Mankiw Agrees on the Target for Deficit Reduction

Former Chairman of the Council of Economic Advisors and Harvard Professor Greg Mankiw explains how a sustainable budget would affect debt levels in a piece in Saturday's New York Times.

Professor Mankiw was one of 160 economists that signed a letter to President Obama and Congressional leadership a few weeks ago, urging them to take up comprehensive debt reduction. In his NYT article, Mankiw explains the target that lawmakers should focus on: the debt-to-G.D.P. ratio.

So what does President Obama mean when he talks about fiscal sustainability? He doesn’t mean running a surplus and repaying the debts that have been incurred on his watch, as people who spend more than they earn would have to do. Nor does he mean balancing the budget, as Representative Ryan suggests. Rather, the president seems to mean keeping the debt-to-G.D.P. ratio stable at this new, higher level. That is certainly what the last budget he submitted proposed to do.

Achieving this goal is much easier than balancing the budget. Because G.D.P. grows, the government debt can continue to grow as well, just not too fast. Stabilizing the debt-to-G.D.P. ratio requires that future budget deficits be smaller than they have been over the last few years, but they can still be sizable.

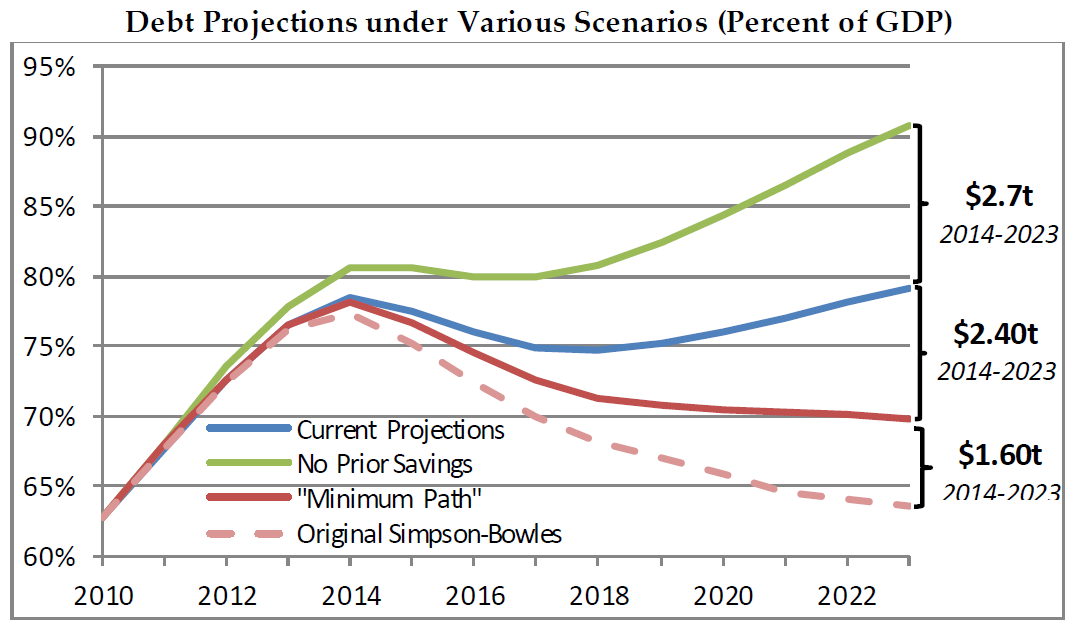

Mankiw argues that just stabilizing the deficit does not go far enough, for many of the same reasons that we identified in our paper Our Debt Problems Are Far From Solved. As we show below, an additional $2.4 trillion in deficit reduction should be enough to put debt on a clear downward path.

Budget projections are not perfect, so debt should be put on a clear downward path in case anything should go wrong, in addition to allowing more fiscal flexibility and leading to greater economic growth:

Yet this goal, hard to reach as it might be in the current political environment, is still too modest. The problem is that budget projections are based on forecasts, and such forecasts exclude the extreme events that have historically driven up government debt.

Military and economic catastrophes are, by their nature, unpredictable. While we can’t plan on one, prudence requires that we take their possibility into account. In normal times, when we are lucky enough to enjoy peace and prosperity, the debt-to-G.D.P. ratio shouldn’t just be stable; it should be falling. That has generally been the case throughout our history, and it should become the case again as we look forward.

The bottom line is that President Obama is right that sustainability is a reasonable benchmark for evaluating long-run fiscal policy. But the standard he applies when evaluating it appears too easy. It will leave us too vulnerable when the next catastrophe strikes.

President Obama is expected to release his FY 2014 budget next week. Hopefully, it will follow the trend of Congressional budget resolutions this year and put debt on a clear downward path. Lawmakers will still need to agree upon reforms to entitlement programs, the tax code, and other spending programs in order to reach that goal, but agreeing on the proper target is a good place to start.