Progressive Caucus Releases Budget

The Congressional Progressive Caucus (CPC) kicked off the Congressional budget season last week by releasing its "Better Off Budget." This release marks CPC's fourth published alternative to the official House Budget. The progressive budget generally offers a more liberal alternative than that proposed by either party or the President.

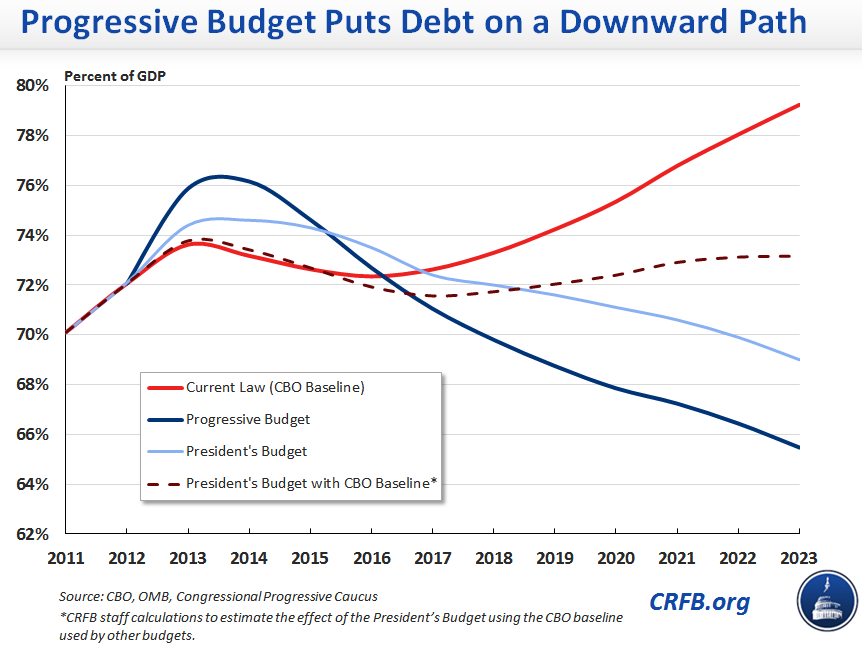

The Progressive budget proposes both higher taxes and greater amounts of spending in most areas of the budget. The budget calls for about $5.9 trillion of higher tax revenue and $3.6 trillion per year in higher spending over ten years, resulting in $2.7 trillion of deficit reduction over the next decade including interest savings. This deficit reduction would be sufficient to put debt on a clear downward path; it would decrease from 74 percent of GDP today to 65 percent of GDP in 2024. In contrast, we found that debt under the President's budget would be 73 percent – or about where it is today – if it were estimated using CBO's economic assumptions, instead of OMB's rosier economic projections.

Under the Better Off Budget, revenues would rise to 21.5 percent of GDP by 2024, more than 3 percent higher than under current law. Outlays would reach 22.9 percent of GDP in 2024, or about 1 percent higher than under current law. As a result, deficits fall below 2 percent of GDP after 2016 and end up at just 1.4 percent of GDP at the end of the decade, which is lower than the President's budget.

The Progressive Caucus budget proposes new spending initiatives and tax credits as additional stimulus in 2014. It would extend expired unemployment benefits through 2016, when CBO projects the unemployment rate to be 6.1 percent, just slightly below the current rate. It would create a new refundable tax credit, giving up to $600 to workers making up to $95,000/$190,000 (single/married) in 2014 and 2015 modeled after the Making Work Pay credit. Additional stimulus includes a public works jobs program, $100 billion to hire teachers in K-12 schools, and block grants to the states for Medicaid, first responders, and other priorities.

Beyond the initial stimulus investment, the Progressive budget also envisions a dramatic increase in non-defense discretionary spending. It repeals both the sequester and the higher spending caps and increases discretionary spending by $1.5 trillion over those caps, further increasing nondefense spending.

The budget enacts several changes to tax rates and adopts several proposals. For very high earners, the budget raises rates: ranging from 45 percent for incomes over $1 million and rising to 49 percent for incomes over $1 billion. The budget would also tax capital gains as ordinary income. It also adopts the President's budget's proposal to expand the Earned Income Tax Credit (EITC) for childless workers as well as a surtax on very large financial institutions as proposed by House Ways and Means Chairman Dave Camp (R-MI).

| Major Proposals in Progressive Caucus Budget |

|

| Deficit Reduction Proposals |

Savings (2014-2024) |

| Increases tax rates on income above $250K | $1,450 billion |

| $25/ton price on carbon | $1,200 billion |

| Financial transactions tax | $910 billion |

| Enact worldwide taxation system | $620 billion |

| Repeal step-up basis & reform estate tax | $530 billion |

| Cap the value of itemized deductions at 28% | $530 billion |

| Prevent defense spending from growing beyond current levels | $250 billion |

| Other deficit reduction proposals | $1.2 trillion |

| Net Interest Payments | $460 billion |

| Subtotal, Deficit Reduction | $7 trillion |

| New Investment Proposals | |

| Increase Non-Defense Discretionary Budget Above Spending Caps | - $2,040 billion |

| Increase Infrastructure Spending | - $820 billion |

| Create new $600 tax credit for incomes below $95,000/$190,000 | - $250 billion |

| Extend refundable credit expansions | - $170 billion |

| Repeal mandatory sequestration | - $150 billion |

| Repeal SGR | - $140 billion |

| Extend research credit & enact green manufacturing credit | - $125 billion |

| Other new investment proposals | - $500 billion |

| Subtotal, New Investments | -$4.3 trillion |

| Total, Progressive Budget |

$2.7 trillion |

| War Drawdown* | $950 billion |

| Total, Progressive Budget | $3.7 trillion |

*As we've written before, the war drawdown tallies savings from a policy that is already underway. These savings would be counted in a CBO score, but do not represent new savings. By this metric, the progressive budget achieves $2.7 billion of real deficit reduction, but it would be counted as $3.7 trillion if it were scored by CBO.

We welcome this addition to the budget season proposals, and hope it sparks discussion about the budget process and policy proposals. While the CPC budget doesn't abide by Murray-Ryan level spending and does away with both the sequester and the caps, it still manages to raise money for deficit reduction, which is commendable. We hope that forthcoming budgets target deficit reduction as well, and look forward to continued proposals.