60 billion)

In addition to substantially expanding the CDCTC, the President’s budget proposes a new set of subsidies designed to limit a family’s child care costs to 7 percent of income. The White House estimates its proposal would cost $225 billion, but actual costs could be higher.

To support state and local efforts to provide for affordable child care, our illustrative alternative would appropriate $60 billion over ten years toward Child Care and Development Block Grants. This would roughly double the size of these grants, assuming appropriations continue as projected. This grant funding would be in addition to the expanded CDCTC.

Expand Climate-Related Tax Breaks ($200 billion)

The President’s budget includes roughly $360 billion of climate-related tax breaks, including $300 billion of clean energy and electricity tax credits. The House Ways and Means Committee proposed $273 billion of climate-related tax breaks, including $134 billion of electricity energy-related credits. Our illustrative package assumes adoption of the Ways and Means energy and electricity tax breaks and the President’s tax breaks relative to renewable fuels, electric vehicles, and energy efficiency. The actual design could differ.

Increase Climate-Related Spending ($100 billion)

In addition to climate-related spending in the bipartisan infrastructure bill, our illustrative package assumes an additional $100 billion of direct climate spending. These funds would allow for a substantial expansion of research and development (R&D), more green federal procurement, seed funding for a “clean energy accelerator,” and other measures.

Fund Housing and Infrastructure ($100 billion)

Our illustrative package proposes $100 billion of spending and tax breaks to support affordable housing, energy-efficient buildings, and other infrastructure. Funds could help support the building, repairing, and weatherizing of public housing, schools, hospitals, and federal buildings. They could also expand affordable housing subsidies and promote zoning reform.

Raise Tax Rates (-$700 billion)

Like the President’s and the House Ways and Means Committee’s proposals, our illustrative package would raise tax rates on high-income individuals, corporations, and capital gains – though rates would differ somewhat. The package would raise the top rate from 37 percent to 39.6 percent on income above $400,000. It would also raise capital gains and dividends rates on income above $400,000 from 20 percent to 24.2 percent – resulting in a total top rate of 28 percent inclusive of the Net Investment Income Tax (NIIT). Carried interest would be taxed as ordinary income. Finally, the package would raise the corporate rate from 21 percent to 25 percent. The rate could be raised further, but this seems to be the most politically viable increase.

Improve Tax Compliance (-$350 billion)

Perhaps the single best way to raise revenue is to better collect the taxes already owed, otherwise known as narrowing the “tax gap.” Improving tax compliance and reducing the tax gap is not a tax increase and has a long history of bipartisan support. The Congressional Budget Office (CBO) recently estimated that $80 billion of Internal Revenue Service (IRS) funding would produce roughly $200 billion of revenue, resulting in $120 billion of net deficit reduction. Additional revenue could be raised by improving bank information reporting (with strong privacy protections) and improving tax rules that currently allow unintended tax evasion and avoidance.

Generate Additional Revenue (-$150 billion)

To generate additional revenue, our illustrative package includes restoring Superfund taxes on oil (the bipartisan infrastructure bill restores only chemical Superfund taxes) and extending current rules restricting the deduction of business losses against non-business income. In addition, lawmakers could either increase estate tax revenue or reform capital gains at death. Under the first approach, the estate tax exemption of nearly $12 million would revert to pre-2018 levels of roughly $6 million, while a number of loopholes to avoid estate taxes would be closed. Alternatively, we suggest replacing “stepped-up basis” of capital gains at death with carry-over basis, so taxes are paid on all capital gains upon sale of an asset (see more here). Under this policy, capital gains would not be taxed at death – and the policy could be phased in over time.

Reduce Prescription Drug Costs (-$300 billion)

To fund a $300 billion expansion of the ACA, our illustrative package includes $300 billion of prescription drug savings. Half or more of these savings would come from cancelling the costly drug rebate rule enacted under the Trump Administration, which is scheduled to take effect in 2022 (or 2026 assuming enactment of the bipartisan infrastructure bill). Additional savings could come from a combination of reforms to the Part D formula, caps on price increases in excess of inflation, policies that promote generic drugs (for example, evergreening restrictions), reforms to Part B drug reimbursements, and other changes. Though broad-based drug negotiations do not appear to have sufficient support in the House or Senate, narrow negotiations could be part of the package. Read more here.

A $2.3 Trillion Illustrative Package

The $2.3 trillion package builds upon the $1.5 trillion package. It includes the same tax credit expansions but makes the CTC permanent rather than allowing it to expire in 2026. It also includes a paid family leave benefit, expanded long-term care funding, and a Medicare expansion for vision and hearing. Additional offsets come from international tax reform, an expanded NIIT, a 0.2 percent employer-side payroll tax, and health savings. Differences are in blue.

