Inversions Come Up As An Offset Possibility

The House Budget Committee Democrats jumped into the transportation debate last week with a proposed surface transportation reauthorization that mirrors the President's proposal. The six-year bill includes $478 billion of spending, which would increase spending above current levels by about $56 billion over six years and $93 billion over ten years based on the score of the President's budget. The Highway Trust Fund is funded with $41 billion of revenue from limiting inversions, enough to keep the trust fund solvent through FY 2017.

The inversion policy change would lower the threshold for determining when a U.S. company has inverted and is still treated as a U.S. company for tax purposes. Currently, when a U.S. and foreign company merge, the new company is still treated as a U.S. company if 80 percent or more of the shares remain American-owned. Last fall the Treasury Department introduced rules to prevent companies from gaming the current threshold, while this new bill would lower it to 50 percent. The $41 billion of revenue would fund part of the transportation reauthorization, although it is much less than the $210 billion one-time tax on U.S. companies' foreign-held earnings that the President proposed to keep the Highway Trust Fund solvent into 2023.

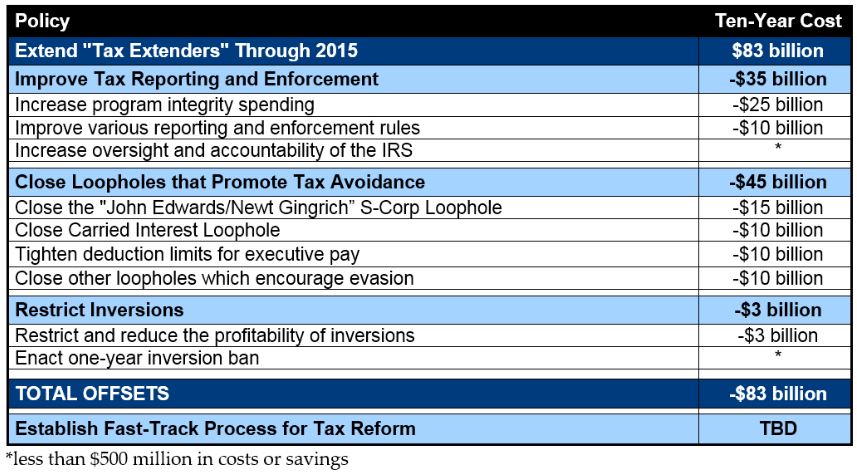

Interestingly, the revenue raised from limiting inversions is equivalent to the cost of the one-year tax extender package passed last year. Lawmakers have typically been irresponsible with tax extenders, adding the last several extensions to the national debt, but there is no reason why they should escape pay-as-you-go rules. The inversion policy would be a natural candidate to be used as an offset, and it is not alone. Our PREP Plan came up with $85 billion of revenue to offset the cost of a two-year extenders package, using options related to tax enforcement or compliance with the spirit of the law, in addition to a separate inversion policy that limited interest deductions for inverted companies. Although the two-year package that the Senate Finance Committee is marking up now costs more ($96 billion), it should not be difficult to find a few other small offsets or reduce the size of the package to make up the difference (and some of the savings in the PREP plan may save more now as well).

The PREP Plan for Tax Extenders

Whether it's transportation spending or tax extenders, we have shown that lawmakers have numerous policies at their disposal to offset the cost of their policy priorities. It's up to them to use those offsets to make sure they remain fiscally responsible.