Analysis of the 2023 Social Security Trustees' Report

The Social Security and Medicare Trustees today released their annual reports on the financial state of the Social Security and Medicare programs over the next 75 years. The latest Social Security projections show the program is quickly headed toward insolvency and highlight the need for trust fund solutions sooner rather than later to prevent across-the-board benefit cuts or abrupt changes to tax or benefit levels. The Social Security Trustees project:

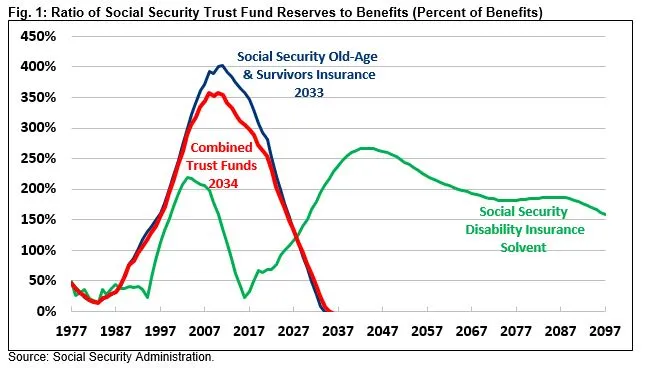

- Social Security is 11 years from insolvency. Social Security cannot pay full benefits to most current retirees under the law. The Trustees project the Old-Age and Survivors Insurance (OASI) trust fund will deplete its reserves by 2033. Including Social Security Disability Insurance (SSDI), the theoretically combined trust funds will be insolvent by 2034, when today’s 56-year-olds reach the full retirement age and today’s youngest retirees turn 73. Upon insolvency, all beneficiaries will face a 20 percent across-the-board benefit cut.

- Social Security faces large and rising imbalances. Social Security will run cash deficits of $2.8 trillion over the next decade, the equivalent of 2.4 percent of taxable payroll or 0.9 percent of Gross Domestic Product (GDP). Annual deficits will grow to 3.5 percent of payroll (1.3 percent of GDP) by 2040 and total 4.4 percent of payroll (1.5 percent of GDP) by 2097. Social Security’s 75-year actuarial imbalance totals 3.6 percent of payroll, which is 1.3 percent of GDP or $23.6 trillion in present value terms.

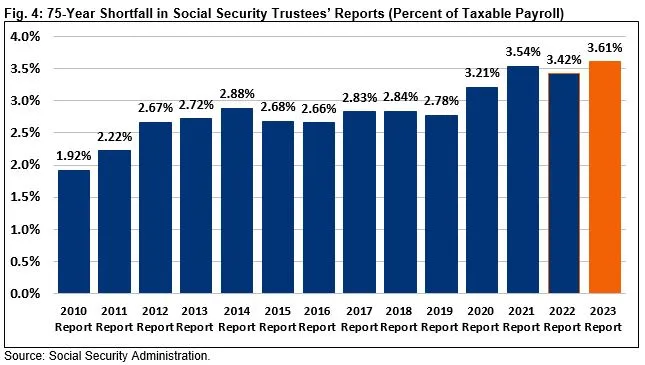

- Social Security’s finances continue to deteriorate. The recent surge in inflation worsened Social Security’s finances relative to the 2022 report, leading insolvency to occur a year earlier and contributing to a 0.2 percentage points of payroll expansion in the 75-year actuarial shortfall. The shortfall is now almost twice as large, as a share of payroll, as was projected in 2010.

- Time is running out to save Social Security. Policymakers have only 11 years left to restore solvency to the program, and the longer they wait, the larger and more costly the necessary adjustments will be. Acting sooner leaves more options available, allows for more gradual phase ins, and gives workers time to plan and adjust.

With insolvency looming, refusal to touch Social Security is an endorsement of a sudden 20 percent across-the-board benefit cut imposed on beneficiaries of all ages and incomes. Instead of demagoguing efforts to save Social Security and Medicare, policymakers should come together and negotiate a package of revenue and/or benefit adjustments to ensure long-term solvency.

Social Security is Only 11 Years from Insolvency

The Social Security program is only 11 years from insolvency, with insolvency of the old-age program only a decade away. Action must be taken soon to prevent an across-the-board benefit cut for many current and future beneficiaries.

The Trustees project the Social Security OASI trust fund reserves will be depleted by 2033, which is the first time since the landmark 1983 reforms that one of the Social Security trust funds is within a decade of insolvency. The SSDI trust fund is in much stronger shape and will remain solvent over the next 75 years. On a theoretically combined basis – assuming revenue is shared between the trust funds – the Social Security program will become insolvent by 2034.

Upon insolvency, all retirees regardless of age, income, or need will face a 20 percent across-the-board benefit cut, which will grow to 26 percent by the end of the 75-year projection window.

The year 2034 is only 11 years away. That means the Social Security trust funds are on course to run out of reserves when today’s 56-year-olds reach the normal retirement age and when today’s youngest retirees turn 73. Meanwhile, the Medicare Hospital Insurance (HI) trust fund is only eight years from insolvency and will exhaust its reserves in 2031. In other words, Social Security and Medicare cannot guarantee full benefits for many current beneficiaries, let alone future ones.

