Analysis of CBO's March 2021 Long-Term Budget Outlook

Today, the Congressional Budget Office (CBO) released its March 2021 Long-Term Budget Outlook, confirming that the federal budget is on an unsustainable long-term trajectory. Overall, the long-term outlook is similar to the agency’s September 2020 projections. CBO’s report shows:

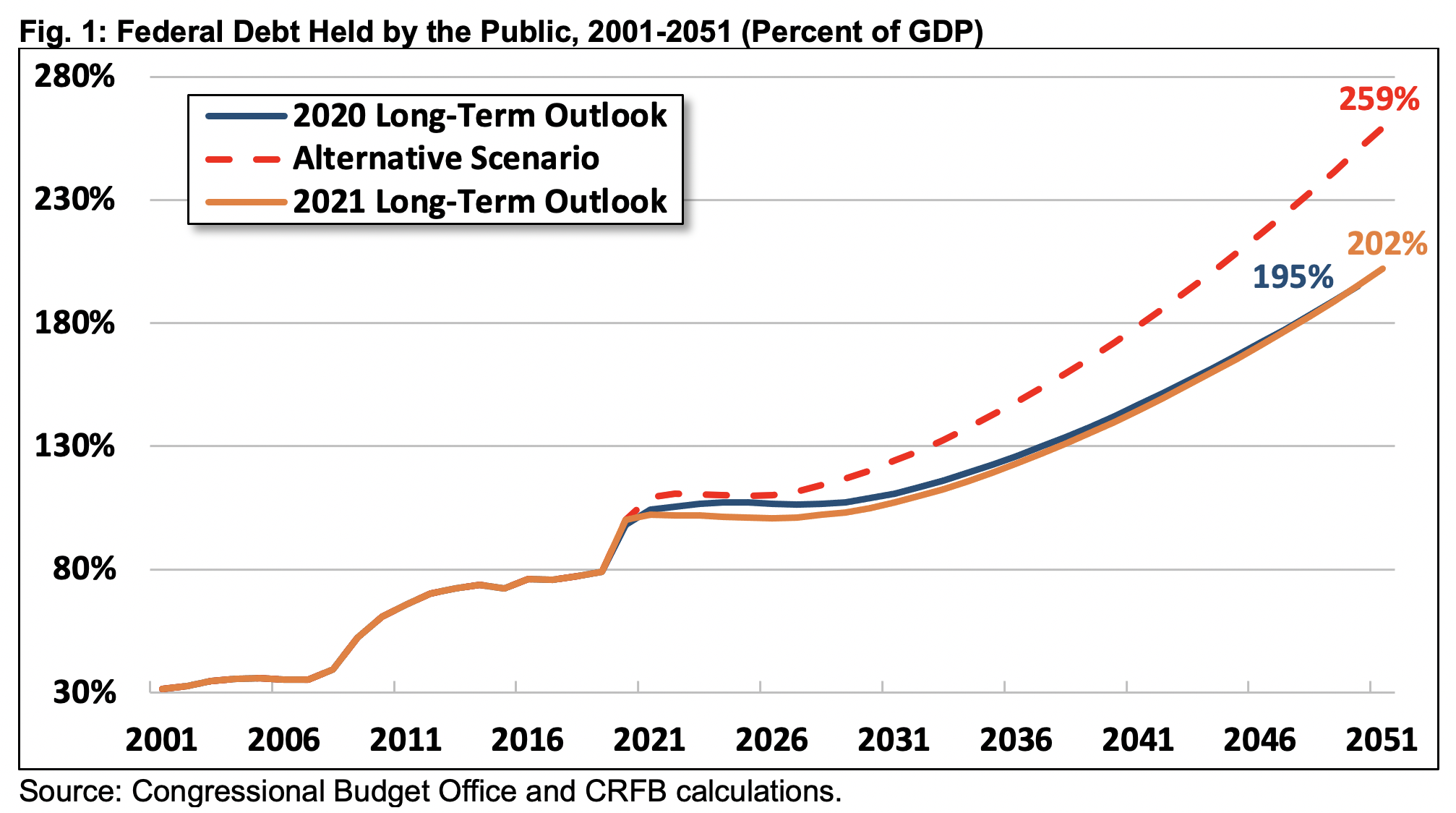

- Debt Will Be Double the Size of the Economy By 2051. Under current law, CBO projects federal debt held by the public to rise from less than 80 percent of GDP at the end of FY 2019 to 202 percent of GDP by 2051. Under a more realistic scenario, debt could reach nearly 260 percent of GDP by 2051.

