Public Trustees Highlight the Need for Prompt Reform

Last week, the Social Security and Medicare Trustees released their annual reports on the long-term finances of each program, showing that those programs remain financially unsound and on the road toward insolvency. As part of the reports the public trustees, who are appointed members of the public rather than agency heads, release a statement highlighting their thinking around key issues surrounding the trust funds. Three issues stand out in this year’s statement: the need for prompt action to solve the impending exhaustion of the Social Security Disability Insurance (SSDI) Trust Fund; the need for near-term action to solve the imbalance in the Old-Age and Survivors Insurance (OASI) Trust Fund; and the importance of maintaining and building on measures to control Medicare cost growth.

The Impending SSDI Crisis

We’ve written many times about the impending exhaustion of the SSDI trust fund and the need for reform. Given the immediateness of this problem, the trustees note that:

"It is impracticable to reduce DI costs sufficiently to prevent imminent Trust Fund depletion (and thus, sudden benefit reductions for highly vulnerable individuals) without at least a temporary increase in DI Trust Fund resources, irrespective of its source or combination with other measures."

At the same time, they indicated reservations about relying on reallocation as a simple fix for DI financing, pointing out that DI already receives a higher share of the Social Security payroll tax relative to its projected obligations than does OASI. They also noted that the last reallocation in 1994 was accompanied by a warning from the Trustees that a further reallocation to DI from OASI “would ultimately raise concern about the financial viability of the retirement and survivors program.”

Although a short-term transfer of money, whether through reallocation or inter-fund borrowing, will be required, lawmakers should also use the opportunity to consider program-wide reforms that improve the program for workers with disabilities and improve its solvency.

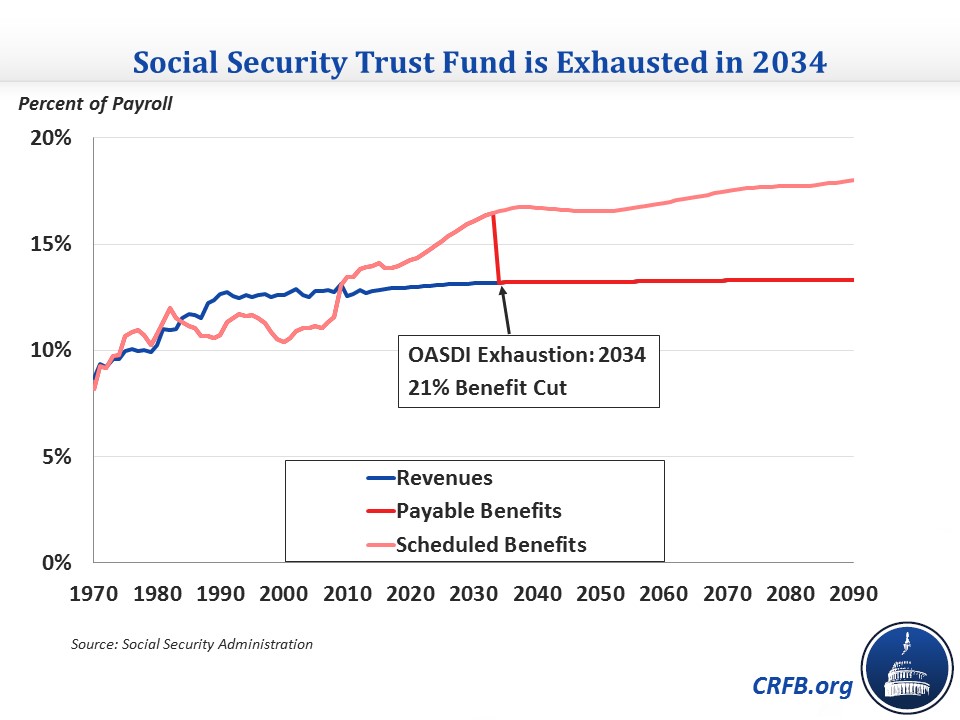

The Need for Prompt Reform to OASI

While addressing the SSDI crisis is extremely important, the trustees are concerned that it is “but the first financing crisis arising from program cost growth trends that have been evident for the past few decades."

In particular, they note that "the projected imbalance of the OASI Trust Fund is larger in both absolute and relative terms than that facing the DI fund and arises from many of the same sources," and that "substantial further delay in enacting financial repairs to Social Security as a whole would compound these problems, creating uncertainty on an even larger scale for millions of vulnerable OASI beneficiaries and taxpayers, and leaving even less palatable options than now exist."

They further emphasize this point by calling for prompt action to prevent the financial shortfall from growing to an “intractable size” that would “unlike the situation in 1983 – likely preclude any plausible opportunity to maintain Social Security’s historical financing structure”.

Keeping Medicare Cost Growth under Control

The trustees’ statement also highlights the importance that the cost-containment measures in current law plays in limiting the forecasted financing gap for Medicare. In particular, it notes that "even under current projections, Medicare faces a substantial financing gap, [and policymakers] will need all of current law's cost containment and more to ensure that it remains on a financially secure footing." On the other hand, if cost-containment provisions under current law were “to be scaled back or repealed, other more aggressive savings measures would need to be enacted in their place.”

We’ve made a similar argument in the debate about repeal of the Independent Payment Advisory Board (IPAB), which would have a significant negative impact on the nation’s fiscal position if not replaced by another mechanism that caps Medicare spending growth.

The Trustee’s report and statement makes it clear that that Social Security and Medicare need to be reformed soon. Fortunately, taking action early will ensure that the financing of these programs can be put on firm footing without making drastic changes to taxes or benefits.