Medicare Trustees Show Need for Reform

The Medicare Trustees released their latest report last week, along with the companion Social Security Trustees' report. The report estimates that under current law, total Medicare spending will increase from 3.6 percent of GDP in 2016 to 5.5 percent in 20 years, and the Hospital Insurance (HI) trust fund will run out in 2028, two years earlier than they projected in last year's report. Below, we explain the report in a bit more detail.

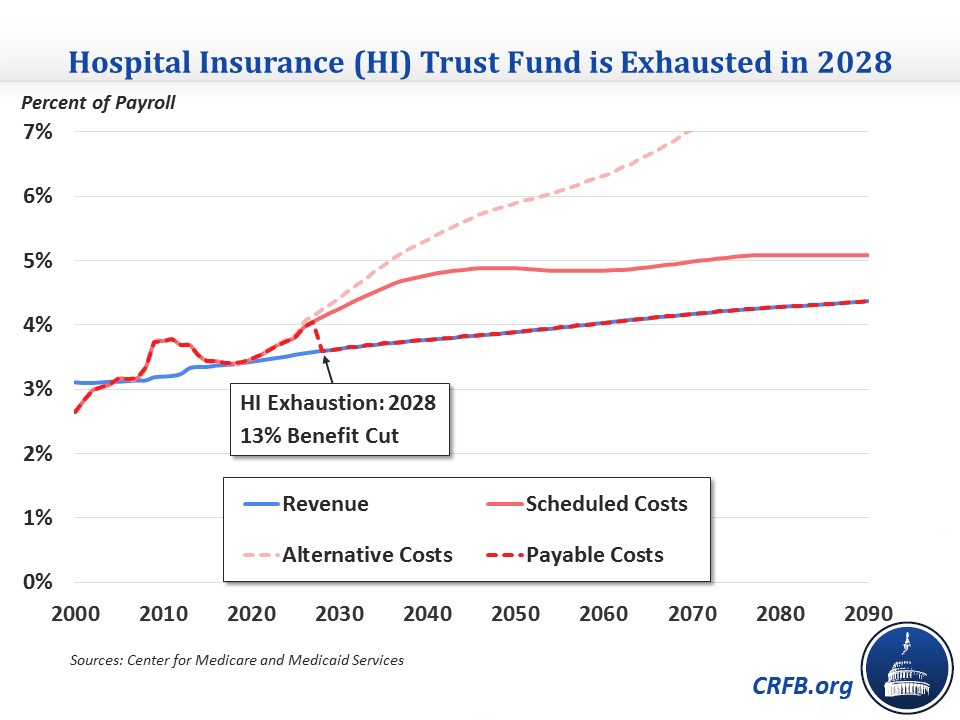

Hospital Insurance Trust Fund

Medicare Part A, the Hospital Insurance (HI) program, is funded from a dedicated payroll tax and relies on a trust fund similar to the one used by the Social Security program. Whereas last year the Trustees estimated that fund would be depleted in 2030, their latest estimates project an insolvency date of 2028. At that point, without legislative action, HI spending would be cut by 13 percent immediately to bring it in line with revenue. The main changes causing the earlier date include lower than expected taxable payroll in 2015, lower near-term productivity growth (which reduces the productivity growth deduction made to payments), and slightly higher hospital utilization.

The increase in HI's 75-year shortfall is relatively modest compared to the change in the insolvency date, increasing from 0.68 percent of payroll in last year's report to 0.73 percent this year. This means it would require about a 0.7 percent increase in the payroll tax (from 2.9 percent to around 3.6 on income below $200,000/$250,000 and from 3.8 to 4.5 percent on higher income) or equivalent spending cuts to make the program solvent over 75 years.

HI's shortfall is largely caused by the same factor as Social Security's: the retirement of the baby boomers. That will result in HI spending rising significantly from 3.4 percent of payroll in 2016 to 4.9 percent in 2045, then increasing only slightly after that to 5.1 percent by 2090. Revenue will rise more gradually, from 3.4 percent of payroll in 2016 to 3.8 percent by 2045 and 4.4 percent by 2090, leaving a projected shortfall of 0.71 percent in the 75th year. The demographic shift also shows up in the ratio of workers to HI beneficiaries, which has already fallen from 4 to 1 in 2000 to 3.1 to 1 in 2015 and will fall further to 2.1 to 1 by 2040.