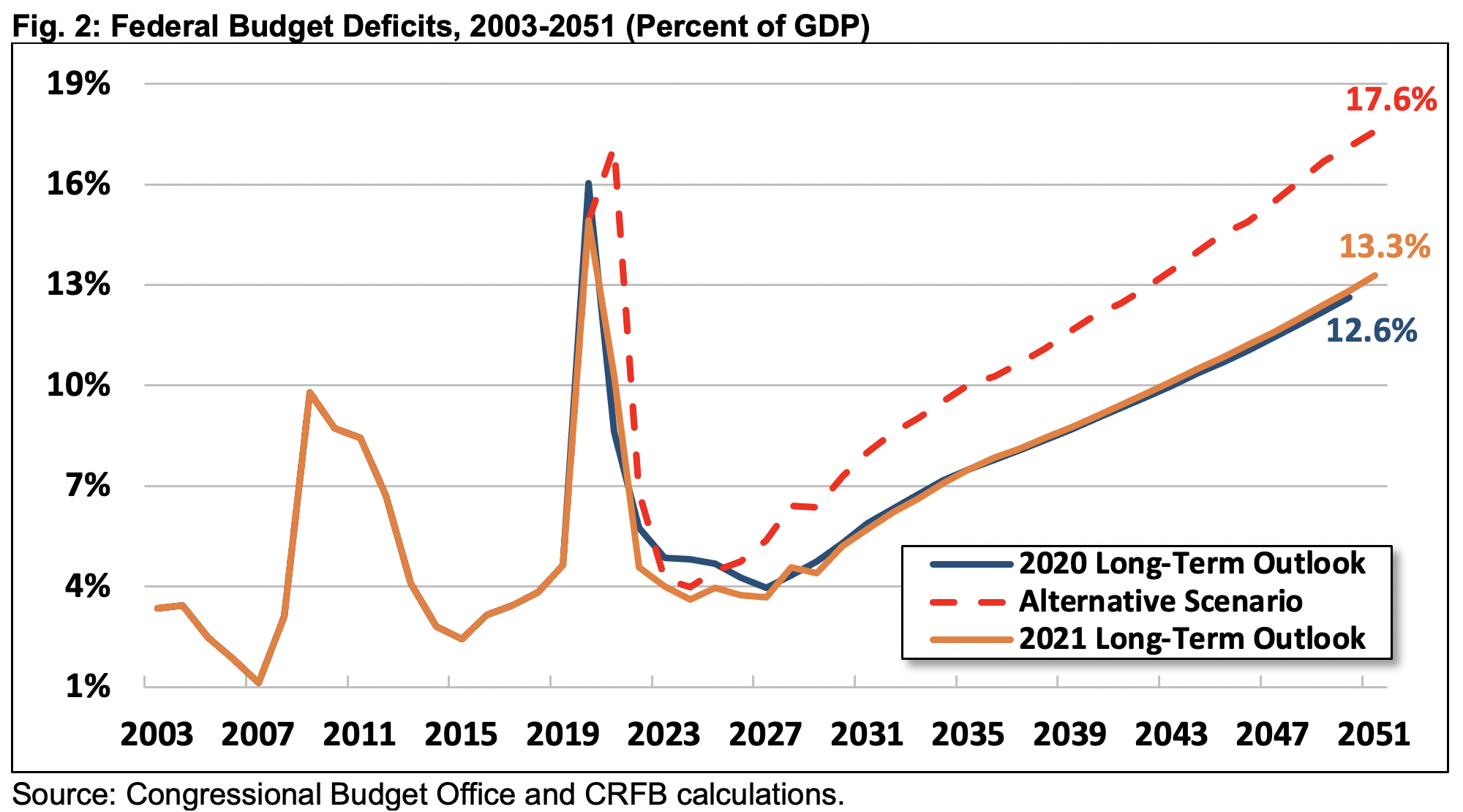

- Deficits Will Explode. Under current law, CBO projects annual budget deficits will grow to 13.3 percent of GDP by 2051. While this is lower than the COVID-driven deficit of 14.9 percent of GDP in FY 2020, it will be nearly three-times higher than the 2019 deficit of 4.6 percent of GDP, roughly four-times as high as the 3.3 percent of GDP average seen over the past 50 years, and higher than any point in modern history outside of World War II and the current crisis.

