Five-Year Highway Bill Could Be a Costly Mistake

As the House and Senate are conferencing their highway bills, a debate has broken out over how to spend the $78 billion of offsets. Setting aside the fact that the offsets themselves largely come from a budget gimmick, lawmakers have a choice between funding six years of spending at current levels or five years of spending at elevated levels.

Increasing highway spending in the context of the current bill, though, would be a costly mistake.

Although there is no problem with increasing infrastructure spending and paying for the costs, the proposal under discussion would effectively result in a permanent cost increase and pay for it only over the next five years. As a result, the future shortfall between highway spending and revenue, of which the largest contributor is the gas tax, would grow even larger than it is today.

At current spending levels, the Highway Trust Fund (HTF) faces a shortfall of about $150 billion through 2025. The House bill includes $78 billion of offsets (largely from a Federal Reserve gimmick) -- enough to continue current spending (adjusted for inflation) for six years. Yet some are pushing to instead spread the $78 billion over 5 years at a higher level.

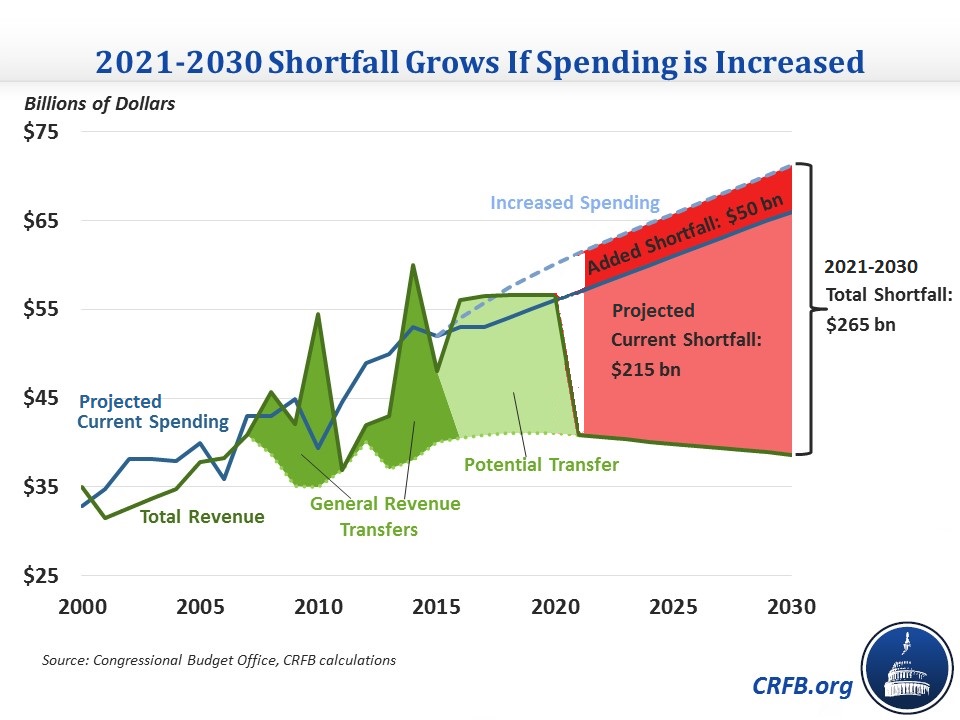

The problem? Increasing spending for the next five years would set the expectation of increased spending in the sixth year, and beyond. But it would do nothing to finance the cost of these spending increases. Specifically, spreading this money over 5 years would increase spending by about $5 billion per year, thus increasing the future gap between spending and revenue from about $18 billion per year to $23 billion. And starting in 2021, the legislation provides no way to pay for that growing gap.

By relying on a temporary general revenue transfer rather than closing the structural gap between highway spending and revenue, this Congress is already leaving future policymakers with a roughly $215 billion funding gap when they next address the highway shortfall. A five-year bill at higher spending levels would threaten to widen that gap to $265 billion.

First and foremost, lawmakers should replace the gimmick with real offsets. But they also should not increase spending, thus worsening the shortfall after the temporary funding runs out, without a plan to deal more permanently with the gap between spending and revenue (such as an automatic gas tax increase if nothing is enacted). Another patch for highway funding combined with increased spending will result in bigger potholes down the road.