Total Medicare Spending

In addition to Hospital Insurance (Part A), Medicare has two other components -- Supplemental Medical Insurance (Part B) and prescription drug coverage (Part D) -- that are funded from a mixture of premiums and general revenue, rather than a dedicated tax.

On a combined basis, the Trustees expect total Medicare spending to grow from 2.2 percent of GDP in 2000 to 3.6 percent this year, 5.6 percent in 2040, and 6.0 percent by 2090. This growth is mainly the result of an aging population and increasing number of beneficiaries. Cost growth per beneficiary is projected to average less than 1.5 over the next two years, between 4 and 5 percent through 2025, and an average of 4 percent thereafter. By comparison, the Trustees project nominal economic growth to average 4.4 percent per year over the long run.

Alternative Projections

Although the Trustees project Medicare costs to stabilize (at much higher than current levels) over the long run under current law, there is concern that current law may be in many ways unsustainable. Specifically, the Trustees question the sustainability of certain provider payment reductions, namely the "productivity adjustments" that subtract productivity growth from payment increases for Part A and some Part B services annually; the expiration of 5 percent bonuses in 2025 paid to physicians who use Alternate Payment Models (APMs); cuts issued by the Independent Payment Advisory Board (IPAB); and the specified long-term physician payment updates that replaced the SGR system (which prescribed a 21 percent cut in payments) but would leave payments below what they would have been under the SGR in about 30 years due to their slow growth.

The Trustees therefore have the Medicare Chief Actuary produce an alternative projection for total Medicare spending that either repeals or partially rolls back these policies. The Actuary assumes over the long term that the productivity adjustments would be reduced by about two-thirds, the 5 percent bonuses would continue, physician payments would grow at 2.2 percent per year (rather than 0.75 percent for APM participants and 0.25 percent for non-participants), and IPAB reductions wouldn't go into effect. Not surprisingly, under this scenario Medicare spending grows much faster over the long term. Under this set of assumptions, spending would rise from 3.6 percent of GDP this year to 6.2 percent by 2040 and 9.1 percent by 2090.

Independent Payment Advisory Board (IPAB) Cuts

One of the big short-term stories in the Trustees' report concerns the Independent Payment Advisory Board (IPAB), a 15-member board created by the Affordable Care Act to control the growth of Medicare spending. Through 2017, IPAB is triggered if per-beneficiary Medicare spending growth exceeds the average of economy-wide inflation (CPI-U) and medical inflation. After 2017, IPAB’s target shifts to GDP growth plus one percent (GDP+1%), which is generally higher. When those targets are exceeded, the IPAB makes specific recommendations to bring the growth rate down to the target, and Congress may either accept the package as is, replace the package with their own policies, or overturn the policies with no replacement with a supermajority of votes.

Upon the ACA's enactment, IPAB was expected to be triggered in 2015, but slower health care cost growth pushed that date off. Now, the Trustees expect IPAB to be triggered for the first time in 2017, meaning that the Board (or Health and Human Services in its place) would make recommendations in 2018 that would go into effect in 2019. The Trustees also expect Medicare to exceed the IPAB targets in 2022, 2024, and 2025. The required cuts are not particularly large -- they are between one-fifth and one-hundredth the size of the Medicare sequester already in effect -- but they could be controversial nonetheless. The Medicare Chief Actuary will make the official determination of whether IPAB is triggered in 2017 by April 30 of next year.

| Required IPAB Cuts | ||

| Year | Percent Cut | Dollar Cut* |

| 2017 | 0.2% | $1.4 billion |

| 2022 | 0.02% | $0.2 billion |

| 2024 | 0.36% | $4.3 billion |

| 2025 | 0.35% | $4.5 billion |

Source: Center for Medicare and Medicaid Services

*Based on gross Medicare spending

*****

The Medicare Trustees' projections show the need to reform Medicare to slow its growth. Even if the current law projections pan out, Medicare spending will increase significantly as a percent of GDP over the next few decades as the baby boomers retire, and the Part A trust fund will be exhausted by 2028. And if they don't pan out, Medicare will rise much faster over the long term and continue to take up a greater share of spending over time. Either way, lawmakers should get to work to make sure they get the most value out of the program and trim costs.