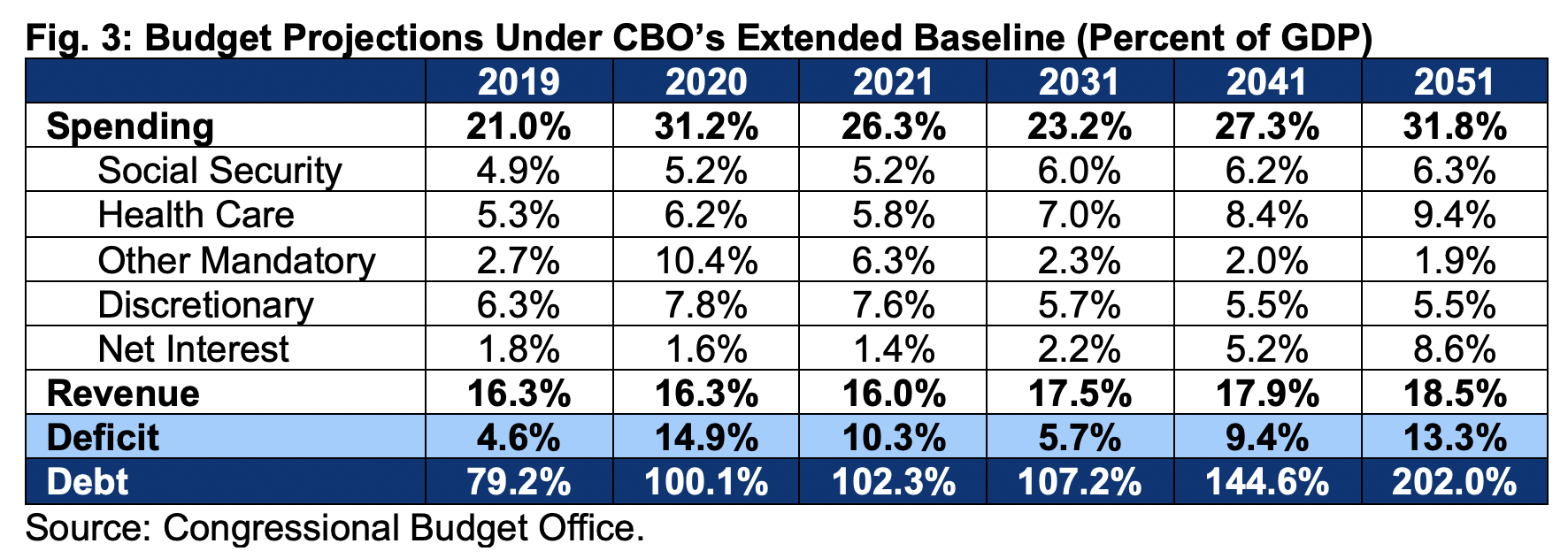

- Spending Will Continuously Outpace Revenue. CBO projects spending will grow from 21.0 percent of GDP in 2019 to 31.8 percent of GDP by 2051, while revenue will grow from 16.3 to 18.5 percent of GDP. Over the long term, rising health care, retirement, and interest costs will cause a significant increase in spending. Revenue will also grow under current law, but only modestly.

