New Report Shows Student Debt Cancellation is Regressive

Recently, Adam Looney, Executive Director of the Marriner S. Eccles Institute at the University of Utah and a Nonresident Senior Fellow in Economic Studies at the Brookings Institution, published a report and follow-up FAQ showing that student loan cancellation is regressive even if measured by wealth and that debt cancellation is not an effective policy for reducing the racial wealth gap. The report argued that more targeted policies are more effective in terms of progressivity and reducing the racial wealth gap.

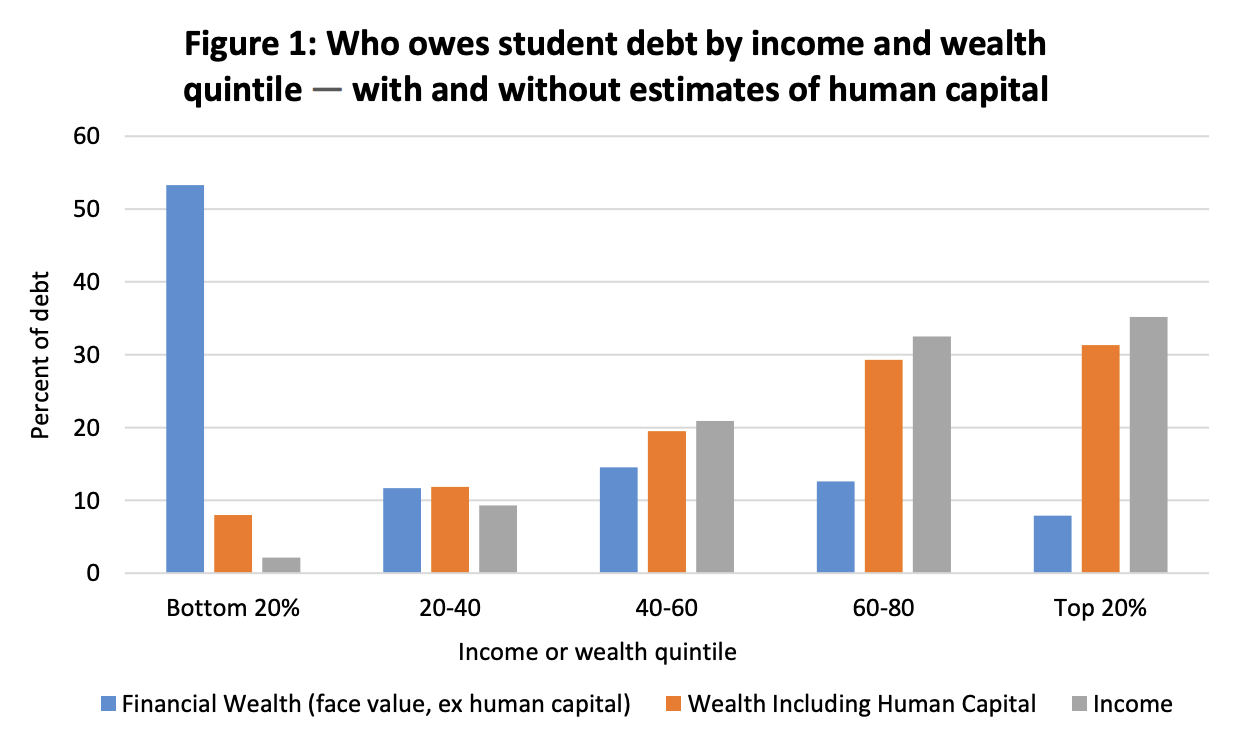

As we’ve shown in several analyses, full and partial debt forgiveness is regressive by income and education, meaning a disproportionate share of the benefit goes to people with higher levels of education and those currently earning high incomes. Some, though, have argued cancellation is progressive by wealth, since those with low or negative net wealth tend to benefit the most from forgiveness. As Looney explains, however, that finding is an artifact of counting the student debt itself against wealth while ignoring the education purchased with that debt.

Looney argues that measuring student debt without future earnings potential as a result of the degree is like measuring the wealth of someone who has a mortgage without incorporating the value of a home. As Looney argues:

Excluding the value of education from a calculation of net worth while including debt used to finance that education is like measuring a homeowner’s wealth by subtracting their mortgage but ignoring the value of the home itself. You’d find that homeowners were poorer than renters, and that people living in mansions were the poorest members of society.

