Lawmakers Promise to Repeal Crop Insurance Reforms

The budget deal recently signed into law relied heavily on one-time savings and gimmicks to offset the costs of the package, with less than half of the full cost offset by real savings, but it did include a few permanent savings from real entitlement reforms.

Unfortunately, before the ink was even dry on the agreement there were reports that Congressional leaders had agreed to reverse one of the few real reforms in the package, regarding crop insurance.

CBO Score

The version released last Monday night included crop insurance reforms which the Congressional Budget Office (CBO) estimated would save $3 billion over ten years. The provision would change the target rate of return on investment (ROI) for private companies which sell subsidized crop insurance plans from 14.5% of total premiums to 8.9%.

As Eric Belasco and Vincent Smith of the American Enterprise Institute noted in a post regarding this provision, the effective government guarantee of positive underwriting gains over the long term largely protects private crop insurance companies from risk. Citing a recent USDA study, CBO has said that the current ROI for crop insurance companies is higher on average than that of other private insurance companies.

Impact on Farmers

It’s also important to note that this provision would not affect the amount farmers pay for crop insurance. Farmers would continue to pay on average 40% of crop insurance premiums with the federal government subsidizing the remaining 60% of premiums.

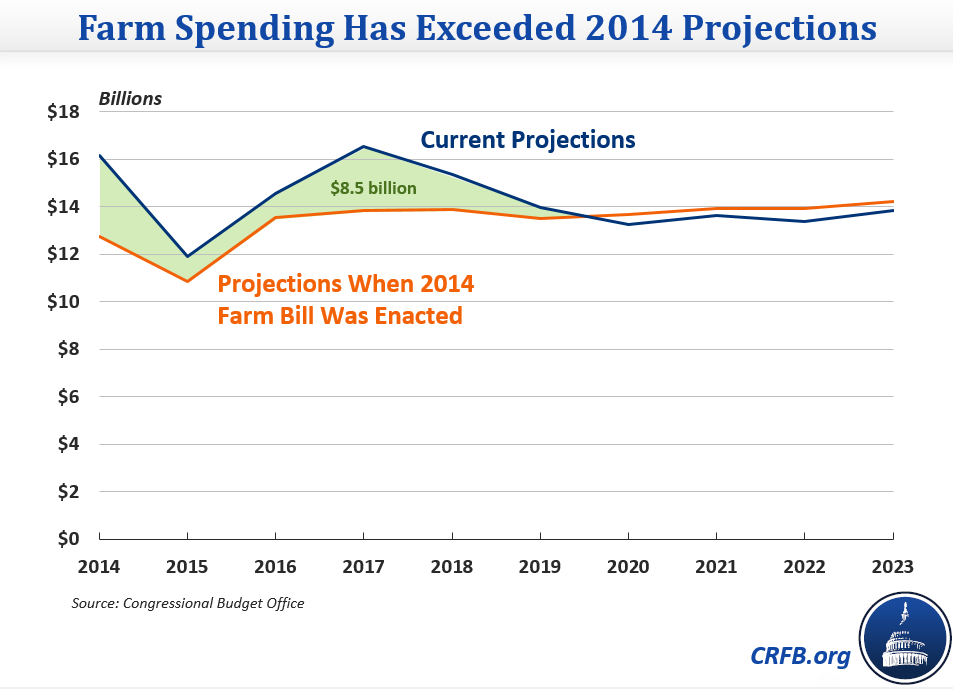

Agriculture Spending Is Higher Than Projected When Farm Bill Was Passed

Some critics of the provision argue that it unfairly targets agriculture for savings because the farm bill enacted in 2014 included savings of approximately $17 billion over ten years. Of this $17 billion, approximately $9 billion came from agriculture and $8 billion from nutrition programs. CBO now projects that spending on agriculture programs will be nearly $8.5 billion higher than projected when the farm bill was enacted, virtually wiping out the savings in the farm bill. The crop insurance savings in the budget deal represented a modest step toward bringing agriculture spending back to the levels anticipated by the 2014 farm bill.

Relatively Modest Reforms

The crop insurance savings in the agreement were extremely modest compared to other proposals that have been put forward. President Obama’s budget included reductions in crop insurance subsidies and other changes which CBO estimated would save nearly $12 billion over ten years. The budget resolution conference report adopted by Congress earlier this year called for a reduction of $300 billion in mandatory spending for programs within the Agriculture Committee’s jurisdiction, with at least $20 billion of those savings assumed to come from the budget function which includes crop insurance and other farm subsidies.

A Promise to Repeal

As their respective chambers took up the bill, the leaders of the House and Senate Agriculture Committees made it clear they had received a commitment from leadership to reverse the crop insurance reforms in the omnibus appropriations bill Congress will consider in the coming weeks. It is unclear whether or how the savings from the crop insurance reforms would be replaced.

What's Next?

As the Washington Post noted in an editorial criticizing the decision to reverse the cuts (and citing CRFB), the question now is whether the savings from crop insurance changes are replaced by “hard” savings — or more gimmicks. If lawmakers do reverse this specific provision in the omnibus, they should replace the savings with other reforms that achieve permanent savings. Crop insurance reforms proposed by the President or other changes in agriculture subsidies would make sense.

This episode illustrates the challenge of translating promises of spending restraint in the abstract into specific policies which actually achieve the promised spending reductions. If Congress is going to truly reduce deficits and bring the debt under control it will need to show much greater courage in making and standing by tough choices reducing spending.