The Trustees’ findings are similar to recent estimates from the Congressional Budget Office (CBO), which estimated the OASI and HI trust funds would be insolvent by 2032 and the theoretically combined Social Security trust funds would exhaust their reserves by 2033.

Social Security Faces a Large and Growing Shortfall

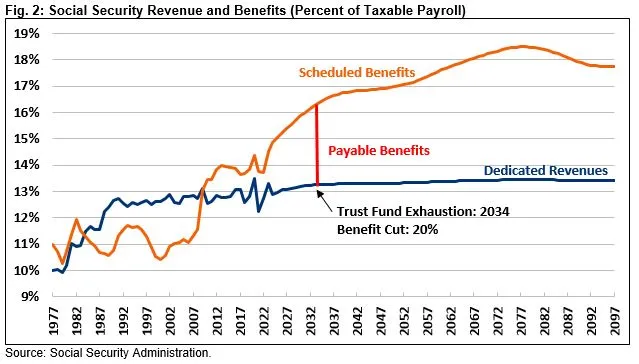

The Trustees project Social Security will run chronic deficits. They estimate the program will run a cash-flow deficit of $119 billion this year – which is 1.2 percent of taxable payroll or 0.5 percent of GDP. Social Security will run $2.8 trillion of cumulative cash-flow deficits over the next decade.

Over the long term, the Trustees project Social Security’s cash shortfall (assuming full benefits are paid) will grow to 3.0 percent of taxable payroll (1.1 percent of GDP) by 2033, to 3.7 percent of payroll (1.3 percent of GDP) by 2050, and to a high of 5.1 percent of payroll (1.7 percent of GDP) by 2077. The shortfall will then decline to 4.4 percent of payroll (1.5 percent of GDP) by 2097.

Social Security’s rising long-term shortfall is largely the result of rising costs due to the aging of the population. Total Social Security costs have already risen from 10.4 percent of taxable payroll in 2000 to an estimated 14.5 percent of payroll in 2023, and are projected to rise further to 17.0 percent of payroll by 2050 and 17.8 percent of payroll by 2097. Revenue will fail to keep up with growing costs, rising only modestly from 13.3 percent of payroll in 2023 to 13.4 percent by 2097.

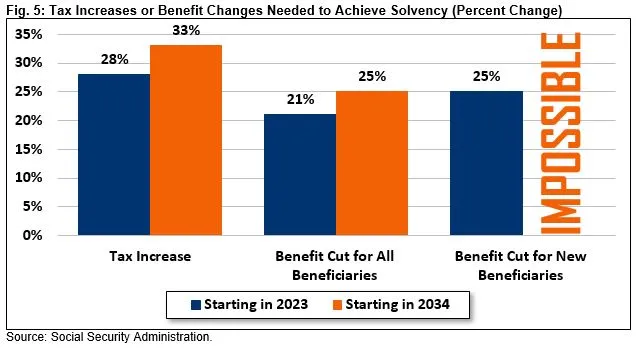

Over 75 years, the Trustees find the program faces an actuarial shortfall of 3.6 percent of taxable payroll, which is 1.3 percent of GDP or $23.6 trillion in present value terms. A plan to restore sustainable solvency over the next 75 years would require the equivalent of increasing payroll taxes immediately by 28 percent (3.4 percentage points), reducing spending by 21 percent for all beneficiaries, reducing spending by 25 percent for new beneficiaries, or some combination. Actual reforms could be better targeted, rather than across the board, and phased in gradually.

Social Security’s Finances Continue to Deteriorate

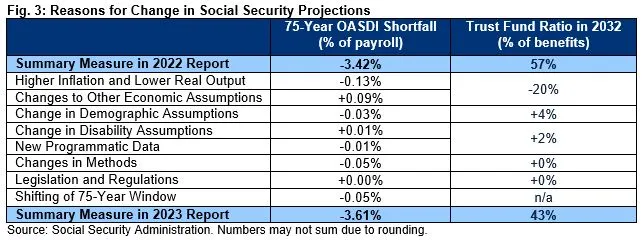

Social Security’s finances have further deteriorated since last year’s June 2022 Trustees report. Specifically, the Trustees now project Social Security will be insolvent a year earlier, in 2033 (as opposed to 2034) for the old age fund and 2034 (as opposed to 2035) for the combined trust funds. The Trustees also project a 75-year shortfall of 3.6 percent of payroll, up from 3.4 percent last year. And in 2032, they project the trust fund will only be large enough to cover 43 percent of annual benefits, down from 57 percent in last year’s report.

The worsened outlook is driven mainly by the recent surge in inflation, which fed into an 8.7 percent cost-of-living adjustment this year (compared to the Trustees’ projection of 3.8 percent) while eating into income growth and thus eroding real wages. The Trustees estimate these factors increased the 75-year shortfall by 0.13 percentage points and were mainly responsible for a 20 percent-of-benefits reduction in the size of the 2032 trust fund.

