Illustrating the Case for Trust Fund Solutions

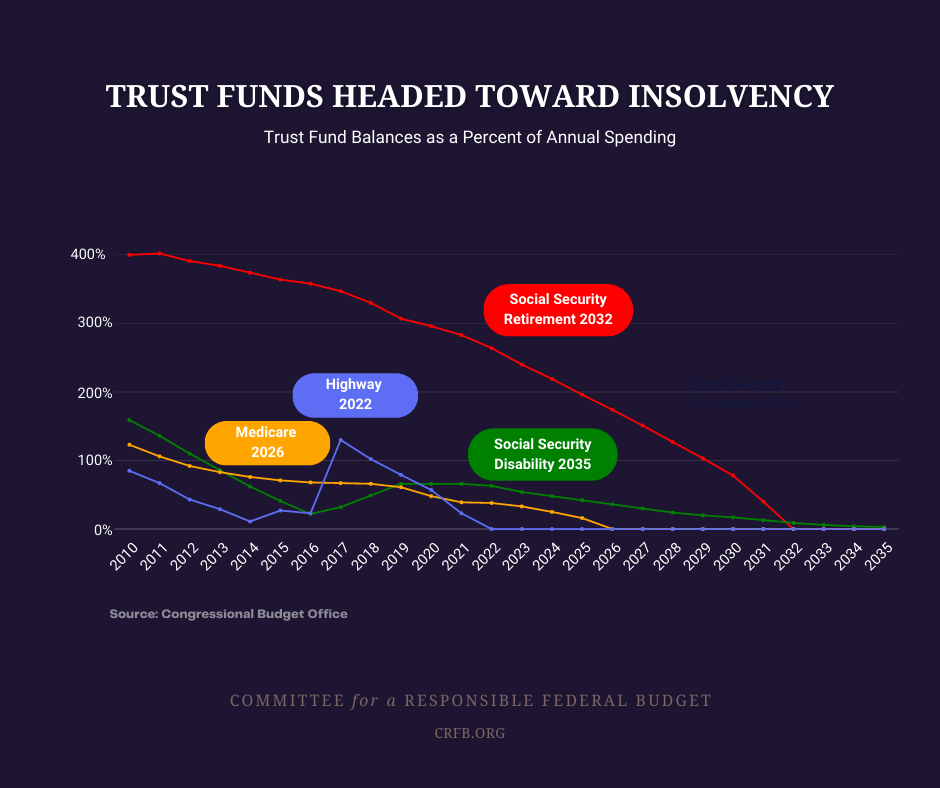

Some of the nation’s most important government programs are financed with dedicated revenue sources using federal trust funds. As we identified in our recent paper, The Case for Trust Fund Solutions, four of those programs are within 14 years of insolvency. CBO projects the following insolvency dates:

- FY 2022: Highway Trust Fund (HTF)

- FY 2026: Medicare Hospital Insurance (HI) Trust Fund

- CY 2032: Social Security Old Age and Survivors Insurance (OASI) Trust Fund

- CY 2035 Social Security Disability Insurance (SSDI) Trust Fund

Policymakers will need to act sooner rather than later to secure these trust funds by increasing revenues, reducing costs, or some combination. The longer we wait to address trust fund solvency, the fewer choices will be available and the harsher any eventual adjustments will be.

