Highlights from CBO's June Baseline Update

Today, the Congressional Budget Office (CBO) released updated ten-year budgetary baseline and economic projections. Like its previous projection in January, CBO continues to show increasing deficits and unsustainable levels of debt, though with slightly higher levels of both in the current projection. We will release our full analysis of the new budget outlook later today.

CBO projects deficits will grow from 3.2 percent of Gross Domestic Product (GDP) in 2016 to 5.2 percent by 2027. The deficit is projected to cross the $1 trillion threshold in 2022 and reach nearly $1.5 trillion by 2027. Over the 2018-2027 period, deficits will total $10.1 trillion (4.3 percent of GDP), compared to the previous estimate of $9.4 trillion (4 percent of GDP).

Driving these increased deficits is a widening gap between outlays and revenue. Outlays are projected to grow from 20.9 percent of GDP in 2016 to 23.6 percent in 2027, while revenue is expected to rise only slightly from 17.8 percent of GDP in 2016 to 18.4 percent in 2027.

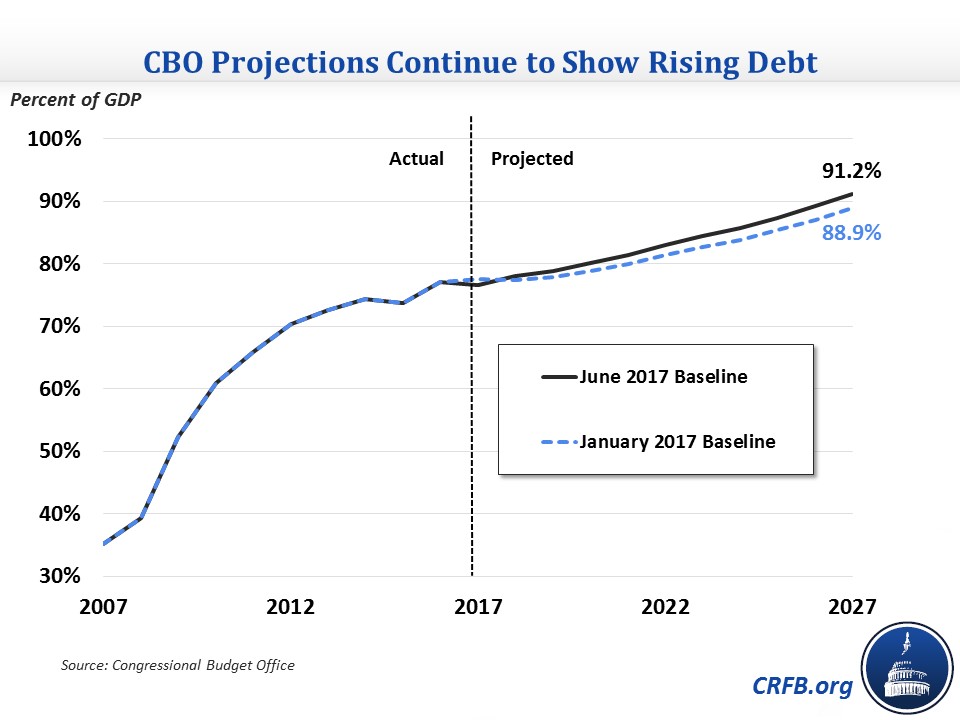

Along with higher deficits, the debt is projected to rise from 77 percent of GDP in 2016 to 91 percent by 2027. CBO’s estimate is slightly more pessimistic than in January, when debt was projected to reach 89 percent of GDP in 2027. Either number is well above the historical average for debt as a share of GDP, which is 40 percent.

In its updated economic projections, CBO projects similar amounts of economic growth, slightly lower unemployment in the short term, but also higher interest rates than it did in January. Notably, the economic growth rate is expected to average 1.8 percent over the next ten years. Boosting that growth rate to 3 percent, as the President’s budget assumes, would require a heroic combination of good policy and good luck.

CBO also expects interest rates to increase significantly in the coming years, with the 10-year Treasury note's rate increasing from 1.9 percent in 2016 to 3.7 percent as soon as 2022. Finally, unemployment is expected to remain below 4.5 percent for the next few years before rising to its steady state of around 5 percent.

Compared to its previous projection in January, deficits are projected to be $686 billion higher over the 2018-2027 period. The largest source of change is legislation, which is responsible for $284 billion of the increase, mostly from the Fiscal Year (FY) 2018 omnibus's increase in Overseas Contingency Operations spending. The law increased OCO spending in FY 2017 by $19 billion above CBO's baseline, an increase that CBO extrapolates to future years. The change in the economic forecast increases deficits by $121 billion, the net result of higher interest rates but also higher revenue. Technical revisions to estimates of program spending and revenue increase deficits by $281 billion on net, largely from lower projected income tax revenue.

Change in CBO's Baseline Budget Projections

| Source of Change | 2018-2027 Deficit Effect |

|---|---|

| January 2017 Baseline Projections | $9.426 trillion |

| Legislative Changes | $284 billion |

| Economic Changes | $121 billion |

| Technical Changes | $281 billion |

| June 2017 Baseline Projections | $10.112 trillion |

Source: CBO. All numbers include debt service.

These updated forecasts confirm CBO's previous estimates of an unsustainable fiscal path and underscore the need for bipartisan efforts to enact deficit reduction measures and restore fiscal responsibility to the budget process.

We will post additional analysis of CBO’s newest projections later today.