Looking at the Long Term Under the Candidates' Plans

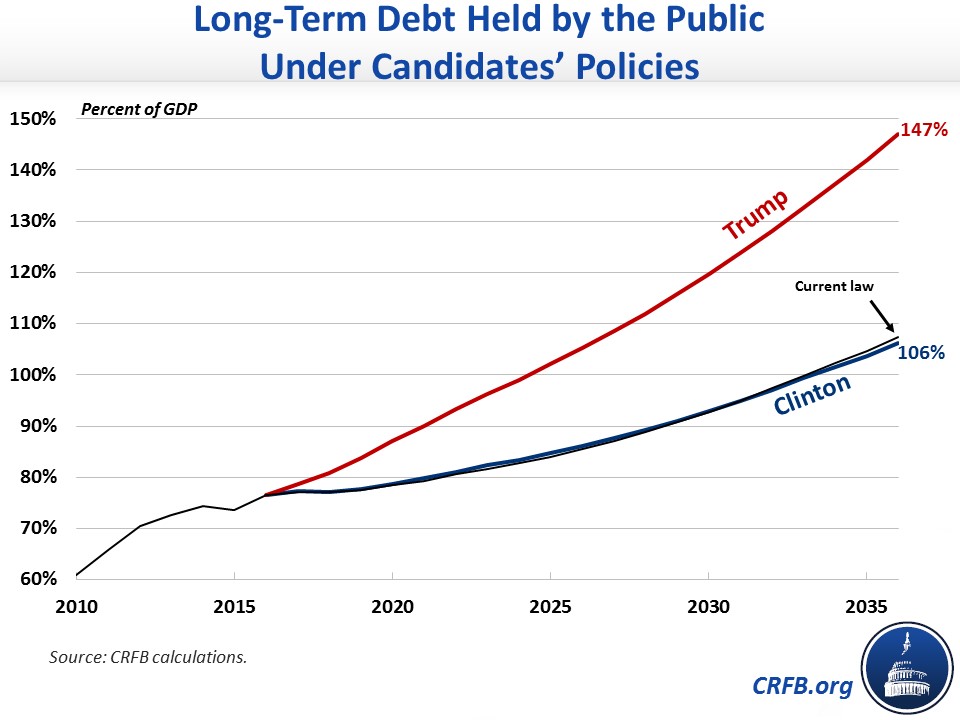

We’ve shown before that neither Hillary Clinton nor Donald Trump would reverse the unsustainable growth of the national debt over the next decade, and Trump would significantly worsen it. Yet the United States’ real fiscal problems are over the long run; in 20 years, debt held by the public is projected to exceed the record level hit just after World War II, reaching 107 percent of Gross Domestic Product (GDP) by 2036. According to our very rough estimates, debt would rise almost as high as the current projections under Clinton’s plan and would rise much higher under Trump's plan.

Extrapolating our previous ten-year estimates, we project that debt held by the public would reach approximately 106 percent of GDP under Clinton by 2036 and would rise rapidly to 147 percent of GDP under Trump by 2036.

