Lawmakers Shouldn't Repeal Cadillac Tax Without Substantial Offsets

A bill to repeal the "Cadillac tax" on high-cost health insurance plans may soon get a vote on the House floor. This tax was an important part of the Affordable Care Act, and versions of it have been supported by conservative and liberal economists and health experts alike. Repealing the Cadillac tax would not only cost $200 billion over ten years and much more over the longer term, but it would also remove one of the most important policies to control private health care cost growth. Lawmakers should reject any repeal unless it is replaced with a measure that both offsets its cost and addresses rising health care costs.

Set to begin in 2022 (after being delayed twice from its original start in 2018), the Cadillac tax applies a 40-percent charge to very high-cost employer-sponsored health insurance plans (about $10,000 for an individual plan and $28,000 for a family plan), offsetting much or all of the tax subsidy offered by the employer-sponsored health insurance (ESI) tax exclusion. The threshold for this charge is indexed to inflation, so it would apply to an increasing number of plans over time so long as health care cost growth outpaces inflation.

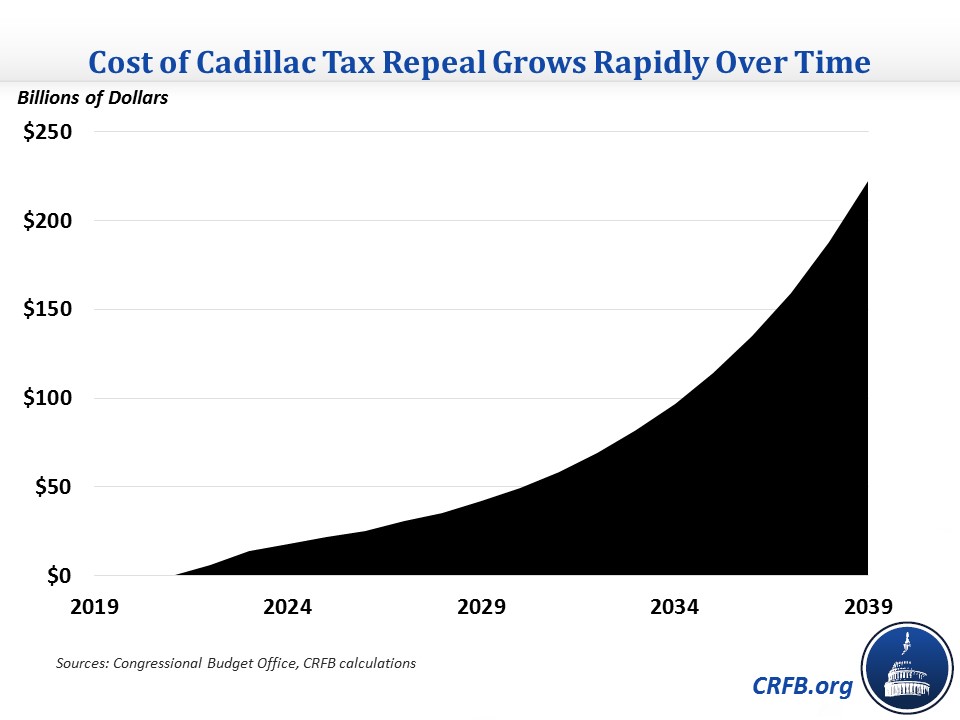

According to the Congressional Budget Office (CBO), repealing the Cadillac tax will cost roughly $193 billion from 2022 through 2029; we estimate another $1 trillion of costs in the 2030s. About half of the ten-year cost is lost revenue from the tax itself, while the other half would come from workers facing lower wages and more costly (but not necessarily better) tax-free health insurance plans. Over time, costs will continue to rise rapidly.

In addition, repealing the tax will remove a tool currently in place to control health care costs. 101 economists in 2015 submitted a letter supporting the Cadillac tax, noting that by reducing the tax subsidy for employment-based insurance, the Cadillac tax will result in people getting insurance with less generous coverage than they otherwise would, driving down health care spending. A recent Washington Post editorial made exactly this point.

Any plan to repeal the tax should therefore not only uphold Pay-As-You-Go (PAYGO) rules by identifying similar levels of savings, but also include alternative policies to control health care cost growth.

Fortunately, there are several options available to offset both the short- and long-term effects of Cadillac tax repeal. The most natural one would be to replace the Cadillac tax with a direct limit on the ESI tax exclusion, which would accomplish a similar goal as the Cadillac tax. That limit could be designed in several different ways that would at least pay for repeal if not tally additional deficit reduction. Other policies, such as medical malpractice or surprise billing reform, should also be on the table.

Options to Offset Cadillac Tax Repeal

| Policy | Ten-Year Savings |

|---|---|

| Repeal Cadillac Tax | -$200 billion |

| Cap ESI exclusion at median cost (income tax only) | $725 billion |

| Cap ESI exclusion at 75th percentile of cost (income tax only) | $380 billion |

| Cap ESI exclusion at 90th percentile of cost (income tax only) | >$100 billion (no recent estimate) |

| Cap ESI exclusion at 75th percentile of cost (payroll tax only) | $125 billion |

| Eliminate the ESI exclusion for the Medicare payroll tax | $250 billion |

| Replace the ESI exclusion with a credit or deduction | dialable |

| Phase out ESI exclusion above $250K of income | $200 billion |

| Limit ESI exclusion to 24-percent bracket | >$50 billion (no recent estimate) |

| Eliminate the tax deduction for employee-paid premiums | $250 billion |

| Restrict Medigap cost-sharing coverage | $85 billion |

| Restrict surprise medical billing | Up to $25 billion |

| Enact medical malpractice reform | Up to $30 billion |

Sources: Congressional Budget Office, CRFB calculations.

However lawmakers choose to offset repeal, it is most important they actually do so, or the long-term fiscal and health care outlooks could look much bleaker.