That’s clearly wrong, yet advocates for debt forgiveness make the same mistake, arguing that recent college graduates with student debt have negative wealth and are thus worse off than otherwise similar Americans who have not gone to college. Consider that the median doctor graduating from medical school in 2017 or 2018 owed $171,000 in student debt, according to the College Scorecard, the median MBA owed $46,000, the median borrower with a BA in business $25,000, and the median AA degree holder in business $18,000. The implied conclusion is that doctors are the worst-off individuals, those with the two-year AA degrees are doing far better, and richest of all are those who never went to college.

Source: Brookings Institution.

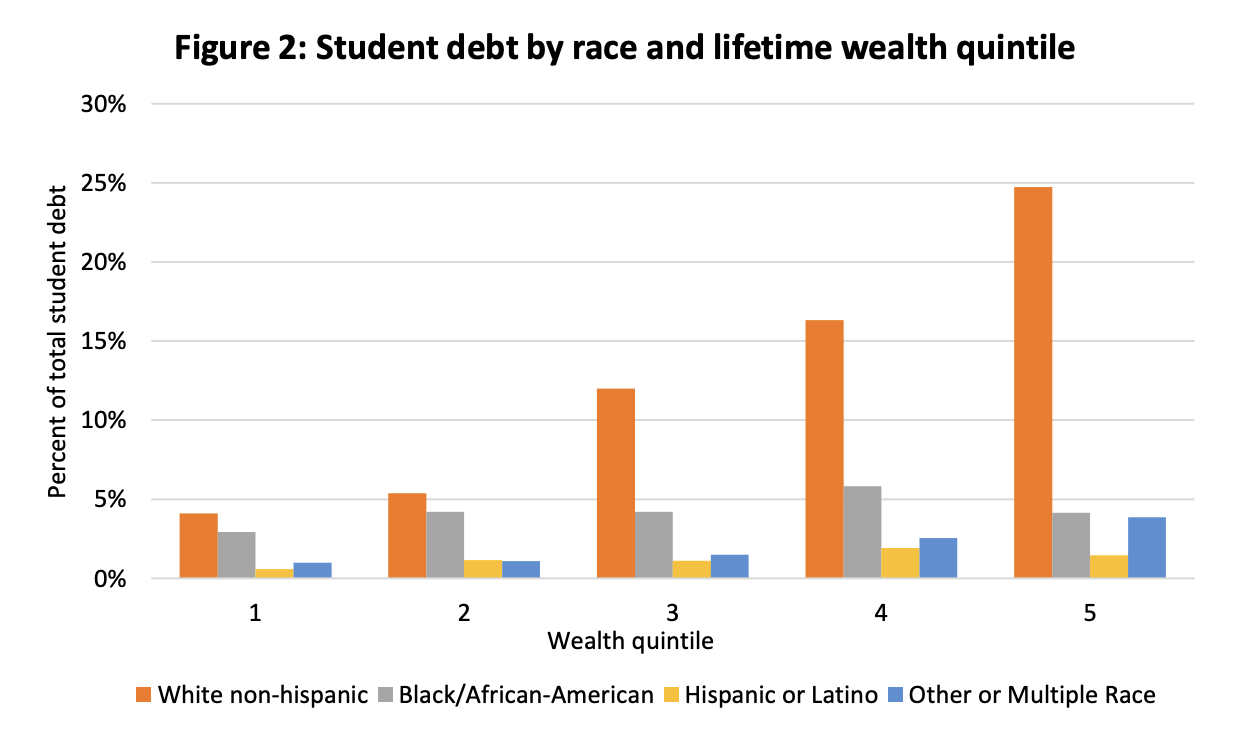

Looney also shows that loan forgiveness would basically leave the racial wealth gap unchanged, and notes two particularly interesting issues. The first is that student debt is highly concentrated among high lifetime wealth White non-Hispanic households. The top 20 percent of White non-Hispanic households by lifetime wealth hold 25 percent of all student debt and hold more student debt than all Black/African American households combined.

The second issue is that Black/African American households are less likely to be paying back their loans on a monthly basis (likely because many are on income-driven repayment plans or in forbearance). While this makes their balances go up, it also means that, on a monthly basis, White non-Hispanic households that are paying their loans down will actually benefit more from cancellation, because it will increase their monthly free-cash flow in comparison to households that are not making monthly payments.

Source: Brookings Institution.

Looney concludes by arguing that more targeted policies would better address concerns about the effect of student debt on lower-wealth and Black/African American households. For example, doubling the Pell Grant and/or forgiving debt based on someone’s Pell status while in school is significantly more progressive and does more to help reduce the racial wealth gap.

We have written many analyses showing that debt cancellation and an indefinite pause on student loan payments are regressive and costly. Our student debt cancellation resource page also has links to relevant information.

You can read the full analysis here and the follow-up FAQ here.