The Long-Term Debt Picture Looks Much Worse As Well

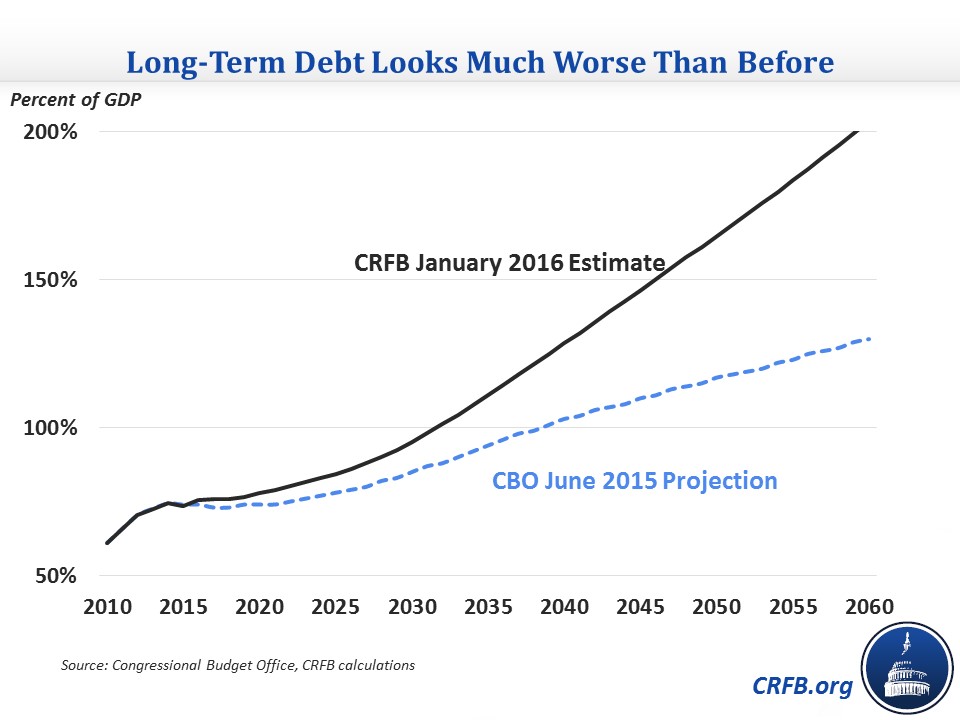

The Congressional Budget Office's (CBO) summary of their upcoming budget projections showed a much worse ten-year outlook for deficits and debt, so it should come as no surprise that the long-term outlook looks worse too. CBO provides little detail at the moment about the long-term picture but does say that debt held by the public would grow to 155 percent of Gross Domestic Product (GDP) in three decades. That would be much higher than the historical record of 106 percent in 1946 and well above the 110 percent that CBO projected for the mid-2040s last year.

While CBO does not provide a detailed long-term outlook, we have constructed a rough long-term budget projection based on their ten-year numbers and the long-term debt number they do give. As expected, long-term debt, which was already set to rise rapidly, is on a much sharper upward trajectory now. We roughly project it will exceed the size of the economy in the early 2030s (compared to the late 2030s in last year's projection) and will double the size of the economy by around 2060, something that would not have occurred in last year's projection until around the turn of the next century.

Driving this increase in debt are the same forces behind the ten-year numbers. Social Security and health care spending will rise, especially over the next few decades, due to population aging and health care cost growth. Revenue will also rise but from a lower starting point and at a slower rate. And as debt rises, interest spending will do so as well.

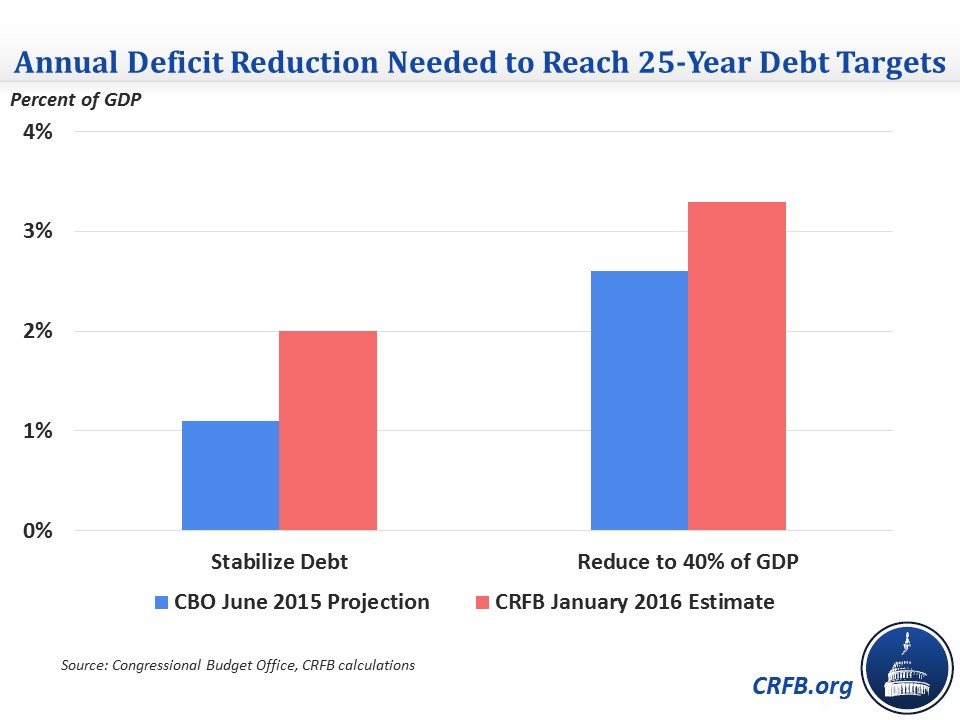

Another way to look at the long term is to measure the fiscal gap, or the amount of noninterest deficit reduction needed to stabilize debt at its current level. By our estimate, it would take changes of 2 percent of GDP per year to stabilize debt over the next 25 years, the equivalent of nearly $400 billion of deficit reduction in 2017 alone. This is nearly double the 1.1 percent of GDP 25-year fiscal gap CBO estimated last year. Reducing debt to its historical average of 39 percent in 25 years would require changes of 3.3 percent of GDP ($635 billion in 2017), more than one-quarter larger than the 2.6 percent CBO previously estimated.

Even these numbers may be optimistic since they include a few assumptions that have not held up in recent years. For one, they assume that lawmakers would not further extend tax provisions that were extended only temporarily or that they would not repeal Affordable Care Act taxes that were already delayed in last year's tax/omnibus package. Also, they assume that lawmakers will not make any further changes to the sequester. Reversing these assumptions would add 5 percent of GDP to debt by 2026 (raising it to 91 percent) and more over the longer term, particularly because of the revenue loss from repealing the Cadillac tax.

The long-term outlook has long showed a bleak picture for debt, but it now shows debt rising continuously and reaching unprecedented levels within two decades. This much worse outlook shows the consequences of fiscal irresponsibility.