What Would a Mini-Bargain Look Like?

A New York Times piece today lays out a possible "mini-bargain" to move past the debt ceiling and expiration of government funding. The piece, "Puzzle Awaits the Capital: How to Solve 3 Fiscal Rifts," discusses the three upcoming fiscal disputes facing Washington: the debate over whether to fund "Obamacare" or risk a government shutdown, the question of how to address the 2014 sequester, and the need to raise the debt limit. The article argues that the first challenge appears to be resolving itself and the third challenge has a still-not-clear future, but it floats an idea for the second challenge.

In short, the article suggests policymakers might waive a portion of two years' worth of sequester cuts (remember, the sequester continues through 2021) in exchange for an equivalent amount of other deficit reduction over ten years. The article suggests that policymakers could first enact a temporary continuing resolution, and then negotiate the details:

The aim of negotiations after that would be to come up with new savings approaching $200 billion.

Part of the savings would come from entitlements, but programs like farm subsidies, rather than the more politically volatile Social Security and Medicare. Part would come from new revenues, but “user fees” tied to special government services, rather than broad-based tax increases.

That could allow both sides to tell key constituencies that they did not violate core principles. And it would be enough to replace cuts in military and domestic programs for about two years, without increasing the deficit.

This solution, of course, would be less than ideal. Ideally, policymakers would use the sequester as it was intended -- as an impetus to develop a comprehensive debt solution. If policymakers do undertake this approach, however, they must at minimum fully offset the cost of any sequester repreal with permanent savings that do not rely on budget gimmicks. There is no question that sequestration is bad policy, but repealing any part of it it without fully offsetting its costs would be unacceptable and undermine our fiscal credibility.

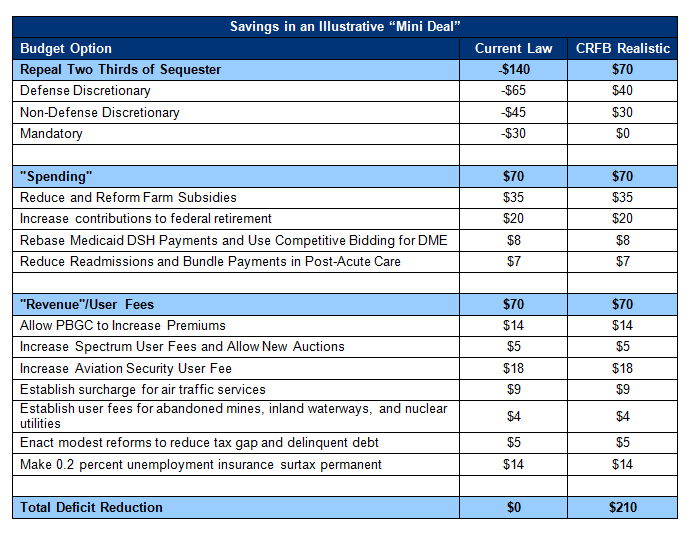

So what about this proposal to offset two years' worth of costs without really touching "entitlements" or directly increasing taxes? Using policies in the President's budget, we took a go at designing such a package. It is certainly possible to do so, though not easy.

By our math, repealing the sequester for two years would cost roughly $210 billion after accounting for various interactions. We assumed that one third of the sequester would be left in place, one third would be offset with what one might consider direct spending cuts, and the remaining third with user fees and revenue from minor changes. Of the direct spending cuts, we took about $15 billion from health care to pay for the health portion of the sequester and the rest from federal retirement contributions and farm subsidies. On the revenue side, we relied on as many user fees as possible -- some of which would technically be classified as "offsetting receipts" and others as revenue -- but we also had to assume about $20 billion in taxes from improving tax reporting and restoring the recently-expired unemployment insurance surtax. It is possible these savings could be replaced with other user fees from outside the President's budget.

Our illustrative deal did not address a number of other provisions that will expire at the end of the year such as the doc fix, expanded unemployment benefits, and the tax extenders. Although we are optimistic on the chances of a permanent doc fix this year, one could see a two year replacement -- costing about $30 to 40 billion -- being replaced with something like a reduction in payments for Medicare bad debts, a combination of a one-year freeze in post-acute care payments, and an extension of the freeze of income-related thresholds for premiums.

The package outlined above could certainly be seen as an improvement over current law. It would replace $140 billion of deficit reduction at a time when we don't particularly need it with an equivalent amount over the next decade and an additional $200 billion to $250 billion of further savings in the folllowing decade.

On the other hand, the package would do little to alter the trajectory of our debt since it would not address the drivers of our long-term debt problem -- the growing costs of entitlement programs -- nor would it do anything to improve the tax code.

Additionally, this package would virtually pick dry the remaining low-hanging fruit of deficit reduction. The same game could not be repeated to replace the next two years of sequester and the two years after that. There simply isn't enough money left from the small basket of user fees and other mandatory programs.

Ultimately, the only sources big enough to pay off the sequester and put our long-term debt on a sustainable are Social Security, Medicare, Medicaid, and the $1.3 trillion of tax breaks in the code. A "grand bargain," even a smaller grand bargain, would allow policymakers to address many of these issues together while also incorporating much of the "low-hanging fruit" and finding a permanent solution of the sequester.

Sooner or later, the available "hard choices" will be the only ones left, and policymakers will have wished they acted sooner to make them. Offsetting the sequester is certainly better than waiving it, but a permanent solution is likely to be the best answer for the short-term economy, the long-term economy, and the unsustainable long-term debt burden we face.