Other changes in economic assumptions actually improved Social Security’s finances. In particular, the Trustees project that faster wage growth below the taxable maximum will shrink the shortfall by 0.03 percentage points, higher near-term real interest rates will decrease it 0.02 percentage points, and other changes will reduce it by 0.03 percentage points.

New demographic assumptions increased Social Security’s 75-year shortfall by 0.03 percentage points of taxable payroll, though they improved the program’s near-term finances. Updates to population, immigration, and marriage assumptions increased the shortfall by 0.04 percentage points, and slightly lower birth rates increased the shortfall by 0.01 percentage points. Meanwhile, higher death rates decreased the 75-year shortfall by 0.02 percentage points of payroll.

Methodological and programmatic data changes worsened the 75-year outlook by 0.06 percentage points of payroll mostly due to updates in the sample of newly eligible retired-worker and disabled-worker beneficiaries used to project average benefit levels as well as updated post-entitlement benefit adjustment factors.

Improvements in the Trustees' disability assumptions decreased Social Security’s 75-year imbalance by 0.01 percentage points of payroll.

The remaining changes to the outlook come from the new projection window. Including the year 2097 in the Trustees 75-year solvency projections worsened the 75-year actuarial imbalance by 0.05 percentage points of payroll.

Not only have Social Security’s finances deteriorated relative to last year, but the program’s imbalances have also been growing for over a dozen years. Indeed, this year’s 3.6 percent of payroll imbalance is almost twice as large as the 1.9 percent of payroll imbalance estimated in 2010.

In one bright spot of the report, the finances of the Social Security Disability Insurance (SSDI) program continue to improve. As recently as 2015, that program faced a 0.31 percent of payroll (17 percent of revenue) shortfall and was only one year from insolvency.

However, the combination of a temporary reallocation of payroll tax revenue, legislative and administrative improvements to the program, and lower overall disability rates have all helped improve the financial state of this program. The Trustees now estimate SSDI will be solvent through the entire 75-year window and faces a positive actuarial balance of 0.01 percent of payroll – up from a 0.01 percent of payroll shortfall last year.

Nonetheless, policymakers should continue to support improvements to the disability program, which can improve fairness and administrability of benefits while supporting individuals with disabilities who want to remain in or return to the workforce.

Delaying Fixes to Social Security is Costly

Changes must be made in order to ensure Social Security’s solvency, and the sooner the better.

In their report, the Trustees recommend that “lawmakers address the projected trust fund shortfalls in a timely way in order to phase in necessary changes gradually and give workers and beneficiaries time to adjust to them.” Quick action would also give policymakers choices in making targeted adjustments, enhancing benefits for vulnerable populations, and ensuring reforms are pro-growth.

Delaying action until 2034 would make the needed tax increases or benefit reductions about one-fifth larger than if action were taken today. According to the Trustees, 75-year solvency could be achieved with a 28 percent (3.4 percentage point) payroll tax increase today but would require a 33 percent (4.2 percentage point) increase in 2034. Similarly, Social Security solvency could be achieved with a 21 percent across-the-board benefit cut today, which would rise to 25 percent by 2034. Benefit cuts for new beneficiaries would need to be 25 percent today, but even eliminating benefits for new beneficiaries in 2034 wouldn’t be enough to prevent insolvency.

Thoughtful trust fund solutions would not only prevent deep, across-the-board benefit cuts, but could also support economic growth, reduce inflationary pressures, and improve the nation’s fiscal outlook. We recently published our Principles for Social Security Reform, which outlines five principles policymakers should consider when crafting a responsible reform package. Unique reform packages can be designed with our Social Security Reformer tool.

The closer we get to insolvency, the fewer of these options remain available.

Conclusion

The Social Security Trustees warn that the Social Security program is significantly out of balance and just 11 years from insolvency. Without reforms, Social Security will not to be able to pay full benefits to most current beneficiaries, let alone today’s workers and future generations.

With insolvency looming, declaring Social Security “off the table” is akin to supporting a 20 percent across-the-board benefit cut to all beneficiaries, regardless of age or income. At best, demagoguing efforts to save the program will delay needed action, resulting in larger and more abrupt tax hikes and benefit cuts in the future.

As lawmakers have continued to delay necessary action, the program’s finances have continued to deteriorate. The recent surge in inflation and subsequent 8.7 percent cost-of-living adjustment have advanced Social Security’s insolvency date and expanded its long-term imbalances relative to last year. Since 2010, the projected 75-year shortfall has nearly doubled.

Fortunately, there are many well-known options to save Social Security. A number of comprehensive plans to restore solvency already exist, and our Social Security Reformer tool allows anyone to design their own. Policymakers should also consider pursuing new, innovative solutions to promote economic growth and improve retirement security in concert with addressing the program’s finances.

Policymakers should work together to enact thoughtful Social Security reforms, not let partisans and special interests hold the program hostage. Action is required sooner rather than later.

What's Next

-

Image

-

-

Image