UI Offsets a Good Start, But Fall Short

Today, the Congressional Budget Office released their score of the proposal from Majority Leader Harry Reid (D-NV) to renew extended unemployment benefits in concert with other reductions in spending. We are quite pleased that, as we called for, the conversation has turned from whether to pay for unemployment benefits to how; and we appreciate that Senator Reid has a specific proposal to pay for the new costs. The statutory pay-as-you-go law requires new spending to be fully offset through 2024. Unfortunately, the CBO score shows that the proposed offsets still fall short of what is necessary to comply with this standard.

Specifically, Senator Reid’s proposal would:

- Renew extended unemployment benefits through November 15th, reducing the maximum weeks from 73 to 57

- Reduce disability insurance benefits for people who also receive unemployment benefits

- Extend the mandatory sequester cuts which end in 2023 into 2024

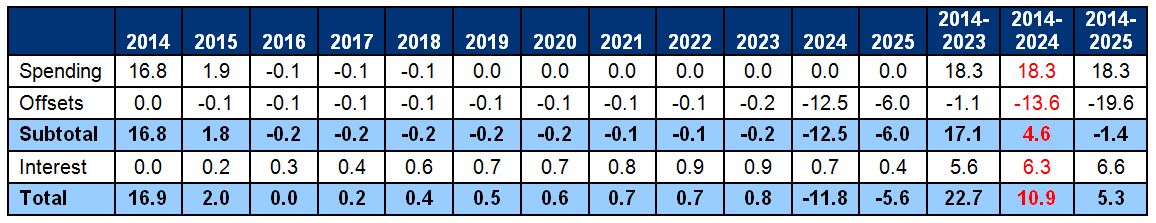

Eventually, the savings from the UI/DI provisions and mandatory sequester would exceed the cost of extending unemployment benefits (excluding interest), however this would not be true until 2025. By our estimates, the legislation would increase the deficit by about $5 billion through the ten year budget window ended in 2024, and by $17 billion through 2023. With interest (which is not counted under PAYGO rules), the legislation would increase the deficit by about $11 billion through 2024.

Budgetary Effect of UI Extension Bill (in billions of dollars)

Source: CRFB calculations from Congressional Budget Office data

Note: The PAYGO window is 2014-2024. Figures for 2024 and 2025 are rough CRFB estimates.

Although the decision to include offsets in the legislation is a huge step forward, policymakers should amend this legislation so it is at least deficit neutral over the next five or ten years and not rely on one-time savings outside of the budget window.

Previously, we’ve offered a number of options that could either be added to the offsets Senator Reid has proposed or otherwise used to replace them.

If something is worth having, it is worth paying for. And it is important that Members stick to fiscal rules and principles along the way. Providing offsets as opposed to deficit-financing the entire legislation is a good start. But improvements are necessary to ensure this bill is not adding to the deficit (and preferably is subtracting from it) over the next decade and beyond.