- Major Trust Funds Are Headed Toward Insolvency. CBO projects Highway Trust Fund (HTF) insolvency in FY 2022, Medicare Hospital Insurance (HI) trust fund insolvency in FY 2026, Social Security Old Age and Survivors Insurance (OASI) trust fund insolvency in calendar year 2032 and Social Security Disability Insurance (SSDI) trust fund insolvency in calendar year 2035. On a theoretical combined basis, the Social Security program will be insolvent in calendar year 2032.

- The Long-Term Outlook is Similar to Last Year. CBO projects debt will total 195 of GDP in 2050, which is also what CBO projected last year. While legislative changes modestly increased long-term debt projections, changes in economic assumptions and projections counteracted that increase.

Ultimately, high debt levels will slow income and wage growth, increase interest payments, place upward pressure on interest rates, reduce the fiscal space available to respond to a recession or other emergency, place an undue burden on future generations, and heighten the risk of a fiscal crisis. Once the current crisis ends, policymakers must work to get our long-term fiscal house in order.

Debt Will Be Double the Size of the Economy By 2051

CBO estimates that federal debt held by the public will reach double the size of the economy, rising from 79 percent of Gross Domestic Product (GDP) at the end of 2019 and 100 percent of GDP at the end of Fiscal Year (FY) 2020 to 202 percent of GDP by 2051. Projected debt in 2051 will be over 4.5 times the 50-year average of 44 percent of GDP and will be on track to double the previous record of 106 percent of GDP a few years later. In nominal dollars, debt will grow from nearly $22 trillion today to over $133 trillion by 2051.

Actual debt levels could be higher than CBO projects. Under an alternative scenario that assumes lawmakers enact an additional $2 trillion of fiscal support in response to COVID-19 (similar to the American Rescue Plan), extend most expiring tax cuts, and grow annual appropriations with the economy instead of inflation, debt would total 259 percent of GDP by 2051.

Deficits Will Explode

Budget deficits had already risen before the pandemic from 2.4 percent of GDP ($442 billion) in 2015 to 4.6 percent of GDP ($984 billion) in 2019 and set a new record of 14.9 percent of GDP ($3.1 trillion) last year due to the crisis. CBO expects the deficit to fall to $2.3 trillion this year and hit a low of $905 billion in 2024 before resuming its upward trajectory. The deficit is projected to total 5.7 percent of GDP ($1.9 trillion) in 2031, 9.4 percent of GDP ($4.4 trillion) in 2041, and 13.3 percent of GDP ($8.8 trillion) in 2051.

CBO’s deficit projection of 13.3 percent of GDP in 2051 will be higher than at any time in modern history outside of World War II and the current crisis, and over four times the 50-year average of 3.3 percent of GDP.

Under current law, both primary (non-interest) budget deficits and interest costs will grow. CBO expects the primary deficit to total 3.3 percent of GDP in 2031, 4.3 percent of GDP in 2041, and 4.6 percent of GDP in 2051. Interest costs are projected to grow to 2.4 percent of GDP in 2031, 5.2 percent of GDP in 2041, and 8.6 percent of GDP in 2051.

Deficits could be even higher if lawmakers continue their pre-COVID streak of fiscal irresponsibility. Under an alternative scenario that assumes lawmakers enact an additional $2 trillion of fiscal support to combat the current crisis, extend most expiring tax cuts, and grow annual appropriations with the economy rather than with inflation, the deficit would total 17.6 percent of GDP in 2051. Under this scenario, the deficit would be higher than at any time in modern history – including 2020 – other than the final three years of World War II and would be over five times higher than the average over the past 50 years.

Spending Will Continuously Outpace Revenue

Rising debt and deficits are driven by a disconnect between spending and revenue. CBO expects spending to grow rapidly over the next three decades and revenue to grow much more gradually.

