Raising Retirement Age Would Promote Working Longer

The 2008 recession substantially altered the enrollment and operations of many government programs, particularly those providing financial benefits. The Urban Institute further explored one of these programs in a recently released report analyzing the recession's effects on Social Security claiming.

As the report states, Social Security benefits upon retirement are in part determined by the full retirement age (FRA), currently at age 66 and scheduled to be 67 for people born in 1960 and later. While benefits can be claimed as early as 62, benefits are adjusted depending on how much earlier or later than the retirement age they are claimed. The paper notes that the recession and resulting unemployment levels forced many low and middle-income elderly workers into early retirement. Retired worker claims increased 12 percent in 2008 and an additional 20 percent in 2009.

Yet, the Urban Institute finds that this surge in early retirement claims was far from permanent. As the unemployment rate began to fall from it's 2009 peak levels, so did claims. What ultimately fueled the reversal from dangerous early retirement trends was a change in government policy: increase in the retirement age.

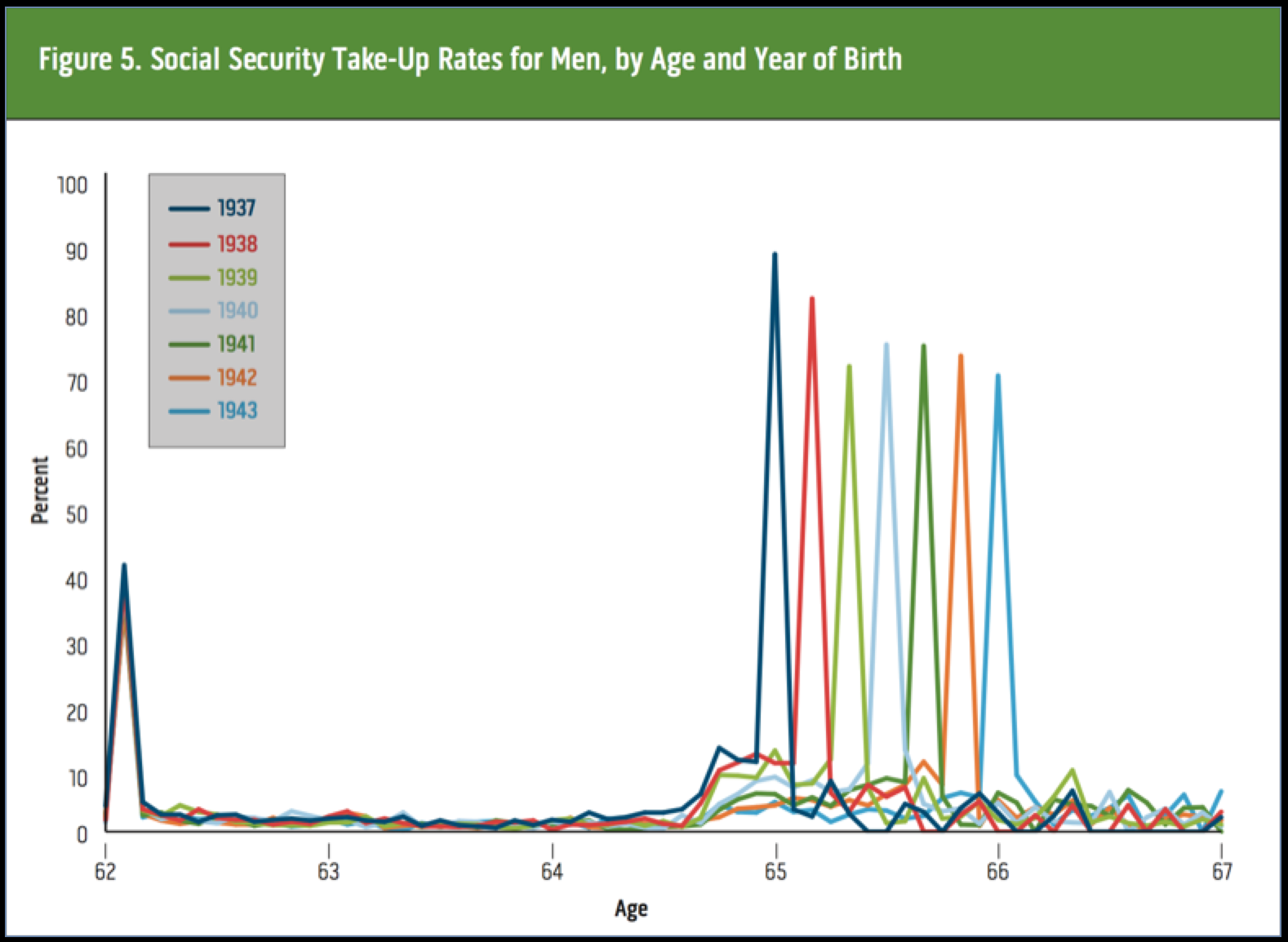

Perhaps the most important change to Social Security was the increase in the FRA, which had been age 65 since the program began. The FRA was raised to 65 years and two months for those born in 1938. It increased another two months for each successive birth cohort until it reached 66 years for those born in 1943. It is scheduled to remain at 66 until it begins increasing two months per year again for those born in 1955 through 1960. Current law sets the FRA at 67 years old for everyone born in 1960 or later.

Increasing the retirement age, as the Urban Institute argues, allowed for the transition from the short-term increases in Social Security claims to a decreasing trajectory as the average retirement age taken by beneficiaries gradually increased. The graph below illustrates the correlation between a gradually increasing FRA and a gradually increasing age of retirement for those born in between 1937 and 1943. The second spike at which many beneficiaries begin collecting Social Security strongly correlates with the gradual scheduled increase in the FRA.

Source: Urban Institute (Survey of Income and Program Participation)

By increasing the FRA, as Urban argues, policy makers have the ability to "influence retirement decisions by signaling an 'appropriate' time to begin collecting retirement benefits." While claiming benefits later has a muted effect on the Social Security Trust Fund (as those benefits are actuarially-adjusted), the decision to retire later will boost economic growth by increasing the size of the labor force, increase retirement savings, and reduce the longevity risk of beneficiaries outliving those savings. There may be some who are not physically able to work longer, but many solutions have been proposed to address this problem, and the retirement age should not be adjusted based on that minority.

Social Security as it currently stands needs reform, with the trust fund's expected depletion in 2033. We know that we will have to act on Social Security, and an increase in the retirement age should be on the table. Not only will it help the Trust Fund, but it will help increase labor participation among the elderly when Americans are living longer, helping both the budget and the economy. Social Security is in need of reform and changes will be neccessary; raising the retirement age is a good place to start.