Twitter

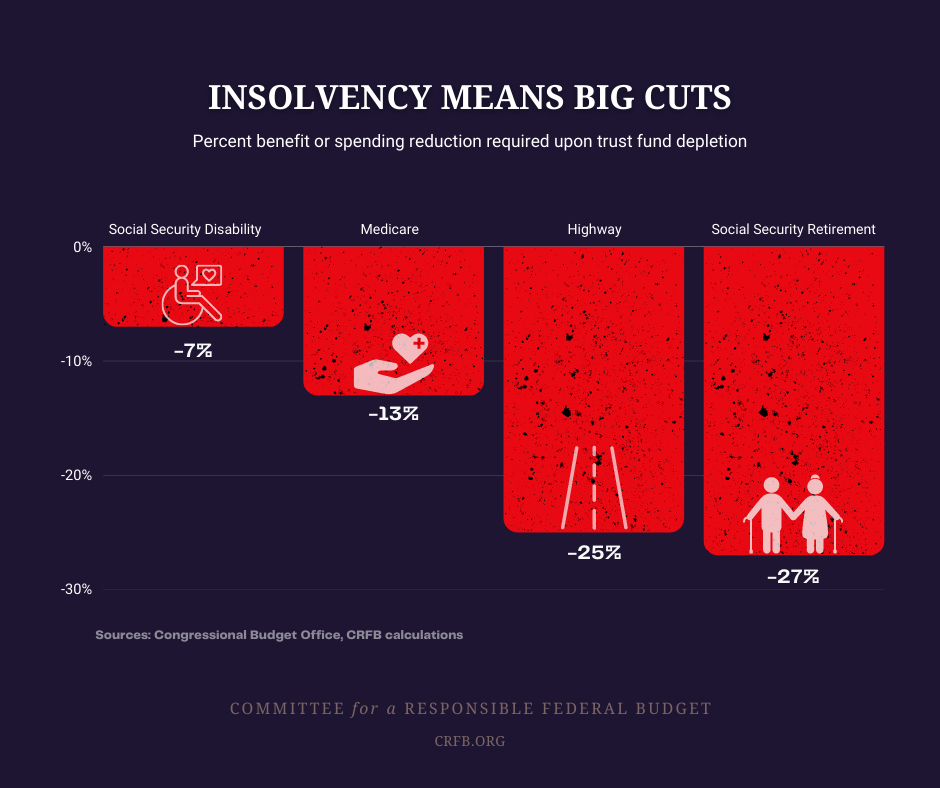

TwitterMajor Trust Funds Are Headed Toward Insolvency: Under the law, trust fund programs cannot spend in excess of their dedicated funding sources. Once the trust funds are depleted, the programs may only spend incoming revenue. For the Highway Trust Fund, this means new projects will be immediately halted and spending ultimately reduced by one-quarter. For Medicare, all payments will be cut by 13 percent or delayed by an equivalent amount upon insolvency. In the case of Social Security, benefits will be cut immediately and across-the-board upon insolvency. SSDI benefits will be cut by 7 percent when its trust fund runs out, while Social Security retirement benefits will be slashed by 27 percent.

Twitter

TwitterAll Four Trust Funds Face Large Long-Term Shortfalls: Over the next decade, the Highway, Medicare HI, and Social Security trust funds face a combined $3.6 trillion deficit, the equivalent of 1.3 percent of GDP. We estimate that their combined deficits will rise to nearly 2 percent of GDP by 2031, over 2.5 percent by 2041, and over 3 percent by 2051.

Twitter

TwitterTrust Fund Solvency Will Improve the Fiscal and Economic Outlook: CBO’s budget projections generally assume trust fund programs continue spending as scheduled after insolvency, as if lawmakers used general revenues to support the funds. Under CBO’s baseline, debt will double from a near-record 100 percent of GDP in 2020 to over 200 percent of GDP by 2051. If all trust funds are restored to solvency as assumed in our Make Trust Funds Solvent (or TRUSTGO) scenario, debt would instead rise to about 135 percent of GDP by 2051. With well-constructed pro-growth solvency packages, we estimate debt would rise to only about 120 percent of GDP.

Twitter

TwitterSolvency Solutions Can Boost National Income: Extrapolating from recent CBO estimates, we find a generic set of solvency packages could increase the growth of gross national product (GNP) by about 0.1 percent per year over the next 30 years. Based on other recent analyses and estimates, we believe solvency packages specifically designed to promote economic growth could boost GNP growth nearly three times as much.

Twitter

TwitterUpcoming trust fund deadlines represent both challenges and opportunities. The time to act on trust fund solutions is now.

For more on the case for trust fund solutions, see our complete analysis here.