How Far We Have to Go on Deficit Reduction

In the past few weeks, we have made the case for putting debt on a downward path as a percent of GDP as a goal for the next round of deficit reduction. This is in contrast to those who have advocated stabilizing the debt over ten years with $1.4 or $1.5 trillion of additional savings and, much more worryingly, those who believe that serious deficit reduction can wait for another ten years. In CRFB's latest policy paper, we re-iterate our arguments for going further than debt stabilization, make the case for acting sooner rather than later, and elaborate on minimum targets for deficit reduction.

Readers of our blog will be familiar with the reasons why we think stabilizing the debt over the medium-term would not be an aggressive enough target. Doing just that would leave no margin for error in projections, would most likely not stabilize the debt over the long term, and would leave much less fiscal flexibility that would otherwise be the case. Also, leaving debt at such a high level would crowd out private investment more when the economy is at full capacity.

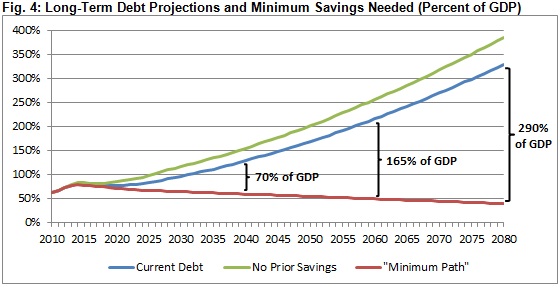

So far, lawmakers have enacted, by our count, $2.35 trillion of savings relative to the August 2010 CBO baseline, a notable achievement. But more is needed to put the debt on a gradual downward path as a share of the economy. Under current projections, debt would exceed the size of the economy by the 2030s and double the size of the economy by the 2050s. While $1.4 trillion of savings would stabilize the debt through 2022, it would not do enough to do so beyond that year.

So what is the appropriate target for deficit reduction? In the paper, we construct a "minimum necessary savings" path, which has debt on a downward path and at 70 percent by 2022. In this path, debt further declines to 60 percent by 2040 and 40 percent by 2080. Achieving the 2022 target would require $2.2 trillion in additional deficit reduction from 2013-2022 from the CRFB Realistic baseline. This path comes with a few caveats. First, there is nothing special about these exact numerical targets; rather, the focus should be on the trajectory of debt rather than the level itself. Second, we do not think this path is necessarily ideal, since it brings down the debt very gradually, especially over the long term. It simply represents a minimum savings path to have debt on a downward path over the medium and long term -- and ideally, lawmakers would choose more aggressive debt targets.

It is clear that to reach the targets we need for the long term, we will need to enact significant reforms to entitlement programs, especially for health care. We will also need to combine those reforms with an overhaul of the tax code that raises revenue. If we do those things, the fiscal future will look much brighter. If we delay action, the problem only gets larger and the solutions only get tougher.

Click here to read the paper.