New Poll Finds Broad Support for Comprehensive Debt Plan

The Campaign to Fix the Debt has recently released the results of a new national telephone poll that found broad support for a comprehensive deficit reduction plan that includes tax reform, sequester replacement, and structural changes to Social Security and Medicare. The bipartisan poll was conducted by Anzalone-Liszt-Grove Research and Voter Consumer Research with 800 likely voters.

Voters clearly see the need for reform – the poll found that the budget deficit is tied with the economy as the number one issue for Congress to address. This is a significant shift from a July CBS poll, which had the economy beating out the debt as a priority by 24 points.

Not surprisingly, respondents were initially resistant to Social Security and Medicare changes, with only 34 percent in favor of general entitlement reform in the abstract. But when the poll noted that any reforms would be phased in gradually, that support jumped to 55-35 percent. Entitlement reform as part of a comprehensive plan was even more popular -- 61 percent of voters responded favorably to entitlement reform alongside cuts to wasteful spending and increased revenue from closing tax loopholes.

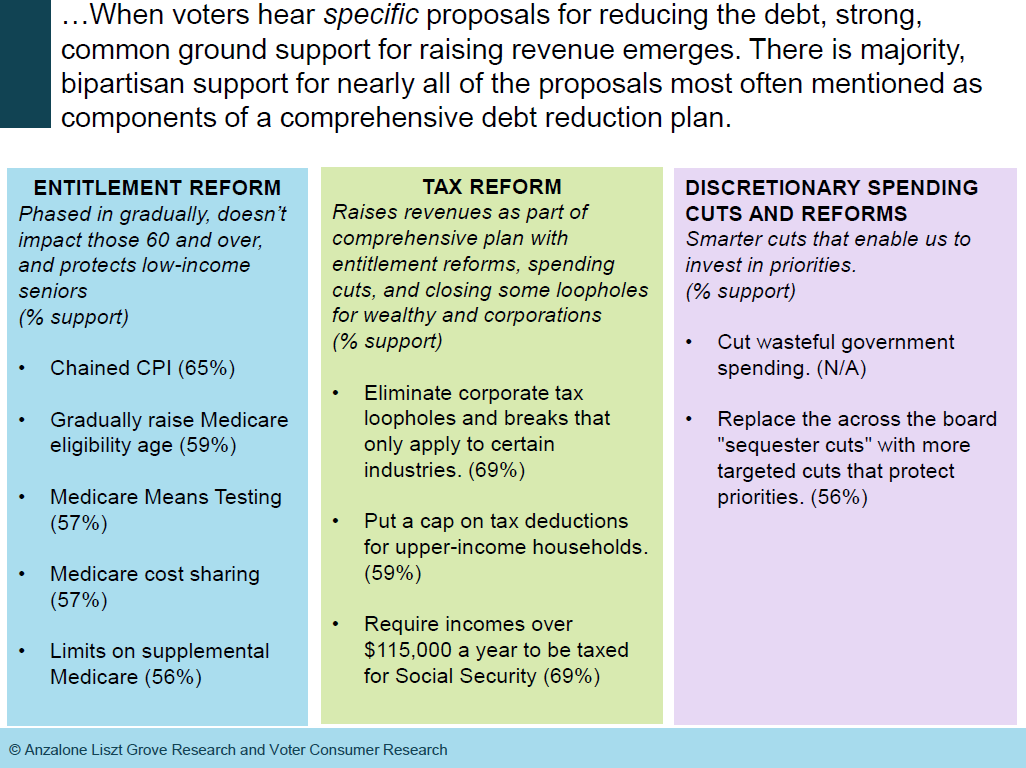

The specific policies that could be included in a comprehensive deficit reduction plan all tested favorably. Chained CPI, increasing the ages, means testing, and cost sharing reforms polled with majority support in the context of including protections for low-income populations, cutting waste, and phasing reforms in gradually. Tax reform also polled very well, especially the idea of closing tax inefficient and unfair tax loopholes.

The chart below demonstrates the broad support for provisions that could be included in a "grand bargain" on fiscal issues.

This new poll is encouraging news as Congress prepares to begin the budget conference process. Lawmakers should heed this call from voters to enact a comprehensive deficit reduction plan that makes structural changes to ensure the solvency of Social Security and Medicare, overhauls or eliminates wasteful tax expenditures to promote fairness and simplicity, and replaces the across-the-board sequester cuts with more targeted reforms.