How to Get a Balanced Budget in Ten Years

In a New York Times article describing Republican plans if they re-take Congress next year, reporter Carl Hulse cited CRFB, saying that "balancing the budget without new revenue would require more than $5 trillion in reductions over a decade." Below, we explain our numbers and show the various ways to balance the budget within a decade.

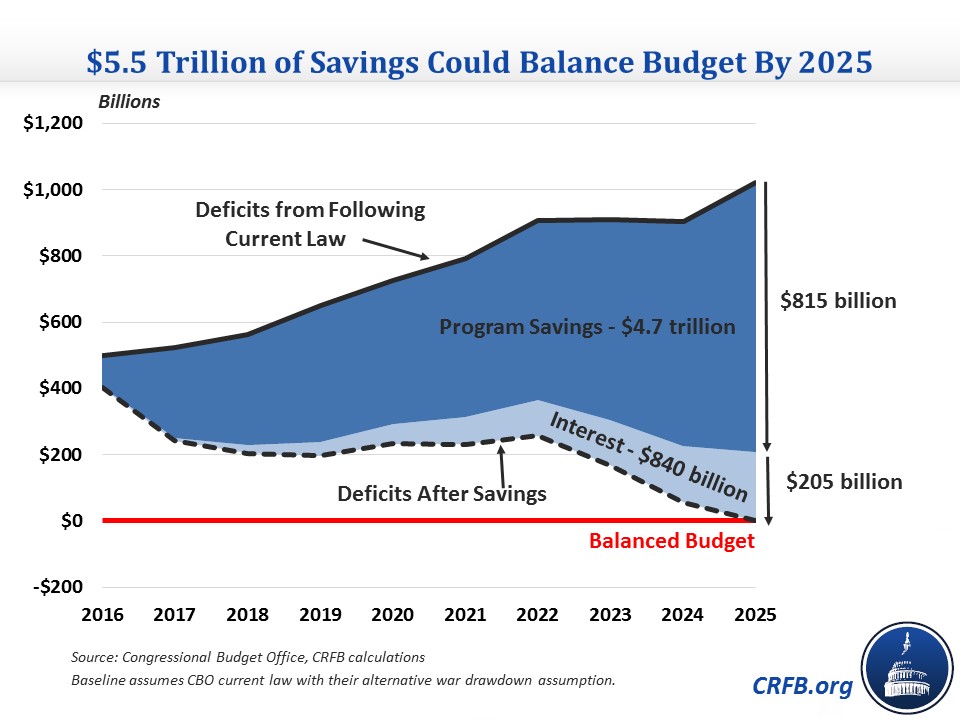

Using CBO's baseline with a war drawdown, we estimate that there would be a deficit of 3.7 percent of GDP, or $1 trillion, in 2025. Balancing the budget in that year would require 2025 savings equal to that amount, but the path of savings has a great influence on how much in cuts must be made over ten years due to accumulated interest savings.

At one extreme, policymakers could make huge cuts up front so that no program cuts would need to actually be made in 2025 to balance the budget. The interest savings would wipe out the deficit by itself, but the ten-year savings would have to be so massive as to be infeasible (for example, it could be accomplished by eliminating all spending over the next four years). At the other end, policymakers could make no cuts until 2025, in which case almost all of the savings would have to come from program cuts, and the ten-year savings would be $1 trillion.

Obviously, neither of these scenarios is realistic (particularly the first), so we chose a path based on the House budget, which intends to reach balance by 2024. That budget had $5.3 trillion of savings, including $4.35 trillion of program savings, nearly $800 billion of interest savings, and $175 billion of savings from a "fiscal dividend." Shifting over the start time for savings and the target for reaching balance by one year leads us to estimate necessary ten-year savings of $5.5 trillion using a similar path, with $4.7 trillion of primary savings and over $800 billion of interest savings. For context, that would require a greater than ten percent reduction in spending over that time and a one-sixth reduction by 2025.

The kicker in these numbers is that they assume current law policies, meaning that temporary provisions expire as scheduled and no new deficit-increasing policies are enacted. However, as we have observed this year, policymakers often continue expired or expiring tax provisions, enact doc fixes, provide sequester relief, or pass new policies with no offsets, phony offsets, or offsets which take ten years to materialize. As an example, this year the House has passed permanent tax cut extensions and new tax cuts that will increase deficits by $1 trillion over ten years and by as much as $1.5 trillion if other tax cut extensions are considered. If these bills are passed into law, balancing the budget would require at least $120 billion more of savings in 2025.

Getting to balance in ten years is an ambitious goal, particularly if lawmakers focus on just one side of the budget. And it would behoove them not to make things harder for themselves by passing deficit-increasing policies as well.