Appropriations 101

Note: We have updated this paper, please see the latest Appropriations 101.

What are appropriations?

Appropriations are annual decisions made by Congress about how the federal government spends some of its money. In general, the appropriations process addresses the discretionary portion of the budget – spending ranging from national defense to food safety to education to federal employee salaries, but excludes mandatory spending, such as Medicare and Social Security, which is spent automatically according to formulas.

How does Congress determine the total level of appropriations?

Under current law, after the President submits the Administration’s budget proposal to Congress, the House and Senate Budget Committees are each directed to report a budget resolution, which if passed by their respective houses, would then be reconciled in a budget conference (see Q&A: Everything You Need to Know About a Budget Conference). The resulting budget resolution, which is a concurrent resolution and therefore not signed by the President, includes what is known as a 302(a) allocation that sets a total amount of money for the Appropriations Committees to spend.

If a concurrent budget resolution does not pass both chambers, each house then may adopt legislation “deeming” 302(a) allocations – a practice which has become increasingly common in recent years. For example, the recent Bipartisan Budget Act directed the Budget Committee Chairs in the House and Senate to set the 302(a) limit for FY2015 at $1.014 trillion.

In addition, discretionary spending is currently subject to statutory spending caps. The Budget Control Act of 2011 set discretionary caps through 2021, which were modified for 2013, 2014, and 2015 by the American Taxpayer Relief Act of 2012 and Bipartisan Budget Act of 2013. Beyond 2015, the statutory caps set by the Budget Control Act are reduced by about $90 billion annually through an enforcement mechanism known as “sequestration” (see Understanding the Sequester) implemented after the failure of the Joint Select Committee on Deficit Reduction to produce legislation to reduce the debt.

How does Congress allocate appropriations?

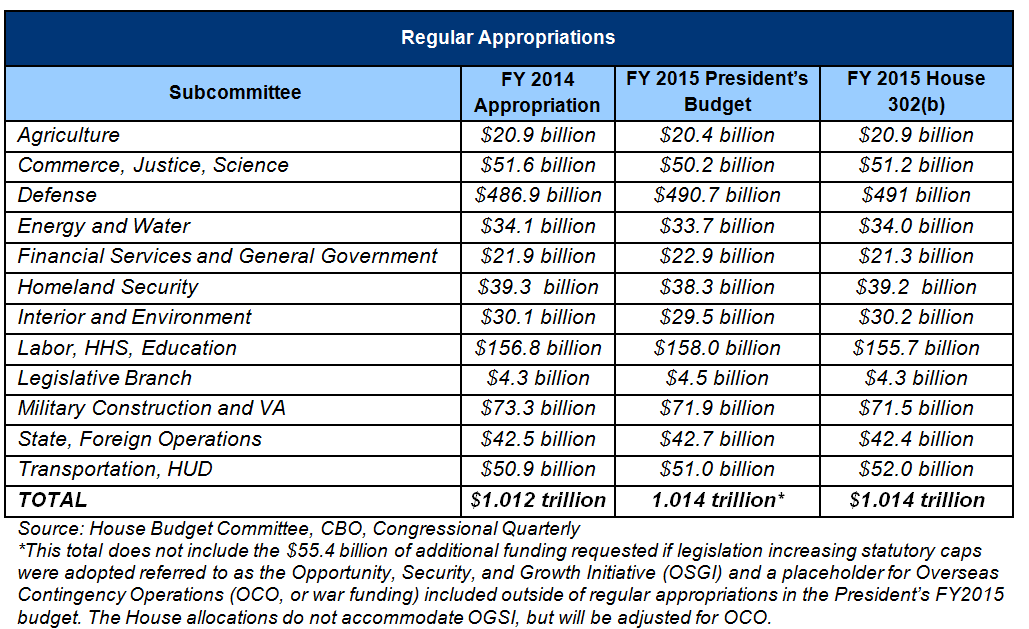

Once they receive 302(a) allocations, the House and Senate Appropriations Committees set 302(b) allocations to divide total appropriations among 12 subcommittees, each dealing with a different part of the budget. Those subcommittees must then decide how to distribute funds within their 302(b) allocations. These 302(b) allocations are voted on by the respective Appropriations Committees but are not subject to review or vote by the full House or Senate. The table below lists the FY2014 regular (non-war, non-disaster) appropriations, along with the President’s budget request for FY2015 and House FY2015 302(b) allocations for each of the subcommittees.

Each subcommittee must propose a bill that ultimately must pass both chambers of Congress and be signed by the President to take effect. Although the budget process calls for 12 individual bills, many of them are often combined into what is known as an omnibus appropriations bill and sometimes a few are combined into what has been termed a minibus appropriations bill.

How are appropriations levels enforced?