Current spending is extremely high as a result of pandemic relief. Setting aside this one-time spike, CBO projects spending to grow from 21.0 percent of GDP in 2019 to 31.8 percent of GDP by 2051 while revenue will grow from 16.3 percent of GDP to 18.5 percent.

Under the alternative scenario, spending and revenue would total 34.8 and 17.2 percent of GDP, respectively, in 2051.

The projected long-term growth in spending is largely driven by rising health, interest, and retirement costs. CBO expects spending in these three areas to rise from 12.3 percent of GDP this year to 24.4 percent of GDP by 2051. Interest spending will be the largest federal program by 2045.

CBO also projects that four major trust funds will be insolvent in the next 14 years. The Highway Trust Fund would become insolvent in 2022, the Medicare Hospital Insurance trust fund would run out in 2026, and the Social Security Old Age and Survivors Insurance and Disability Insurance trust funds would run out in 2032 and 2035, respectively. The hypothetical combined Social Security trust fund would run out in 2032, at which point benefits would have to be cut by one-quarter to bring spending in line with revenue.

The Long-Term Outlook is Similar to Last Year

CBO’s newest projections show lower debt than last year’s projections over both the short and long term. Specifically, debt in 2021 is projected to be 2 percent of GDP lower than in the previous projection, debt in 2031 is expected to be 4 percent of GDP lower, debt in 2041 is projected to be 2 percent of GDP lower and debt in 2050 is expected to be the same as projected in September – 195 percent of GDP.

The near-term decrease in debt is the net effect of lower deficits from CBO’s stronger economic forecast and higher deficits from legislation. Legislative changes increased CBO’s short-term deficit projections by $1.4 trillion through 2030, while economic improvements and technical changes reduced them by roughly $1.8 trillion for a net effect of a $345 billion decrease in projected deficits. As a result, debt in 2031 is expected to be nearly 4 percent of GDP lower than CBO previously projected – 107 percent instead of 111 percent.

Over the long term, the projected decrease in debt through 2050 is largely driven by an improved economic outlook. CBO’s projections of GDP in 2041 and 2050 are $1.8 trillion and $2.3 trillion higher, respectively, than CBO’s previous forecast. While CBO expects spending on Social Security, Medicare, and interest to be higher than previously estimated, lower projected spending on defense and nondefense discretionary programs and higher estimates of economic output offset the projected increase.

Conclusion

CBO’s latest report continues to remind us what we’ve known for some time, but lawmakers choose to ignore: the federal budget is on a long-term unsustainable path. CBO’s latest extended baseline shows the budget outlook will deteriorate over the next 30 years due to irresponsible tax and spending policies and the growth of health, retirement, and interest spending. Moreover, the fiscal response to the COVID-19 public health and economic crisis, while necessary to alleviate human suffering and to stabilize the economy, has increased CBO’s long-term projections of debt and deficits.

Under current law, debt will more than double the size of the economy by 2051, growing from less than 80 percent of GDP at the end of 2019 to 202 percent of GDP by 2051. The deficit, meanwhile, will total 13.3 percent of GDP in 2051 – higher than the 3.3 percent of GDP average seen over the past 50 years and higher than at any point in modern history outside of World War II and last year.

The budget outlook could be far worse than CBO projects. Under an alternative scenario where lawmakers enact additional fiscal support to fight COVID-19, extend expiring tax cuts, and grow annual appropriations with GDP, the deficit would total 17.6 percent of GDP and debt would rise to percent of GDP by 2051.

Ultimately, high debt levels will slow income and wage growth, increase interest payments, place upward pressure on interest rates, reduce the fiscal space available to respond to a recession or other emergency, place an undue burden on future generations, and heighten the risk of a fiscal crisis. While policymakers are rightly focused on responding to the current crisis, they cannot and should not continue to ignore our long-term fiscal situation.

Update: 3/26/21: Debt in nominal dollars today was corrected after publication to reflect federal debt held by the public, not gross debt.