Greece is Rather Unique

The Greek saga took another turn last week as the second bailout from the Eurozone countries approved in 2012 expired on June 30, leading to Greece missing a payment to the International Monetary Fund (IMF) and being put in arrears. A referendum asking Greek voters whether they wanted to approve new terms for financial assistance offered by the European creditors subsequently failed, strengthening the hand of the Syriza-led government but also leaving Greece's status in the euro up in the air. The government is putting together another proposal to its creditors to be reviewed later this week.

First, here's how Greece got to this point.

Background

The Greek drama started in late 2009 when the new government headed by George Papandreou revealed that the 2009 deficit would be much larger than previously expected at a time when debt already exceeded the size of the Greek economy. Fears of an inability to afford and service its debt led interest rates to rise, with the ten-year rate doubling from 4.5 percent to 9 percent just between late-2009 and mid-2010.

After receiving several credit rating downgrades, the Greek government enacted austerity measures targeting a deficit of 3 percent of GDP in 2013, down from 15 percent in 2009, in exchange for a 110 billion euro rescue package. The austerity, though, hurt the economy as real GDP shrunk by 5 percent in 2010 and 9 percent in 2011, according to the IMF, and the unemployment rate shot up from 10 percent in late 2009 to over 25 percent by 2012. All the while, interest rates continued to rise dramatically, with the ten-year rate peaking at around 30 percent in early 2012. A second bailout around that time plus a pledge from European Central Bank (ECB) President Mario Draghi to do "whatever it takes" to preserve the euro quelled fiscal concerns for the time being, but Greece's economy remained in terrible shape.

In January of this year, the left-wing party Syriza and party leader Alexis Tsipras won the legislative election and took control of parliament on an anti-austerity platform, creating uncertainty about the path that the new government would take. The second bailout, which was set to expire in February, was extended through the end of June.

However, Greece and the European creditors were unable to come to an agreement by that time, leading Greece to default on a $1.6 billion payment owed to the IMF on June 30 and interest rates to rise further on Greek debt. The government scheduled a referendum for July 5 to allow voters to accept or reject the latest terms that were offered for financial assistance. A "yes" vote might have been seen as a rebuff of the Syriza government, while a "no" vote would leave an uncertain future and a possible exit from the euro.

The referendum was voted down by 61 percent of voters, causing interest rates on Greek debt to jump a few percentage points in early trading on Monday.

The Situations in the U.S. and Greece are Very Different

In the U.S., Greece has been simultaneously used as the poster child for the problems with high debt and with austerity. Although both sides have a point to some extent, Greece represents the extreme example of both and there are clear differences between the U.S. and Greece that are important to consider.

Most importantly, the U.S. has and borrows in its own currency, which is also the world's reserve currency. This means that the United States government can generally take steps to avoid defaulting by printing money to pay the debt off – though importantly doing so could still have serious and in the worst case disastrous consequences. The U.S. also controls its own monetary policy and thus has access to many tools to fine tune the economy and erode the value of the debt if necessary. By contrast, Greece relies on and borrows in the Euro. And the European Central Bank must balance the varying economic circumstances of all the Eurozone countries. In that sense, Greece is more akin to a U.S. state within the Eurozone, and it is less interconnected to other Eurozone countries than the states are.

The U.S. is also the world's largest economy, and as such has a much greater ability to withstand financial or economic shocks, and U.S. debt often serves as a safe haven in times of financial instability, making the U.S. less likely than Greece to experience a quick swing in the perception of its finances.

These factors mean that the U.S. is better able to withstand high debt than Greece -- plus federal government debt is much lower in the U.S. as a percentage of the economy. Therefore, the U.S. does not face the same pressures to engage in the immediate austerity that Greece has.

U.S. Deficit Reduction Pales in Comparison to Greece's Austerity

As Greek austerity took its course and resulted in a drop in GDP and very high unemployment, some commentators made parallels between that and the deficit reduction undertaken in the U.S. However, it is clear that Greek austerity has been much harsher than the deficit reduction undertaken in the U.S. According to the IMF, the Greek structural balance -- the deficit or surplus as a percentage of potential GDP, after accounting for cyclical economic effects -- swung by 21 percentage points from its peak in 2009, declining from a nearly 19 percent of potential GDP deficit to a 2 percent projected surplus in 2015, while the U.S. structural deficit declined by only 6 percent of potential GDP between 2010 and 2015. Looking at just the U.S. federal government (not including the finances of states and localities), the structural deficit declined by 5 percent of potential GDP between 2009 and 2015.