If any appropriations bill or amendment in either house exceeds the 302(b) allocation for that bill, causes total spending to exceed the 302(a) allocation, or causes total spending to exceed statutory spending caps, then any Member of Congress can raise a budget “point of order” against consideration of the bill. The point of order can be waived by a simple majority in the House as part of the rule for floor consideration of the bill and overridden by a 60-vote majority in the Senate. If, despite these points of order, Congress enacts legislation increasing spending beyond the defense or non-defense caps, then the President must issue a sequestration order to reduce discretionary spending across-the-board in the category in which the caps were exceeded, effective 15 days after Congress adjourns for the year. Importantly, certain types of discretionary spending – including for overseas contingency operations and for designated emergencies – do not count against the statutory caps.

What happens if funds are needed outside of the appropriations process?

Congress can pass a supplemental appropriations bill in situations that require additional funding immediately, rather than waiting until the following year’s appropriations process. Supplementals are often used for emergencies such as natural disasters or military actions. Occasionally, Congress has used supplemental appropriations to stimulate the economy or to provide more money for routine government functions after determining that the amount originally appropriated was insufficient. Supplemental appropriations bills are subject to the same internal and statutory spending limits as regular appropriations. They require the same offsets to ensure they do not exceed spending limits, unless designated as emergency spending.

What role does the President play in the appropriations process?

Although the President has no power to set appropriations, he influences both the size and composition of appropriations by sending requests to Congress. Specifically, each year the President’s Office of Management and Budget (OMB) submits a detailed budget proposal to Congress based on requests from agencies. The appendix to the President’s budget submission contains much of the technical information and legislative language used by the Appropriations Committees. In addition, the President must sign or veto each of the 12 appropriations bills, giving him additional influence over what the bills look like.

What is the timeline for appropriations?

The 1974 Budget Act calls for the President to submit his budget request by the first Monday in February and for Congress to agree to a concurrent budget resolution by April 15th. The House may begin consideration of appropriations bills on May 15th even if a budget resolution has not been adopted, and is supposed to complete action on appropriations bills by June 30th. However, none of these deadlines are enforceable and they are regularly missed. The practical deadline for passage of appropriations is October 1st, when the next fiscal year begins and the previous appropriation bills expire. For a full timeline of the budget process click here.

What happens if appropriations bills do not pass by October 1?

If the appropriations bills are not enacted before the fiscal year begins on October 1st, federal funding will lapse, resulting in a government shutdown. To avoid a shutdown, Congress will often pass a continuing resolution, which allows for continued funding, providing additional time for completion of the appropriations process. If Congress has passed some, but not all, of the 12 appropriations bills, a partial government shutdown can occur.

What is a continuing resolution?

A continuing resolution, often referred to as a CR, is a temporary bill that continues funding for all programs based on a fixed formula, usually prior year funding levels. Congress can pass a CR for all or just some of the appropriations bills. CRs can increase or decrease funding and can include “anomalies,” which adjust spending in certain accounts to avoid technical or administrative problems caused by continuing funding at current levels, or for other reasons.

What happens during a government shutdown?

A shutdown represents a lapse in available funding, and during a shutdown the government stops most non-essential activities related to the discretionary budget. To learn more see Q&A: Everything You Should Know About Government Shutdowns.

Do agencies have any discretion in how they use funds from appropriators?

Executive branch agencies must spend funds provided by Congress in the manner directed by Congress in the text of the appropriations bills. Appropriations bills often contain accompanying report language with additional directions, which are not legally binding but are generally followed by agencies. Congress often provides broad authority, which gives agencies more control in allocating spending. However, in some instances, Congress will provide for very narrow authority or can use funding limitation clauses to tell agencies what they cannot spend the money on. Agencies have some authority to reprogram funds between accounts after notifying (and in some cases getting approval from) the Appropriations Committees.

What is the difference between appropriations and authorizations?

Authorization bills create, extend, or make changes to the law and specific programs and specify the amount of money that appropriators may “spend” on a specific program, in other cases leaving the amount open ended. Appropriations bills then provide the discretionary funding available to agencies and programs that have already been authorized. For example, an authorization measure may create a food inspection program and set a funding limit for the next five years. However, that program is not funded by Congress until an appropriations measure is signed into law. The authorization bill designs the rules and sets out the details for the program, while the appropriations bill provides the actual resources to execute the program. In the case of mandatory spending, an authorization bill both authorizes and appropriates the funding for a specific program, without requiring a subsequent appropriations law.

Where are the House and Senate in the current appropriations process?

Both the Senate and House have deemed their 302(a) allocations at $1.014 trillion for regular appropriations pursuant to the Bipartisan Budget Act of 2013. Currently, both chambers are working on writing and passing individual appropriations bills. To follow the progress of individual appropriations bills throughout the process, see our Appropriations Watch: FY2015.