Why Did the Deficit Drop in 2014? Part 2

At the beginning of the month, the Congressional Budget Office released its annual report on the federal budget, which showed that the deficit is expected to fall by $166 billion from last year to this year, but increase by $1.7 trillion over the next ten years compared to previous projections.

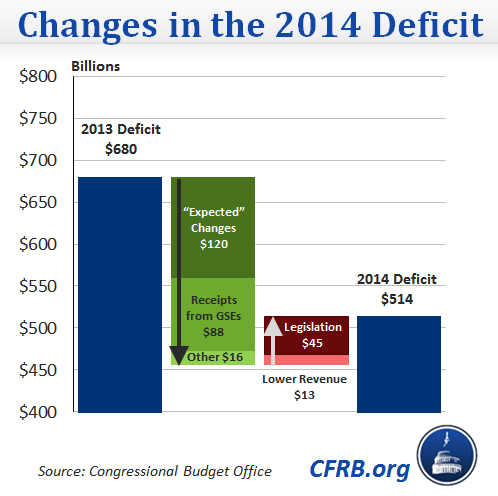

The next day, we released an analysis of the reasons why the deficit dropped since last year. Three-quarters of the drop, or $120 billion, could be attributed to "expected" changes that had been predicted in last year's report. Higher collections from Fannie Mae and particularly Freddie Mac also improved the deficit, while legislation increasing discretionary spending above sequestration amounts in exchange for cuts in future years increased the 2014 deficit. In this post, we look into the other changes to the 2014 deficit, those included as "expected" changes, particularly the automatic stabilizers that increase deficits when the economy is operating below potential.

There are several large factors which will reduce the deficit in 2014. Perhaps most fundamentally, government revenues increase along with the economy. As payrolls, personal incomes, and corporate profits increase, so does tax revenue. The economy is projected to grow by nearly 4 percent, and income tax revenue will grow by nearly 5 percent.

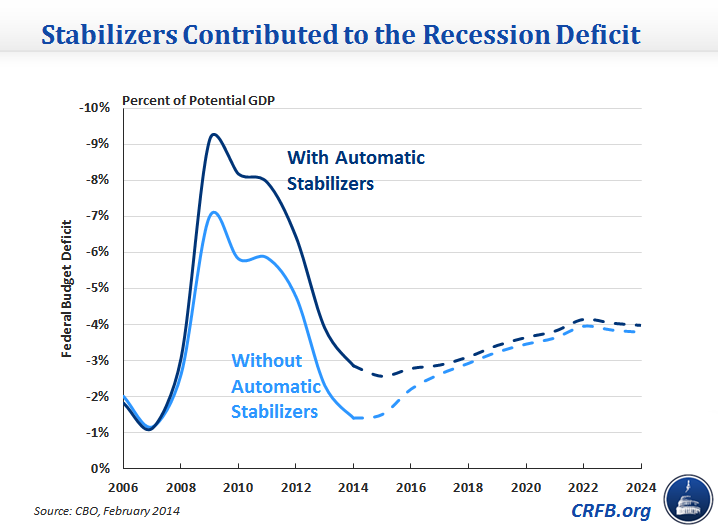

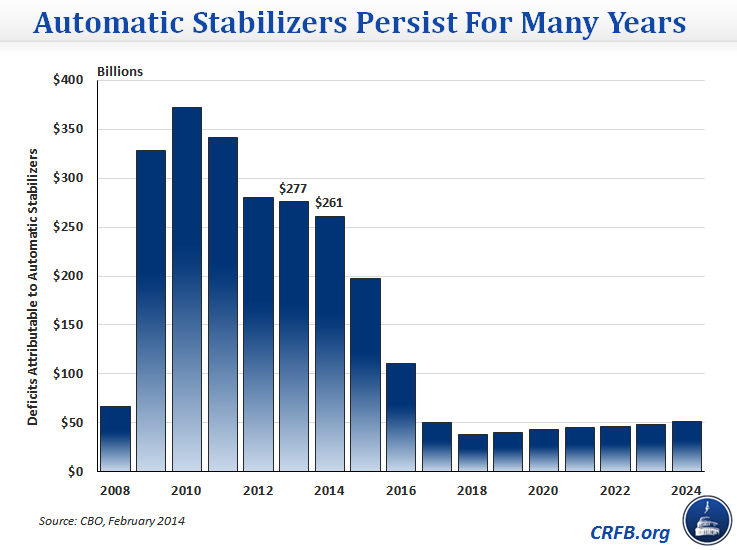

Yet revenues still have a long way to recover from the recession. During a recession, certain "economic stabilizers" automatically increase the deficit by lowering tax revenue and raising safety net spending. At their height in 2010, these stabilizers increased the deficit by $373 billion, nearly 30 percent of the total deficit.

The high deficits of the last few years are falling; however, the deficits from automatic stabilizers are projected to continue for several more years. The automatic stabilizers only fell by $16 billion between 2013 and 2014, a drop caused by $6 billion in higher revenues and $10 billion in lower safety net spending. In 2014, stabilizers will cost $261 billion, over half of this year's $514 billion deficit. The automatic stabilizers will continue to drop in future years, but are not expected to reach zero based on a change in how CBO projects future growth: they no longer expect the economy to reach full potential within ten years or the unemployment rate to fall to levels projected in past forecasts.

Other factors contributed to the changes to the deficit. The new taxes in the fiscal cliff deal, such as a new top rate of 39.6 percent and a 5 percent higher rate on capital gains and dividends, raised approximately $47 billion. While they were in effect for all of calendar year 2013, they did not apply to the entire fiscal year 2013, which includes 3 months of 2012, before the tax increases were enacted.

Other factors increase the deficit. The Affordable Care Act's new coverage provisions have begun, costing the federal government $41 billion in exchange subsidies and expanding health coverage to low-income populations. Finally, with every passing year, more of the population ages into retirement – Social Security outlays will increase by $38 billion and net Medicare spending is expected to increase by $13 billion.

As Congress wrestles with how to achieve deficit reduction, they would be wise to consider the various factors pulling the deficit in different directions – particularly over the long term. The newest deficit projections were slightly rosier in the short-term, but that was largely as a result of factors outside their control. Later this decade and over the long term, there will almost surely be no conversations about why the deficit is falling. The focus will instead be on why the deficit is growing because of health care costs and an aging population. However, waiting until that happens before we take action will risk higher debt levels, forgoes time when reforms could be gradually phased in, and places a larger share of the population at risk by being either in or near retirement. Falling deficits this year should be an opportunity to create lower deficits in the future too.