Our Analysis of CBO's Estimate of the President's Budget is Here

We've released our analysis of CBO's estimate of the President's budget, breaking down the report and its supplementary data in less than six pages. Our paper explains that CBO finds that many policies would save less than the President's budget claims shows debt on an upward, rather than a downward path.

Although CBO shows lower debt as a percent of GDP than OMB does, it also shows debt on a slight upward path after 2020, meaning the budget is less likely to stabilize debt over the long term using CBO's numbers (OMB's numbers showed stable debt through 2040). Debt would fall from 74 percent of GDP in 2014 to 72 percent by 2020 before rising gradually to 73 percent by 2025. Thus, the budget would likely have to do more to truly put debt on a sustainable path.

Debt as a Percent of GDP in the President's Budget

Debt would rise after 2020 because deficits would increase throughout much of the ten-year window. Although they would fall from $486 billion (2.7 percent of GDP) in 2015 to $380 billion (2 percent) in 2016, they would rise continuously after that to $801 billion (2.9 percent) by 2025. The 2025 deficit is lower than CBO's baseline deficit of 3.8 percent but higher than OMB estimated deficit of 2.5 percent.

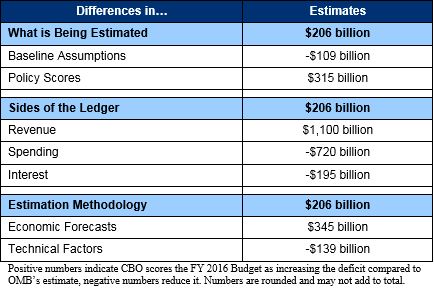

Overall, the budget reduces deficits through 2025 by $1.2 trillion relative to CBO's baseline or by $615 billion excluding the budget's war drawdown. Our paper explains that CBO's estimate has deficits that are $206 billion higher than OMB estimated, and its estimate of the policy changes finds $315 billion less in savings on a comparable basis. The $206 billion difference can be broken down in a number of different ways, as this table from the paper shows.

Breaking Down the 2015-2025 Deficit Differences Between CBO and OMB

Although CBO's estimate of the President's budget generally shows lower debt as a percent of GDP over the next ten years than OMB does, it would leave debt on an upward path so it would likely not stabilize debt over the long term as OMB anticipates. The budget would need to go further to truly make debt sustainable. As we say in our analysis:

To ensure the debt is on a sustainable path, policymakers should focus first on the savings in the President’s budget, enacting only the new spending and tax breaks that pass a cost-benefit analysis when weighed against the need for further deficit reduction. Furthermore, policymakers should go beyond the President’s budget to pursue serious structural entitlement reform. This means not only identifying further health care reforms, but putting in place a plan to make Social Security sustainably solvent for the next 75 years and beyond.

In additional to tax reform and spending cuts, such entitlement reform will be necessary to put the county on a sustainable fiscal course for this and future generations.

Click here to read the full paper.