Lawmakers Are Getting Closer to Bringing Back Trillion-Dollar Deficits

Lawmakers are closer to making trillion-dollar deficits a reality again by next fiscal year as a result of the passage of the final, conferenced version of the tax bill and an anticipated Obamacare tax extenders package. These two packages combined (along with a health spending package that is offset, but increases deficits in the short term) would increase the deficit to $1.02 trillion in 2019 and $1.07 trillion in 2020. When combined with anticipated sequester and disaster relief, short-term deficits would exceed $1.1 trillion in each of those years.

Including interest, the conferenced tax bill is estimated to increase deficits by $1.77 trillion over 10 years and $695 billion in fiscal years (FY) 2018-2020 alone. We estimate the health tax extenders package proposed by the House Ways and Means Committee, which delays several taxes created by the Affordable Care Act, would increase deficits by about $125 billion (including interest) over 10 years and about $90 billion in FY 2018-2020 alone. Lawmakers are also prepared to pass a five-year reauthorization of the Children's Health Insurance Program (CHIP) and extensions of other health spending policies that are fully offset over 10 years, but would increase deficits in the short term. The result is a substantial increase in short-term (as well as longer-term) deficits. With these three packages, we estimate the deficit would increase from $666 billion in FY 2017 to $781 billion in 2018, $1.02 trillion in 2019, and $1.07 trillion in 2020. The deficits in 2019 and 2020 would be the highest deficits in nominal dollars since 2012.

Lawmakers may not be done with tax cuts and health care tax extenders, though. The House unveiled an $81 billion disaster relief package earlier this week, and lawmakers are rumored to be working on a $200 billion sequester relief package. Since most of the costs of these packages would be in the near term, short-term deficits would go up further if they were not offset. We estimate deficits would exceed $1.1 trillion in 2019 and 2020 with disaster and sequester relief included, though actual numbers may differ slightly depending on what the packages look like.

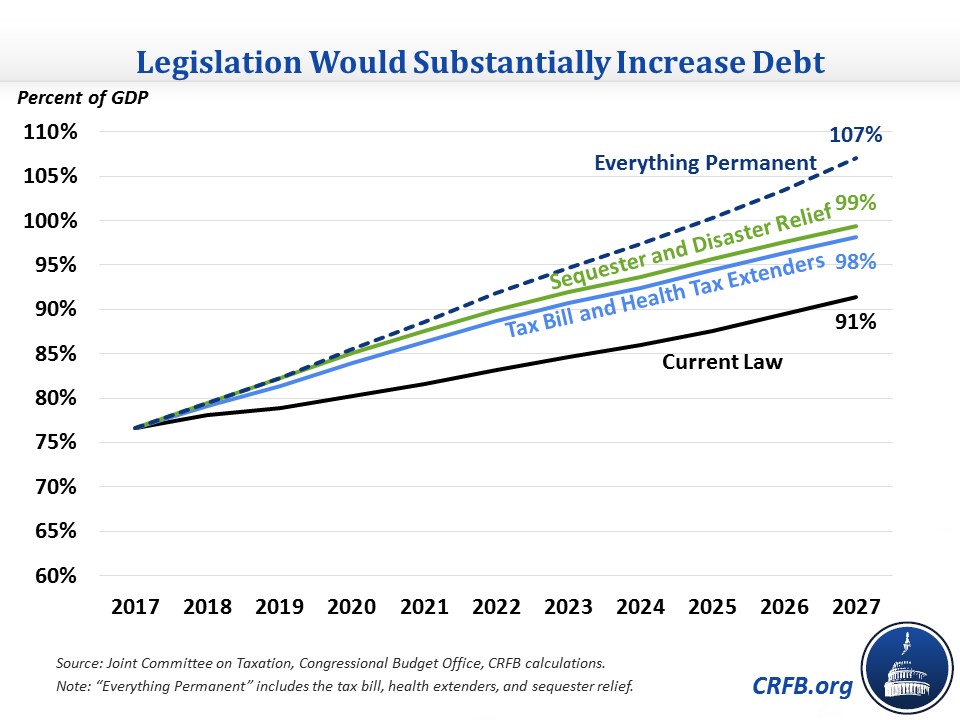

These large increases in deficits will also mean higher debt, which is already scheduled to increase from 77 to 91 percent of GDP between 2017 and 2027 before accounting for any legislative changes. The tax bill and health tax extenders will cause debt to reach 98 percent of GDP in 2027, and adding the sequester and disaster relief will increase that ratio to 99 percent. Notably, none of these numbers account for permanent extensions of temporary policies in any of these packages, which would cause debt to exceed the all-time record of 106 percent of GDP by 2027.

The next few months could be very expensive ones for the federal government. Lawmakers should ensure that any deficit-increasing legislation is paid for and should reject any bills that aren't.