Group of Senators Introduce Bill to Narrow the Tax Gap

Last month, Senator Angus King (I-ME), along with Senators Sherrod Brown (D-OH) and Tim Kaine (D-VA), introduced the Stop Corporations and High Earners from Avoiding Taxes and Enforce the Rules Strictly (Stop CHEATERS) Act. The bill (S.1857) includes several provisions intended to narrow the “tax gap”, or the difference between total taxes owed to the federal government each year and the amount it actually collects. Specifically, it would increase funding to the Internal Revenue Service (IRS), implement a new information reporting regime for banks and other financial institutions, and increase IRS enforcement penalties.

The Department of the Treasury recently estimated a "gross tax gap" of $630 billion in tax year 2019, with over $3.6 trillion of taxes owed but only about $3 trillion paid voluntarily, or just under 84 percent. As one of the most fair and efficient ways of raising additional revenue without raising taxes, narrowing the tax gap has been gaining traction among lawmakers; Proposals to narrow the tax gap have recently been debated in several committee hearings, featured in multiple bills, and included in President Biden’s Fiscal Year (FY) 2022 budget proposal and the recent Bipartisan Infrastructure Framework.

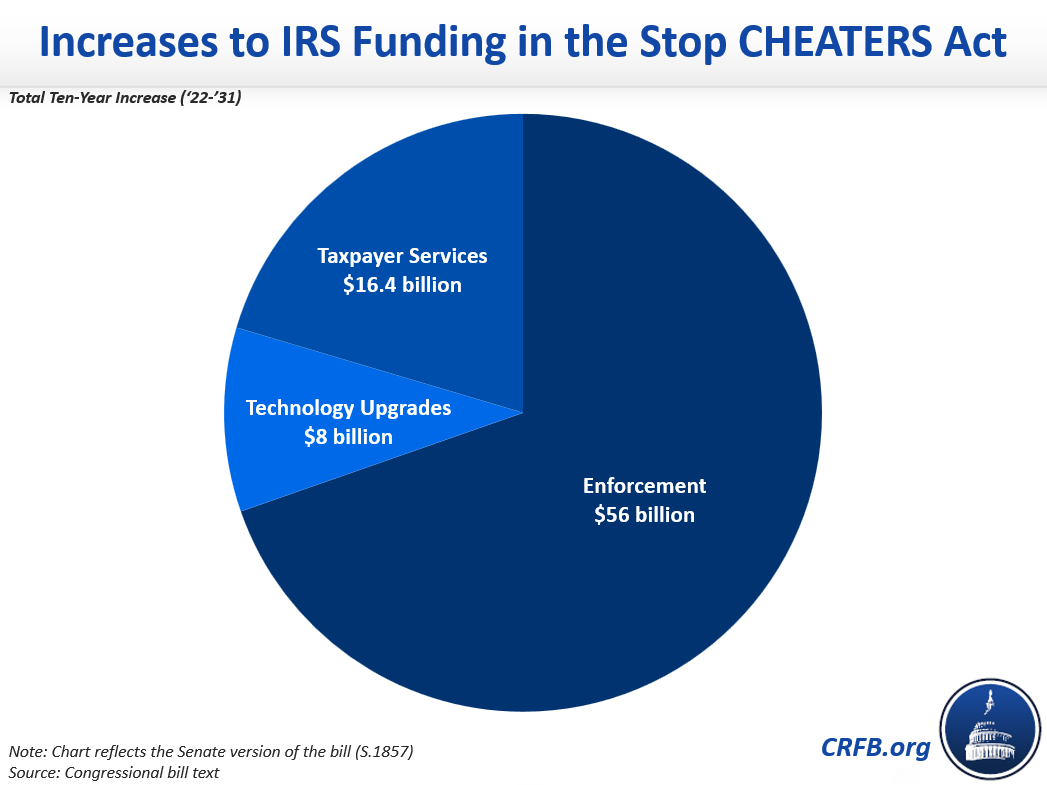

The Stop CHEATERS Act would address the tax gap problem in three, distinct ways. First, it would boost IRS funding by nearly $80 billion over the coming decade, including $56 billion for salaries and expenses of additional enforcement staff, $8 billion for technology upgrades, and $16.4 billion to improve taxpayer services.

To ensure the boost to enforcement funding actually results in more audits of wealthy taxpayers and corporations, the bill lays out a set of target audit rates to be achieved by 2025, including 50 percent of individual tax returns with disclosed total income of $10 million or more, and 95 percent of corporations with more than $20 billion in assets.

Second, the bill would institute a new, more robust information reporting regime meant to improve “visibility” of certain types of income for the IRS — particularly pass-through business income — that are currently subject to little or no third-party information reporting or withholding. All banks or other financial institutions would be required to submit annual reports to the IRS summarizing total deposits to and total withdrawals from all accounts maintained for other people, as well as identifying information regarding the owners of those accounts.

Third, the bill would boost IRS enforcement penalties, particularly for high-earners. Specifically, it would increase any amount owed to the IRS due to underpayment by 20 percent for taxpayers earning less than $2 million, 30 percent for taxpayers earning between $2 million and $5 million, and 40 percent for taxpayers earning more than $5 million.

All three of these measures would raise more federal revenue without increasing taxes. Though estimates differ, the Congressional Budget Office, the Office of Management and Budget, and outside estimators all agree that boosting IRS funding will yield more tax dollars. It is one of the very few policies that truly does pay for itself.

Stronger information reporting will also improve tax compliance. According to IRS analyses, income subject to little or no third-party information reporting or withholding has a misreporting rate of roughly 55 percent, compared to only one percent for normal wage income. For that reason, we recently estimated that about half of the tax gap comes from self-employment and pass-through business income.

Meanwhile, higher penalties will almost by definition raise revenue, both from the penalties themselves and the higher compliance rates they induce.

By providing the IRS with enough funding to rebuild its enforcement team, update outdated technologies, institute a new information reporting regime, and increasing penalties for noncompliance, the Stop CHEATERS Act would help the federal government raise more of the revenue that is already owed.

As Senator King has argued, to “address our growing national debt, there is one common sense solution that should have unanimous bipartisan support: let’s enforce the tax laws already on the books.” While the Stop CHEATERS Act represents only one possible way to reduce the tax gap, it is a thoughtful proposal aimed at an important goal.