IRS Taxpayer Advocate Releases 2013 Report

Yesterday, the IRS Taxpayer Advocate released its 2013 annual report, detailing what it sees as the largest problems facing taxpayers. The Taxpayer Advocate Service is an independent organization within the IRS that helps taxpayers resolve problems with the IRS and recommend changes that will prevent those problems.

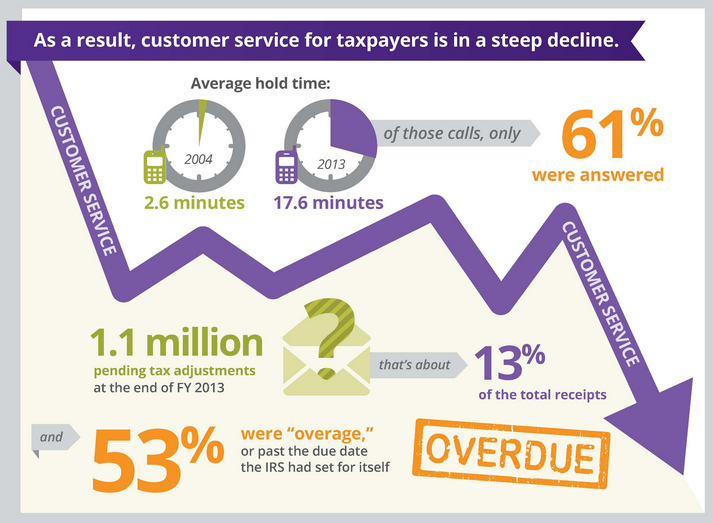

Each year, the report focuses on a different theme. This year, it focused on IRS budget cuts as "one of the most serious problems facing taxpayers." The report argues that these cuts have forced the IRS to work with fewer resources despite heavier workloads, ultimately hurting customer service. For instance, the report finds that the agency received 109 million calls, but could only answer 61 percent of the calls from those seeking to speak with a customer service representative, down from 87 percent a decade earlier. People who reached the agency spent an average of nearly 18 minutes waiting on the phone. Many of these taxpayers would voluntarily pay the taxes they owe if they could only get an answer from the IRS.

Further, the report describes how the IRS does not even fully answer questions on the calls:

During the filing season (January through April), it will answer only “basic” tax law questions; it will not answer “more detailed” questions. After April, it will not answer any tax law questions (even basic ones), including from the millions of taxpayers who obtain filing extensions and prepare their returns later in the year. At the risk of vast understatement, it is a sad state of affairs when the government writes tax laws as complex as ours — and then is unable to answer any questions beyond “basic” ones from baffled citizens who are doing their best to comply.

The report identified several other major problems, noting that the IRS needs a taxpayer bill of rights to bolster taxpayer confidence in the agency, further employee training, and education on taxpayer rights. The report also called to allow the IRS to regulate tax preparers after a recent court case prevented the IRS from ensuring preparers meet basic competency requirements.

Among the report's legislative recommendations:

- Permanently repeal the AMT: The Alternative Minimum Tax's original goal was to ensure that wealthy taxpayers who used lots of tax provisions to reduce their tax bill still paid a minimum level of tax. However, the report notes that the AMT falls short of this goal: about 1,000 millionaires will pay no federal income tax in 2013. Nonetheless, many taxpayers are required to calculate their taxes twice, even if they do not end up paying the AMT. The AMT only serves as an extra burden on taxpayers with children and those who live in high-tax states.

- Remove the IRS from spending caps: "Because the IRS is the federal government’s accounts receivable department and generates a substantially positive return on investment, it is self-defeating to treat the agency like a pure spending program. With most spending programs, a dollar spent is simply a dollar spent from a budget perspective. With the IRS, a dollar spent generates many dollars in additional revenue."

- Fix the regulations around the Affordable Care Act tax credits: Under the Affordable Care Act, tax credits paid to the insurance company are supposed to prevent any person from paying more than 9.5 percent of their income toward health insurance. However, current IRS regulations may prevent the tax credits from being used to support a family insurance plan since the regulations only reference the cost of insuring one person, even if the whole family needs coverage. Thus, families may face significantly higher costs than if the regulation interpreted the law differently.

- Allow more taxpayers to claim the EITC: The Earned Income Tax Credit (EITC) provides refunds to low-income taxpayers, but is also a common target for fraud by taxpayers or their preparers. In these cases, the IRS has the authority to ban a family from claiming the credit for three years. However, this report suggests that the IRS has been banning families without knowing if it was fraud, inappropriately penalizing people for math errors and honest mistakes. The IRS should improve its procedures for handling these cases.

- Allow colleges to verify their student's social security numbers: Currently, colleges must report the amount of tuition paid or billed to the IRS, using the Social Security numbers reported by students. Unlike other reported information, however, colleges are not allowed to verify whether the numbers are correct. If the numbers are incorrect, either due to a typo or name change, the college can be liable for penalties for each error, which can add up to millions of dollars for large universities.

We have pointed out before that the complexity of the tax code increases the burden on both taxpayers and IRS enforcement efforts. Given that lawmakers have apparently chosen to live with sequester spending levels in the near future, it would behoove them to simplify that burden. The Taxpayer Advocate highlights potential problems from expecting an agency to do more work with a smaller budget. The report offers a number of helpful recommendations to improve the tax code and citizens' interactions with the IRS.

Read the full report here.