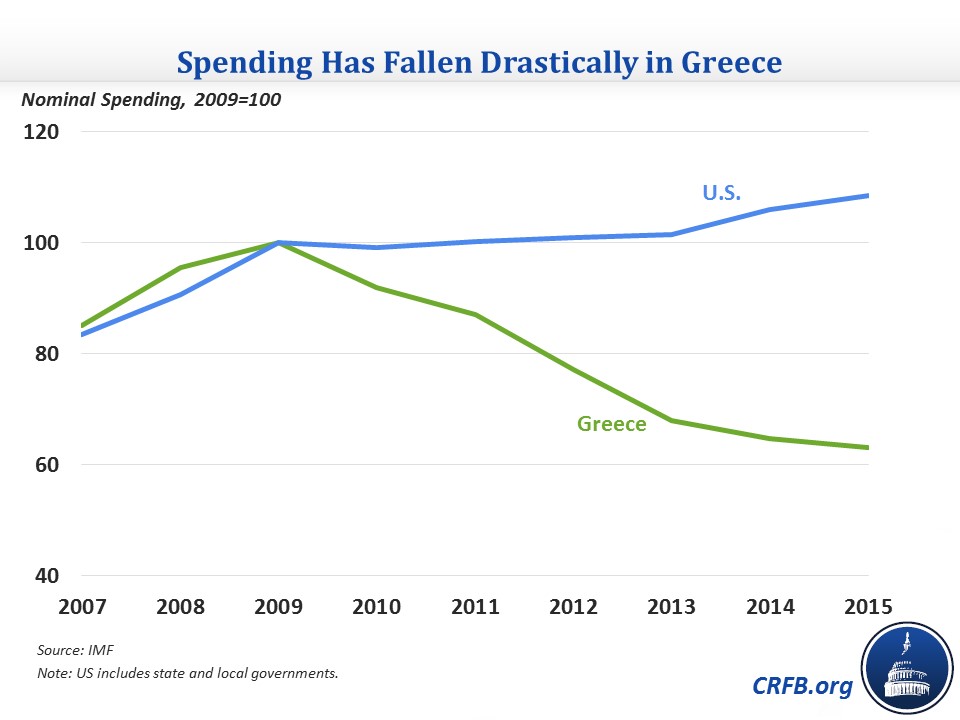

More narrowly, Greece also experienced a sharper fall in government spending, with a nearly 10 percent of GDP decline from its 2009 peak compared to 6 percent in the U.S. (or 4 percent for just the federal government). But this measure obscures the magnitude of the difference because Greek GDP has declined by one-quarter while U.S. GDP has grown by one-fifth over that time. In nominal terms, Greek spending has fallen by more than one-third while U.S. spending has increased by 9 percent (5 percent at the federal level).

Greek deficit reduction has therefore been much more aggressive than that undertaken in the U.S.

Skies Aren't Clear For U.S.

It is clear that the U.S. is not Greece either in the severity of its fiscal problems or in the magnitude of its austerity, but that is a low bar to clear. While America's federal fiscal situation will stabilize for the next five years as a share of GDP, debt will rise continuously after that, exceeding the size of the economy by 2040 and growing further thereafter to unprecedented levels.

Even if a fiscal crisis is unlikely anytime soon, the consequences of debt would hit much sooner, with crowding out of private investment, higher interest rates and interest spending, and less budgetary flexibility as debt rises and interest rates return to more historically typical levels.

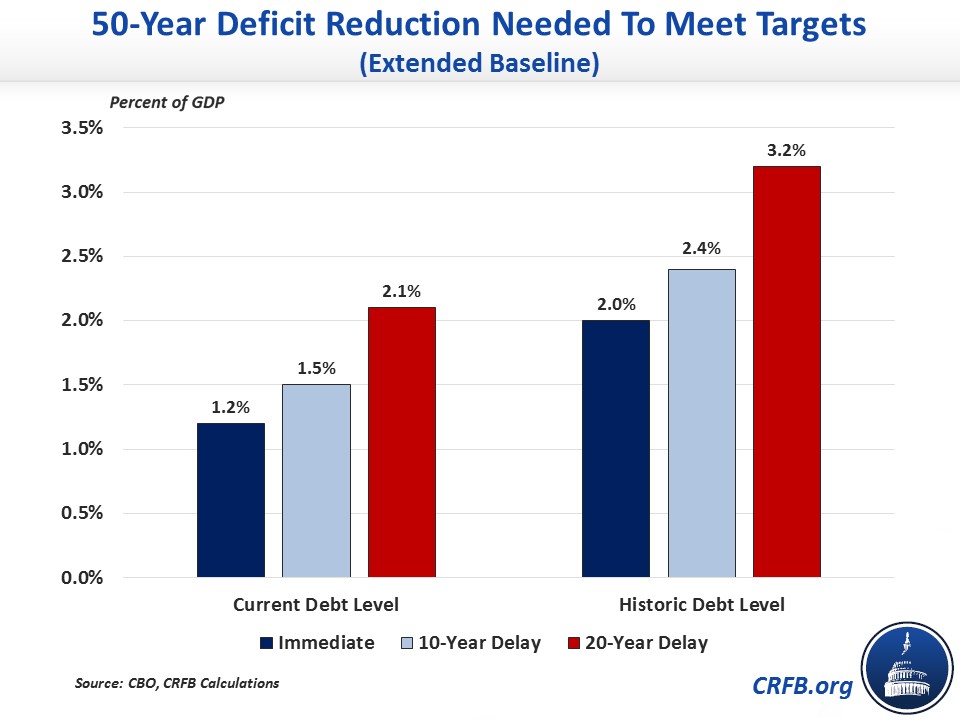

Further, continuing to wait will only make the situation harder to reverse. As we detailed in a previous blog, the changes needed to hit debt targets 50 years from now would grow significantly if we delay action for a few decades. For example, reducing debt to its historical average of around 50 percent of GDP would require deficit reduction of 2 percent of GDP per year if enacted immediately, but that number would grow by 60 percent to 3.2 percent of GDP if we waited 20 years.

If we wait several decades and require a quick course correction, policymakers will have much less latitude to delay changes or make them gradually over time. The economic damage would be compounded if debt concerns were touched by policy responses to a recession. At an extreme, lawmakers may find themselves unwilling to make the changes necessary to bring debt under control and may resort to printing money to finance debt (available to the U.S. but not Greece), a move that could set off inflation.

In short, waiting to stabilize and reduce our debt would make the necessary deficit reduction larger and more economically damaging while increasing the risk of a crisis as debt reaches unprecedented levels. Even if its situation isn't nearly as dire as Greece's, the U.S. needs to make a course correction of its own.