IMF Report Underscores Need for Long-Term Deficit Reduction in U.S.

The International Monetary Fund (IMF) made news earlier this week when it issued a report saying that most advanced economies will not need future deficit reduction in light of the current pandemic. However, this IMF finding applies to countries that were in good fiscal health prior to the pandemic, therefore it does not apply to the United States. Indeed, the very last line of a Financial Times piece entitled “IMF says austerity is not inevitable to ease pandemic impact on public finances” states, “The fund singled out China and the US as countries that were unlikely to stabilize their public debt burdens by the middle of the decade, given their big plans for public spending and few plans for tax increases.”

The premise of the IMF piece is that one-time borrowing to address the crisis won’t much change the medium- or long-term debt trajectory for most countries. More specifically, the IMF finds that deficits in 2025 in most developed countries will be similar to pre-pandemic projections. While higher debt will mean more interest payments, this will be roughly offset by lower interest rates and other factors.

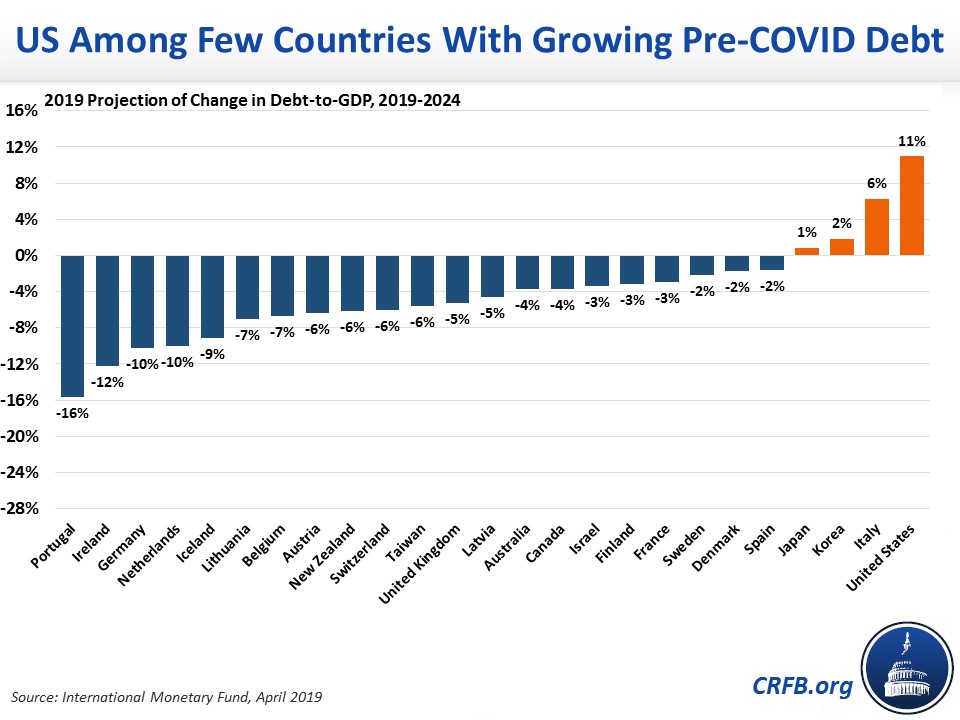

The IMF’s findings should offer some comfort for countries that were projecting stable or declining debt by 2025. However, the United States was one of the few developed countries facing rising debt levels prior to the crisis.

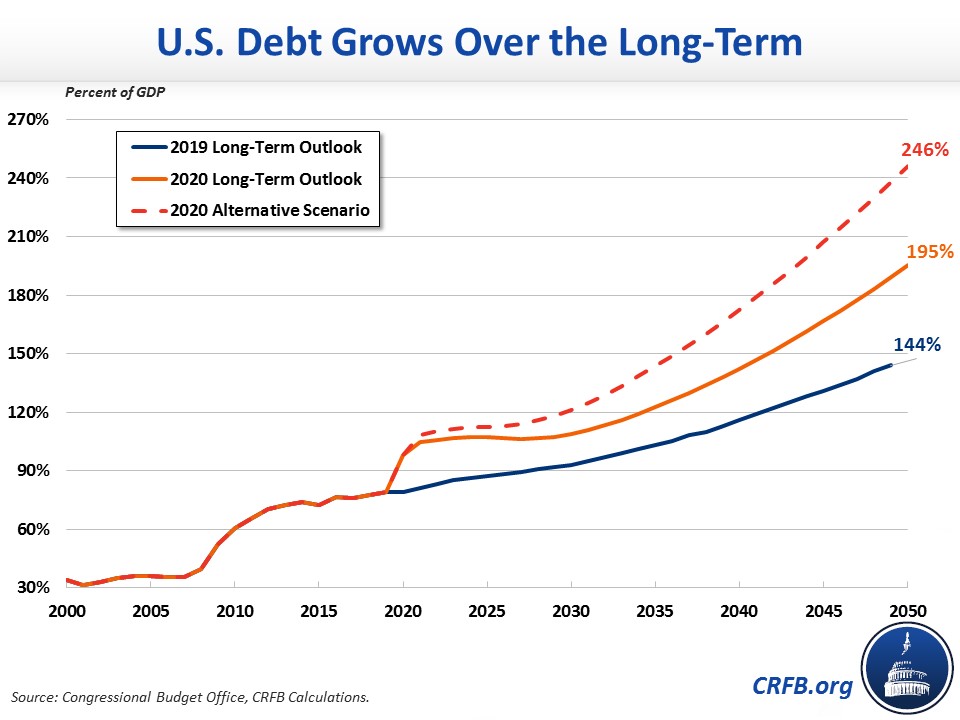

Without future deficit reduction, debt in the United States is projected to continue rising as a share of the economy. Under current law, the Congressional Budget Office (CBO) projects debt will grow to 109 percent of GDP by 2030 and 195 percent by 2050. Under a more realistic current policy scenario, debt could reach 121 percent in 2030 and 246 percent in 2050. And under the Biden or Trump agendas, debt would reach at least 125 percent of GDP by 2030.

The IMF report notes that borrowing now to address the crisis does not necessarily put a country in a worse fiscal position than it was before. While higher one-time borrowing does increase debt, it doesn't much change the long-term growth rate of debt for countries who expert economic growth to outpace interest rates.

However, the United States was already in a weak fiscal position and facing an unsustainable long-term trajectory driven by the failure to control or finance the growth of health and retirement spending. That trajectory was exacerbated by (pre-pandemic) recent tax cuts and spending hikes that doubled near-term deficits even before the crisis. While recent COVID relief didn't substantially worsen the debt trajectory, it certainly didn't improve it. And even by 2050, CBO estimates debt will be 10 percent of GDP higher as a result of recent legislation.

To be sure, there is a broad consensus that the United States should continue its efforts to combat the current pandemic and economic crisis and should not enact deficit reduction too quickly. However, unlike most other developed nations, revenue increases and spending cuts will be needed over the medium and long term.

As the IMF report notes:

The near-term priority is to avoid premature withdrawal of fiscal support. Support should persist, at least into 2021, to sustain the recovery and to limit long-term scarring. Health and education should be given prime consideration everywhere. Fiscally constrained economies should prioritize the protection of the most vulnerable and eliminate wasteful spending. To manage the intertemporal tradeoffs in fiscal policy, a medium- to long-term fiscal framework is recommended.