How Much Savings Would It Take to Make Debt Sustainable?

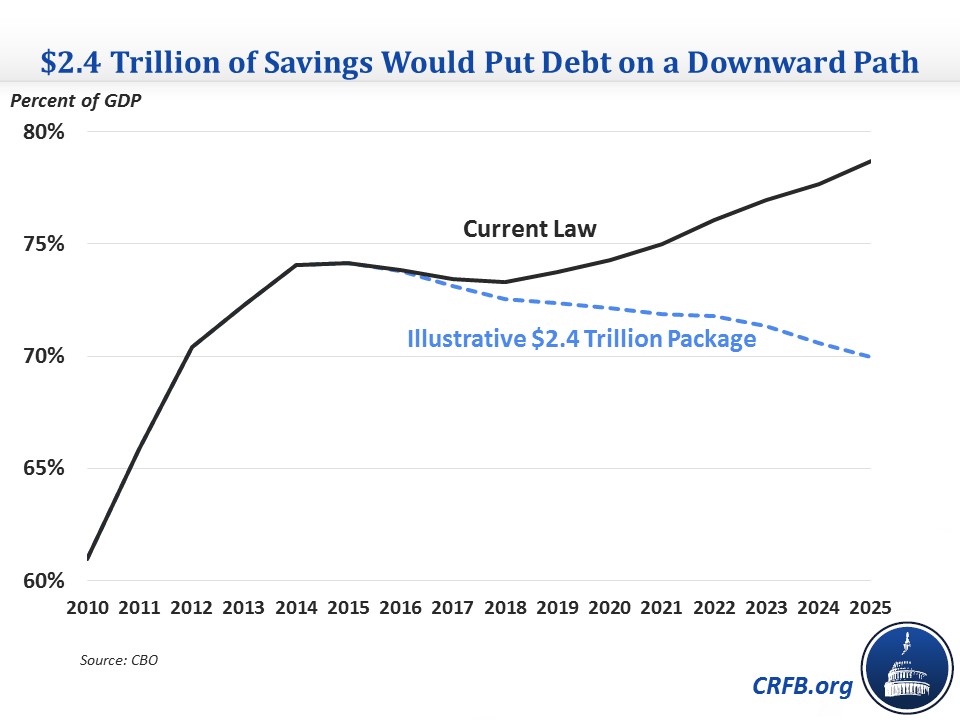

CBO's budget outlook, little changed since its last update, shows the same story it has for a few years: the debt picture will stabilize through about the end of the decade, but then will grow by nearly 5 percentage points of GDP between 2020 and 2025 from 74 to 79 percent of GDP.

Simply stabilizing the debt at current levels would require $1.3 trillion of deficit reduction over a decade, while putting debt on a downward path as a share of GDP -- a minimum standard of sustainability -- would require $2.4 trillion of savings.

In previous iterations of CBO's baseline, we showed an illustrative savings path that would leave debt clearly declining as a percent of GDP. For example, in May 2013, we showed that it would take $2.2 trillion of savings over ten years compared to our realistic baseline to put debt on a downward path to 67 percent by 2023. We used this level because the downward path proved robust to having more frontloaded savings, worsening economic projections, and lawmakers enacting deficit-increasing policies.

However, two years have now passed and CBO's projections worsened in the meantime, so the target could be somewhat more lax but require higher savings. Getting debt to 70 percent of GDP by 2025 would take $2.4 trillion of savings compared to CBO's baseline. We estimate that a reasonably backloaded plan of this magnitude would put the trajectory of debt on a clear downward path, and leave deficits in a consistent decline to about 2 percent of GDP by 2025 (instead of deficits increasing as a percent of GDP after 2016 under current law). Of course, actual plans may vary and the extent to which they would ensure long-term sustainability depends greatly on the types of policies included.

If policymakers choose to be more aggressive, the task obviously gets more difficult. Reaching 60 percent of GDP by 2025 would require $5.1 trillion of savings, and reaching 50 percent would require nearly $7.9 trillion.

The target can also change based on the policy assumptions. If we take the assumptions from the Alternative Fiscal Scenario that CBO published last year -- meaning lawmakers extend all temporary tax provisions, permanently extend the "doc fix," and repeal the sequester -- the targets would be $2.5 trillion larger than current law. In other words, it would take $4.9 trillion, nearly the amount of spending cuts in last year's House budget, for debt to reach 70 percent of GDP within ten years. On the other hand, if lawmakers were to draw down war spending as expected rather than keeping it at the current level, adjusted for inflation, indefinitely, the savings target would be $535 billion smaller than current law. Again, different plans meeting the same target could have vastly different effects on long-term debt depending on the policies pursued.

| Ten-Year Savings Needed to Reach 2025 Debt Targets | |||

| Target | Current Law | AFS |

W/ Drawdown |

| Stabilize at 2015 Level | $1.3 trillion | $3.8 trillion | $750 billion |

| 70% of GDP | $2.4 trillion | $4.9 trillion | $1.9 trillion |

| 60% of GDP | $5.1 trillion | $7.6 trillion | $4.6 trillion |

| 50% of GDP | $7.9 trillion | $10.4 trillion | $7.3 trillion |

Source: CBO, CRFB calculations

These targets are not necessarily easy to achieve. Using the $2.4 trillion target as an example, last year's President's budget achieved less than half that amount and even excluding some of the more politically ambitious investments would still clearly fall short. Excluding repeal of the Affordable Care Act's coverage expansion, the House budget's specific spending cuts would also fall a little short.

This means that both sides will have to not only find policies where they have common ground, they will also have to reach outside their comfort zone to make long-term debt sustainable.