Below, we discuss additional policies included in the $2.3 trillion illustrative package but not in the $1.5 trillion package.

Make Expanded CTC Permanent ($450 billion)

Like the President’s budget and the House Ways and Means Committee proposal, our $1.5 trillion illustrative package would extend the expanded CTC until the end of 2025, when large parts of the Tax Cuts and Jobs Act (TCJA) of 2017 expire. A permanent tax credit would be far preferable. In the $2.3 trillion illustrative package, we continue the CTC credit and monthly payments indefinitely. To help defray the cost of this extension – which effectively incorporates an extension of the TCJA’s CTC – this would permanently repeal the dependent tax exemption that is currently set to $0 but scheduled to return in 2026. This package would not repeal the personal exemption.

Provide Paid Family Leave Benefits ($150 billion)

President Biden and the Ways and Means Committee both proposed a federal program to offer 12 weeks of paid family and medical leave. Depending on the details, this new program could cost more than $500 billion over a decade. In our $2.3 trillion illustrative package, we include a new benefit to offer paid family leave only (not paid medical leave). We use the framework put forward by the Ways and Means Committee but set benefits based on the Social Security benefit formula – 90 percent of a worker’s first $12,000 of wages, 32 percent of a worker’s next $60,000, and 15 percent of a worker’s next $60,000. This would result in a maximum monthly benefit of roughly $3,400 per person or $6,800 per couple, compared to $4,000/$8,000 in the President’s proposal and $5,200/$10,400 in the Ways and Means Committee’s proposal.

Support Medicaid Home- and Community-Based Services ($150 billion)

The President’s budget proposed $400 billion for Medicaid long-term care benefits, especially to expand access to home- and community-based services. As negotiations have progressed, it has become clear that this goal could be accomplished at a lower cost. In this illustrative package, we include $150 billion of further long-term care funding. This could be achieved by making permanant the one-year boost in long-term care funding in the American Rescue Plan.

Offer Medicare Hearing and Vision Insurance Benefits ($50 billion)

The Ways and Means Committee included an expansion of Medicare Part B to include coverage of dental, vision, and hearing without increasing its premium. Importantly, most seniors already have access to these benefits through Medicare Advantage (MA), Medicaid, or other means. These benefits would cost roughly $80 billion per year when fully phased in; about one-third would flow through MA plans that already offer these benefits. This package includes vision and hearing benefits but not dental benefits. As with all other Part B benefits, higher premiums (roughly $5 per month) would cover about a quarter of the costs. Finally, MA payments would not be increased. We assume benefits would begin in 2023.

Reform International Tax Rules (-$200 billion)

Both President Biden and the Ways and Means Committee have proposed increasing taxes on international income through a higher international minimum tax, changes in the way that minimum tax is calculated, and a variety of anti-base erosion measures. The President’s proposals would raise over $1 trillion, while the Ways and Means proposals would raise $300 billion to $350 billion. In this illustrative package, we assume $200 billion of net revenue from international reforms. We do not specify details, which should be developed by the tax-writing committees.

Expand the Net Investment Income Tax (-$250 billion)

Currently, earned income above $200,000 ($250,000 for couples) is subject to a 3.8 percent Medicare payroll tax (1.45 percent from the employer, 2.35 percent from the employee), while capital gains, dividends, and interest income is subject to a 3.8 percent Net Investment Income Tax (NIIT). However, some pass-through business income is subject to neither the NIIT nor the Self-Employed Contributions Act (SECA) tax. The President and the Ways and Means Committee both propose closing this gap for income above $400,000. We include this policy in this illustrative package. Alternatively, policymakers could consider measures to reform pass-through taxation similar to those being developed by the Senate Finance Committee.

Establish a 0.2 Percent Employer Payroll Tax to Fund Paid Leave (-$150 billion)

Social insurance benefits – especially benefits that would otherwise be provided by an employer – are often funded through payroll taxes. In our $2.3 trillion illustrative package, we suggest a 0.2 percent payroll tax paid solely by employers to cover the cost of the new paid family leave benefit. There would be no change to worker payroll taxes.

Reduce Health Care Costs (-$200 billion)

To cover the additional health care costs from long-term care and hearing and vision benefits, our $2.3 trillion illustrative package suggests an additional $200 billion of health care savings. Savings come from reducing excessive MA spending, equalizing Medicare payments for similar services offered in hospitals and clinics, reducing payments for post-acute care, eliminating reimbursements for bad debts, and/or further lowering drug costs – possibly through rebates or targeted negotiations. A number of available options are discussed here.

* * *

There are many ways to design a reconciliation package with $1.5 trillion to $2.3 trillion of gross costs that is fully paid for. Our illustrative packages are designed to help frame the discussion and offer policymakers options and possibilities to responsibly Build Back Better.

Read more options and analyses on our Reconciliation Resources page.