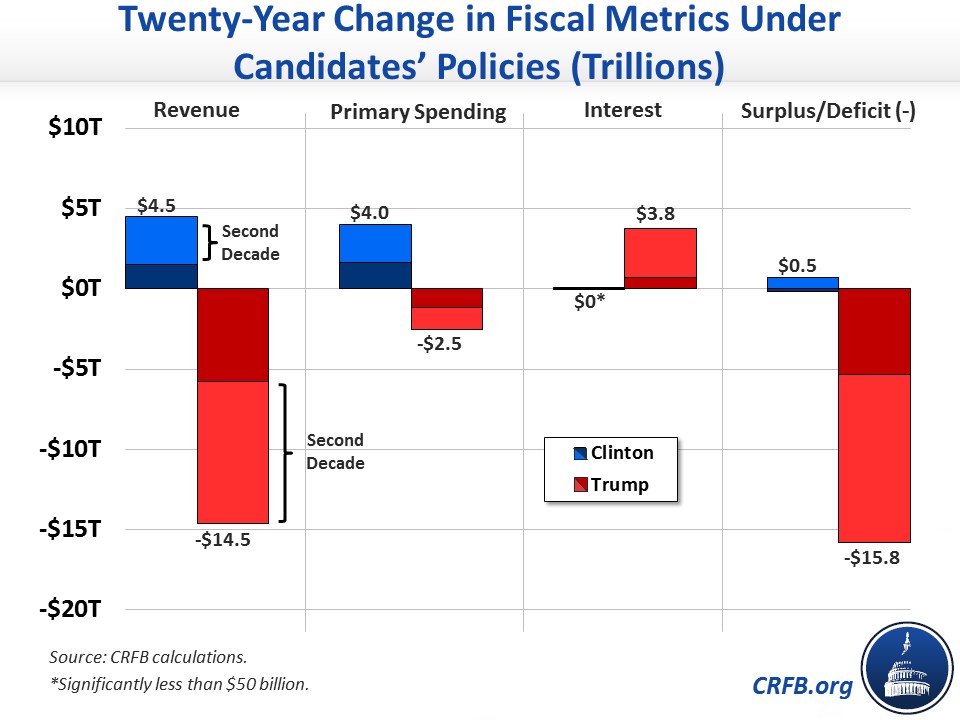

Compared to current law, over twenty years we project Clinton would reduce debt by about $500 billion compared to current law projections, or by about 1 percent of GDP – the result of $4.5 trillion in higher taxes and $4 trillion in higher spending. Meanwhile, Trump would increase the debt by nearly $16 trillion over current law projections, or by about 40 percent of GDP – the result of $14.5 trillion of tax cuts, $2.5 trillion of spending cuts, and $3.8 trillion of higher interest costs.

For Clinton, the swing from slight debt increases in the first decade to slight debt reduction in the second decade is largely the result of the rising revenue from immigration reform and estate taxes changes as well as the expiration of temporary spending items (mainly infrastructure spending). For Trump, the cost of already-large tax cuts will continue to rise, and while the much smaller spending cuts will rise at a similar pace, they will do so from an even smaller level and will be partially offset by the growing cost of repealing the Affordable Care Act (“Obamacare”).

As a result, debt held by the public will rise from around $14.1 trillion today to over $42 trillion by 2036 under Clinton and nearly $59 trillion under Trump, compared to $43 trillion under current law.

| 10-Year Debt Impact (change from current law) |

20-Year Debt Impact (change from current law) |

Total Debt Held by the Public in 2036 |

|

|---|---|---|---|

| Trillions of Dollars | |||

| Current Law | +$9.0 trillion | +$28.8 trillion | $42.9 trillion |

| Clinton | +$9.2 trillion (+$0.2 trillion) |

+$28.3 trillion (-$0.5 trillion) |

$42.4 trillion |

| Trump | +$14.3 trillion (+$5.3 trillion) |

+$44.6 trillion (+$15.8 trillion) |

$58.8 trillion |

| Percent of GDP | |||

| Current Law | +9 percent | +30 percent | 107 percent |

| Clinton | +9 percent (+0 percent) |

+29 percent (-1 percent) |

106 percent |

| Trump | +29 percent (+20 percent) |

+70 percent (+40 percent) |

147 percent |

Source: CRFB calculations.

While only Trump would massively increase debt levels above projections, Clinton’s plan would do little more than pay for her proposals, and thus neither candidate would slow the unsustainable growth in the debt. Even stabilizing the debt at today’s post-World War II era record-high levels would require significant tax and/or spending adjustments and would likely require a particular focus on entitlement reform over the long run.

Both candidates should show presidential leadership and present plans to put the debt on a more sustainable path both this decade and over the longer term.

Tweet this chart.

Tweet this chart.